Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2018, Big Bhd. (Big) acquired 640,000 ordinary shares in Bang Sdn. Bhd. (Bang). On the date of acquisition, the general reserve

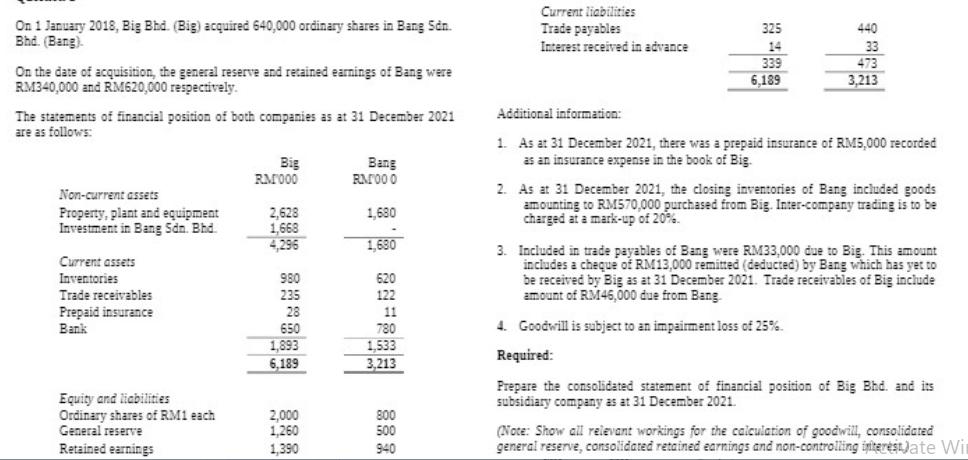

On 1 January 2018, Big Bhd. (Big) acquired 640,000 ordinary shares in Bang Sdn. Bhd. (Bang). On the date of acquisition, the general reserve and retained earnings of Bang were RM340,000 and RM620,000 respectively. The statements of financial position of both companies as at 31 December 2021 are as follows: Non-current assets Property, plant and equipment Investment in Bang Sdn. Bhd. Current assets Inventories Trade receivables Prepaid insurance Bank Equity and liabilities Ordinary shares of RM1 each General reserve Retained earnings Big RM000 2,628 1,668 4,296 980 235 28 650 1,893 6,189 T 2,000 1,260 1,390 Bang RM000 1,680 1,630 620 122 780 1,533 3,213 800 500 940 Current liabilities Trade payables Interest received in advance 325 339 6,189 440 33 473 3,213 Additional information: 1. As at 31 December 2021, there was a prepaid insurance of RM5,000 recorded as an insurance expense in the book of Big. 2. As at 31 December 2021, the closing inventories of Bang included goods amounting to RM570,000 purchased from Big. Inter-company trading is to be charged at a mark-up of 20%. 3. Included in trade payables of Bang were RM33,000 due to Big. This amount includes a cheque of RM13,000 remitted (deducted) by Bang which has yet to be received by Big as at 31 December 2021. Trade receivables of Big include amount of RM46,000 due from Bang 4. Goodwill is subject to an impairment loss of 25%. Required: Prepare the consolidated statement of financial position of Big Bhd. and its subsidiary company as at 31 December 2021. (Note: Show all relevant workings for the calculation of goodwill, consolidated general reserve, consolidated retained earnings and non-controlling interesate Wir

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

0pdf File CUsersmkhandelwalDownloads1040Form201040pdf a T X Form 1040 2021 If you have a qualifying ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started