Answered step by step

Verified Expert Solution

Question

1 Approved Answer

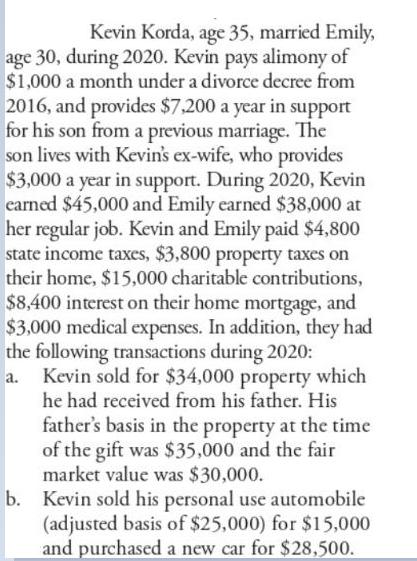

Kevin Korda, age 35, married Emily, age 30, during 2020. Kevin pays alimony of $1,000 a month under a divorce decree from 2016, and

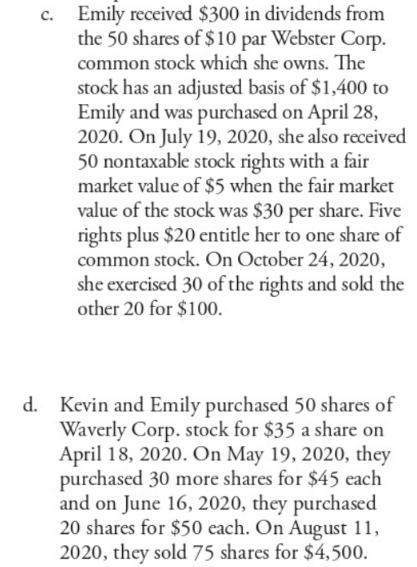

Kevin Korda, age 35, married Emily, age 30, during 2020. Kevin pays alimony of $1,000 a month under a divorce decree from 2016, and provides $7,200 a year in support for his son from a previous marriage. The son lives with Kevin's ex-wife, who provides $3,000 a year in support. During 2020, Kevin earned $45,000 and Emily earned $38,000 at her regular job. Kevin and Emily paid $4,800 state income taxes, $3,800 property taxes on their home, $15,000 charitable contributions, and $8,400 interest on their home mortgage, $3,000 medical expenses. In addition, they had the following transactions during 2020: a. Kevin sold for $34,000 property which he had received from his father. His father's basis in the property at the time of the gift was $35,000 and the fair market value was $30,000. b. Kevin sold his personal use automobile (adjusted basis of $25,000) for $15,000 and purchased a new car for $28,500. c. Emily received $300 in dividends from the 50 shares of $10 par Webster Corp. common stock which she owns. The stock has an adjusted basis of $1,400 to Emily and was purchased on April 28, 2020. On July 19, 2020, she also received 50 nontaxable stock rights with a fair market value of $5 when the fair market value of the stock was $30 per share. Five rights plus $20 entitle her to one share of common stock. On October 24, 2020, she exercised 30 of the rights and sold the other 20 for $100. d. Kevin and Emily purchased 50 shares of Waverly Corp. stock for $35 a share on April 18, 2020. On May 19, 2020, they purchased 30 more shares for $45 each and on June 16, 2020, they purchased 20 shares for $50 each. On August 11, 2020, they sold 75 shares for $4,500.

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Kevin 45000 Emily 30000 Emilys selfemployment income 8000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started