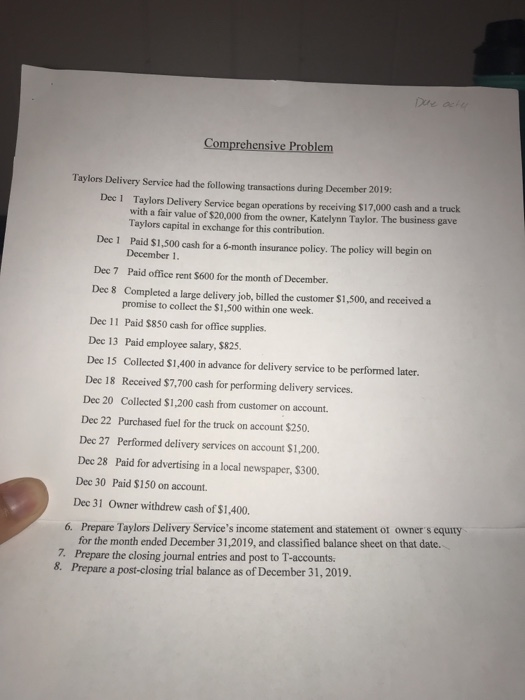

Comprehensive Problem Taylors Delivery Service had the following transactions during December 2019 Deel Taylors Delivery Service began operations by receiving $17,000 cash and a truck with a fair value of $20,000 from the owner, Katelynn Taylor. The business gave Taylors capital in exchange for this contribution. Dec 1 Paid $1,500 cash for a 6-month insurance policy. The policy will begin on December 1. Dec 7 Paid office rent $600 for the month of December. Dec 8 Completed a large delivery job, billed the customer $1,500, and received a promise to collect the $1,500 within one week. Dec 11 Paid $850 cash for office supplies. Dec 13 Paid employee salary, $825. Dec 15 Collected $1,400 in advance for delivery service to be performed later. Dec 18 Received $7,700 cash for performing delivery services. Dec 20 Collected $1,200 cash from customer on account. Dec 22 Purchased fuel for the truck on account $250. Dec 27 Performed delivery services on account $1,200. Dec 28 Paid for advertising in a local newspaper, S300. Dec 30 Paid $150 on account. Dec 31 Owner withdrew cash of $1,400. 6. Prepare Taylors Delivery Service's income statement and statement of owner's equity for the month ended December 31,2019, and classified balance sheet on that date. 7. Prepare the closing journal entries and post to T-accounts. 0. Prepare a post-closing trial balance as of December 31, 2019. Comprehensive Problem Taylors Delivery Service had the following transactions during December 2019 Deel Taylors Delivery Service began operations by receiving $17,000 cash and a truck with a fair value of $20,000 from the owner, Katelynn Taylor. The business gave Taylors capital in exchange for this contribution. Dec 1 Paid $1,500 cash for a 6-month insurance policy. The policy will begin on December 1. Dec 7 Paid office rent $600 for the month of December. Dec 8 Completed a large delivery job, billed the customer $1,500, and received a promise to collect the $1,500 within one week. Dec 11 Paid $850 cash for office supplies. Dec 13 Paid employee salary, $825. Dec 15 Collected $1,400 in advance for delivery service to be performed later. Dec 18 Received $7,700 cash for performing delivery services. Dec 20 Collected $1,200 cash from customer on account. Dec 22 Purchased fuel for the truck on account $250. Dec 27 Performed delivery services on account $1,200. Dec 28 Paid for advertising in a local newspaper, S300. Dec 30 Paid $150 on account. Dec 31 Owner withdrew cash of $1,400. 6. Prepare Taylors Delivery Service's income statement and statement of owner's equity for the month ended December 31,2019, and classified balance sheet on that date. 7. Prepare the closing journal entries and post to T-accounts. 0. Prepare a post-closing trial balance as of December 31, 2019