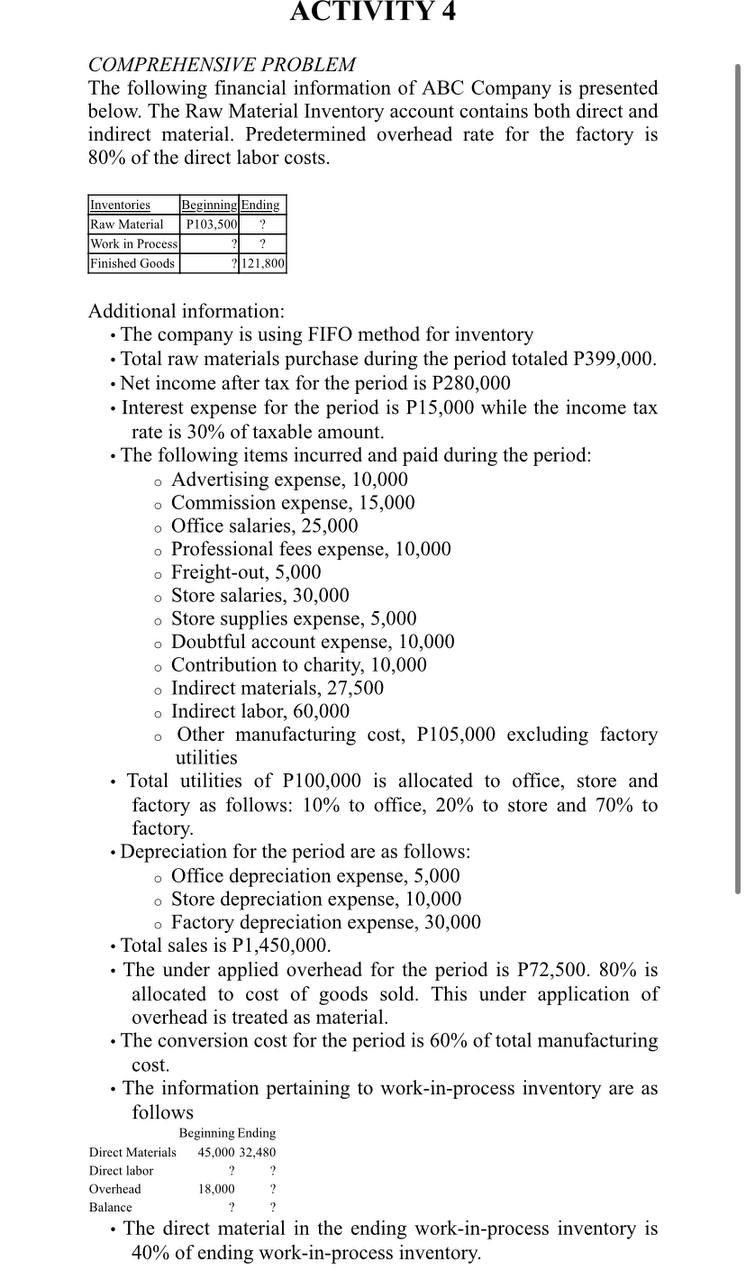

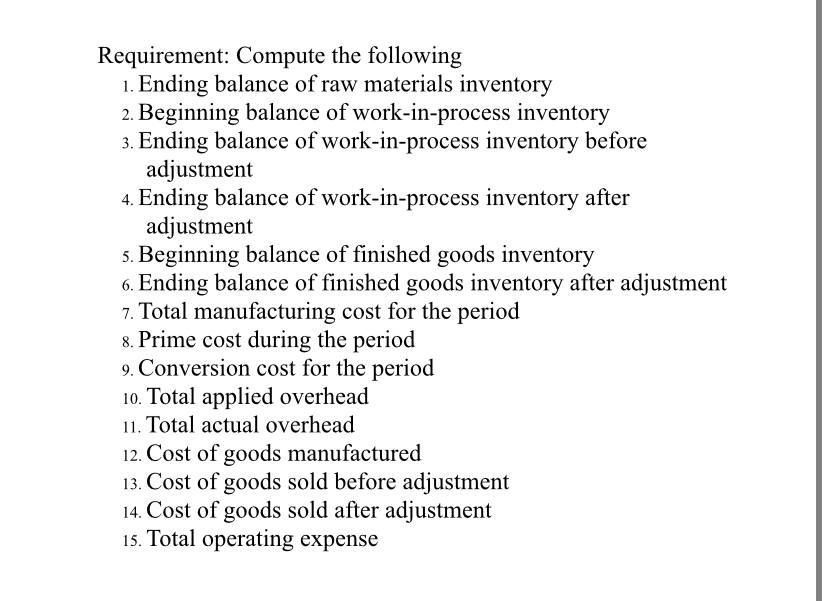

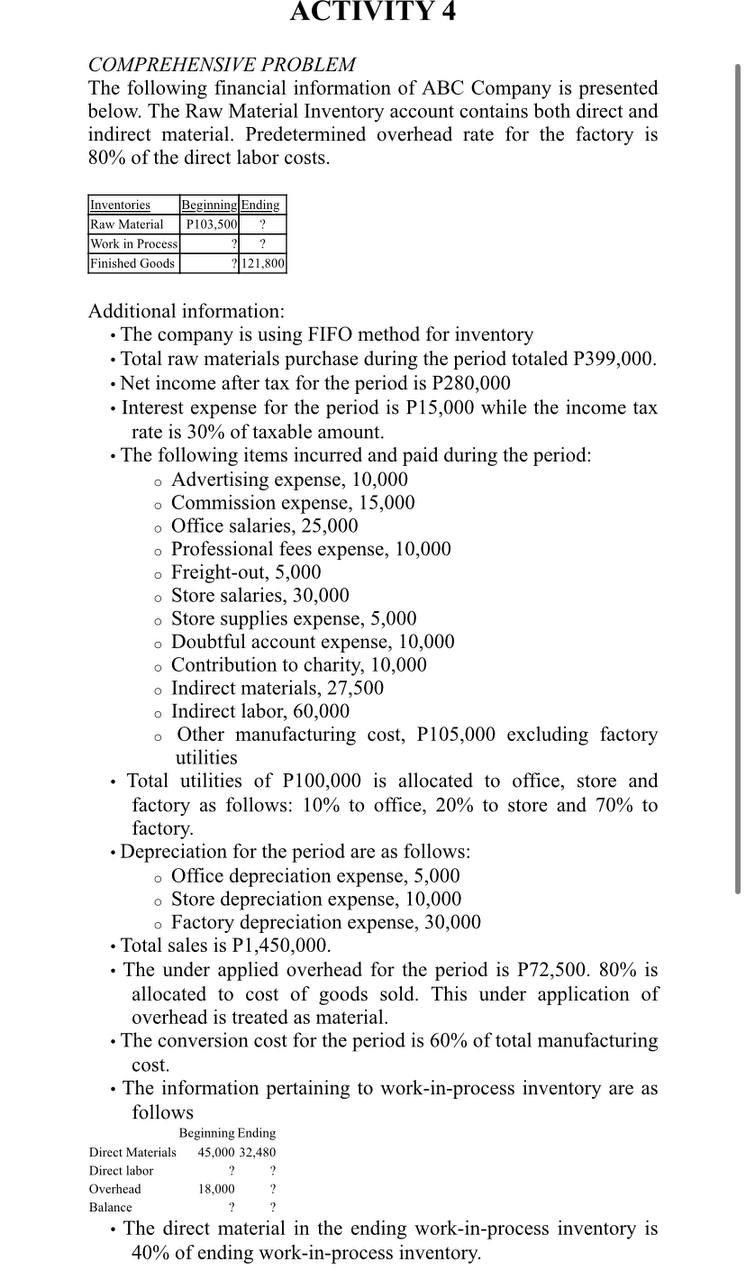

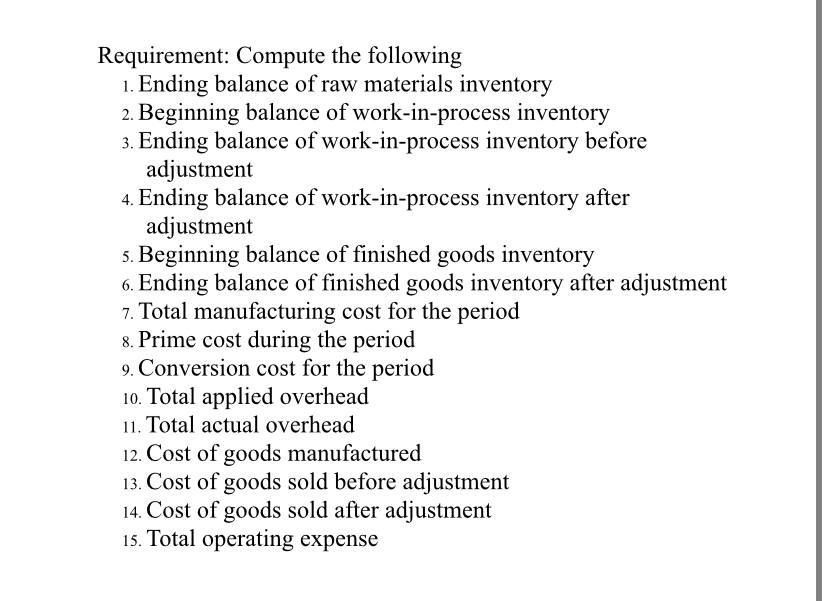

COMPREHENSIVE PROBLEM The following financial information of ABC Company is presented below. The Raw Material Inventory account contains both direct and indirect material. Predetermined overhead rate for the factory is 80% of the direct labor costs. Additional information: - The company is using FIFO method for inventory - Total raw materials purchase during the period totaled P399,000. - Net income after tax for the period is P280,000 - Interest expense for the period is P15,000 while the income tax rate is 30% of taxable amount. - The following items incurred and paid during the period: - Advertising expense, 10,000 - Commission expense, 15,000 - Office salaries, 25,000 - Professional fees expense, 10,000 - Freight-out, 5,000 - Store salaries, 30,000 - Store supplies expense, 5,000 - Doubtful account expense, 10,000 - Contribution to charity, 10,000 - Indirect materials, 27,500 - Indirect labor, 60,000 - Other manufacturing cost, P105,000 excluding factory utilities - Total utilities of P100,000 is allocated to office, store and factory as follows: 10% to office, 20% to store and 70% to factory. - Depreciation for the period are as follows: - Office depreciation expense, 5,000 - Store depreciation expense, 10,000 - Factory depreciation expense, 30,000 - Total sales is P1,450,000. - The under applied overhead for the period is P72,500. 80\% is allocated to cost of goods sold. This under application of overhead is treated as material. - The conversion cost for the period is 60% of total manufacturing cost. - The information pertaining to work-in-process inventory are as follows - The direct material in the ending work-in-process inventory is 40% of ending work-in-process inventory. Requirement: Compute the following 1. Ending balance of raw materials inventory 2. Beginning balance of work-in-process inventory 3. Ending balance of work-in-process inventory before adjustment 4. Ending balance of work-in-process inventory after adjustment 5. Beginning balance of finished goods inventory 6. Ending balance of finished goods inventory after adjustment 7. Total manufacturing cost for the period 8. Prime cost during the period 9. Conversion cost for the period 10. Total applied overhead 11. Total actual overhead 12. Cost of goods manufactured 13. Cost of goods sold before adjustment 14. Cost of goods sold after adjustment 15. Total operating expense COMPREHENSIVE PROBLEM The following financial information of ABC Company is presented below. The Raw Material Inventory account contains both direct and indirect material. Predetermined overhead rate for the factory is 80% of the direct labor costs. Additional information: - The company is using FIFO method for inventory - Total raw materials purchase during the period totaled P399,000. - Net income after tax for the period is P280,000 - Interest expense for the period is P15,000 while the income tax rate is 30% of taxable amount. - The following items incurred and paid during the period: - Advertising expense, 10,000 - Commission expense, 15,000 - Office salaries, 25,000 - Professional fees expense, 10,000 - Freight-out, 5,000 - Store salaries, 30,000 - Store supplies expense, 5,000 - Doubtful account expense, 10,000 - Contribution to charity, 10,000 - Indirect materials, 27,500 - Indirect labor, 60,000 - Other manufacturing cost, P105,000 excluding factory utilities - Total utilities of P100,000 is allocated to office, store and factory as follows: 10% to office, 20% to store and 70% to factory. - Depreciation for the period are as follows: - Office depreciation expense, 5,000 - Store depreciation expense, 10,000 - Factory depreciation expense, 30,000 - Total sales is P1,450,000. - The under applied overhead for the period is P72,500. 80\% is allocated to cost of goods sold. This under application of overhead is treated as material. - The conversion cost for the period is 60% of total manufacturing cost. - The information pertaining to work-in-process inventory are as follows - The direct material in the ending work-in-process inventory is 40% of ending work-in-process inventory. Requirement: Compute the following 1. Ending balance of raw materials inventory 2. Beginning balance of work-in-process inventory 3. Ending balance of work-in-process inventory before adjustment 4. Ending balance of work-in-process inventory after adjustment 5. Beginning balance of finished goods inventory 6. Ending balance of finished goods inventory after adjustment 7. Total manufacturing cost for the period 8. Prime cost during the period 9. Conversion cost for the period 10. Total applied overhead 11. Total actual overhead 12. Cost of goods manufactured 13. Cost of goods sold before adjustment 14. Cost of goods sold after adjustment 15. Total operating expense