Question

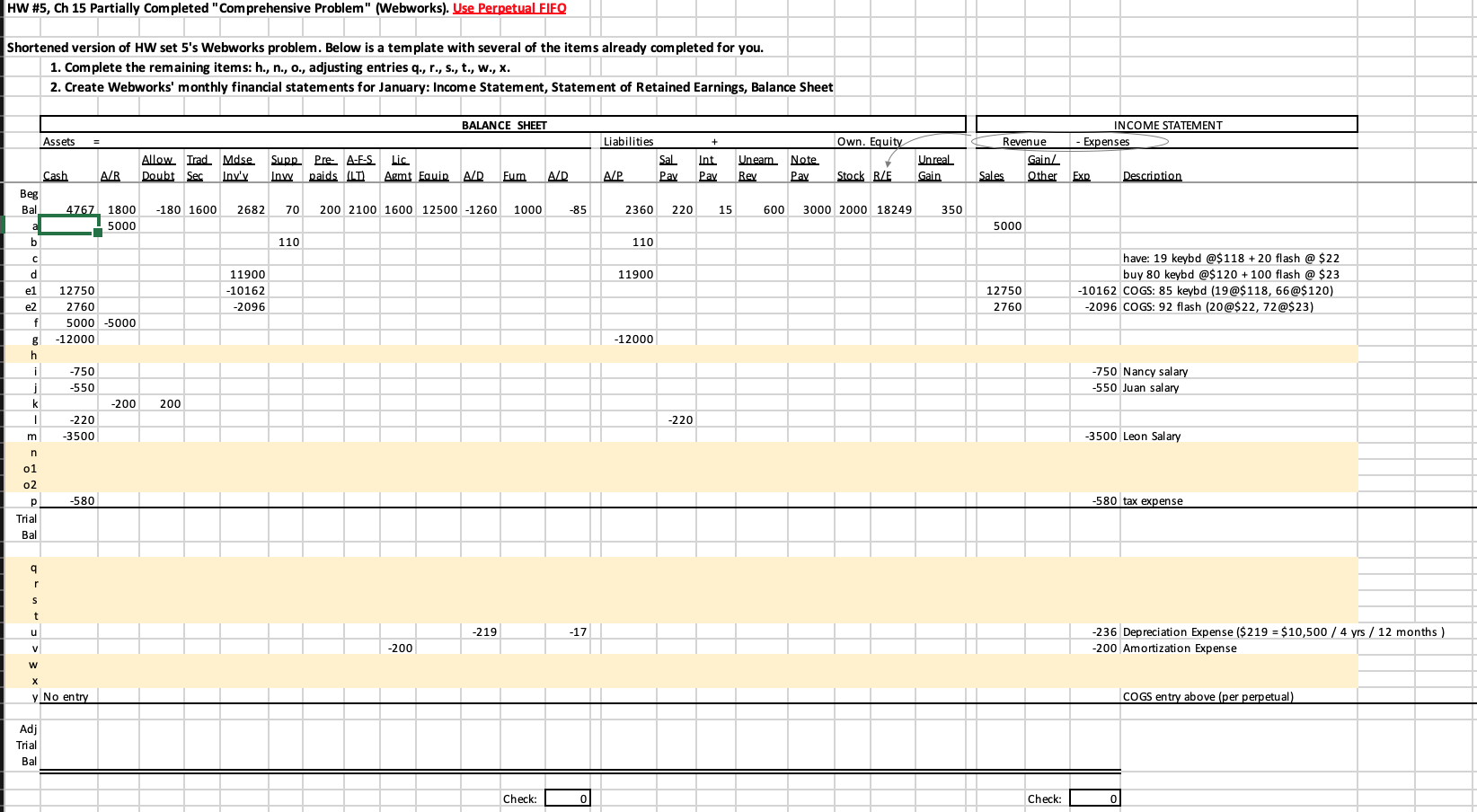

Comprehensive Problem (Webworks) Skip part B (T-accounts are part Debits & Credits... this is strictly OPTIONAL) Ignore problem's instruction to use periodic FIFO. Use perpetual

"Comprehensive Problem" (Webworks) Skip part B (T-accounts are part Debits & Credits... this is strictly OPTIONAL) Ignore problem's instruction to use periodic FIFO. Use perpetual FIFO for the COGS entries. CORRECTIONS: Relating to item w. : QRS securities are debt securities that are classified as available-for-sale. The fair value at the beginning of the month is $2,100. RST securities are considered equity securities (included in trading securities) that were bought in Ch. 14 (item j) for $18 per share in cash. The question has a typo and should instead read "On March 31, the QRS securities have a fair value of $2,275. RST Company is selling for $18 per share, and Webworks owns 100 shares." For item x., the interest is for the Note Payable, and the rate is 6% per year (from Ch 14 Webworks' problem, item e)

h. Leon Jackson(the company's owner)determines that some of this equipment is not being used and sells it. The equipment sold originally cost $2,000 and had accumulated depre- ciation of $297. Webworks sold the equipment for $1,650 cash.

n. Webworks completes the design for the bakery but not the photographer for which it was paid in February. Only $300 of the unearned revenue should be reclassified to revenue.

o1,o2 .Webworks decides that more space is needed than that which is available in the home of Leons parents (much to his parents relief). His parents return the $200 he prepaid for March. Webworks signs a six-month lease in a nearby office building. Webworks will pay $500 at the beginning of each month, starting on March 1. The life of the building is forty years, and no bargain purchase option exists, nor do the payments come close to paying the market value of the space.

q. Webworks owes Nancy $200 and Juan $150 for their work during the last week of March.

r. Webworks receives an electric bill for $400. Webworks will pay the bill in April.

s.Webworks determines that it has $50 worth of supplies remaining at the end of March.

t. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

w.QRS Company is selling for $13 per share and RST Company is selling for $18 per share on March 31.

x.Interest should be accrued for March.

y.Record cost of goods sold.

HW #5, Ch 15 Partially completed "Comprehensive Problem" (Webworks). Use Perpetual FIFO Shortened version of HW set 5's Webworks problem. Below is a template with several of the items already completed for you. 1. Complete the remaining items: h., n., O., adjusting entries q., r., s., t., W., X. 2. Create Webworks' monthly financial statements for January: Income Statement, Statement of Retained Earnings, Balance Sheet Liabilities INCOME STATEMENT Expenses + Own. Equity Sal Pav Int Pay Uneam Note Rey Pav Unreal Gain Revenue Gain/ Sales Other A/P Stock R/E Exp Description 2360 220 15 600 3000 2000 18249 350 5000 110 11900 have: 19 keybd @$118 + 20 flash @ $22 buy 80 keybd @$120 + 100 flash @ $23 -10162 COGS: 85 keybd (19@$118, 66@$120) -2096 COGS: 92 flash (20@$ 22, 72 @$23) 12750 2760 BALANCE SHEET Assets Allow Trad Mdse. Supp Pre- A-E-S Lic Cash AIR Doubt Sec Inviv Inv paids (LT) Agmt Equin A/D Fum A/D Beg Bal 4767 1800 -180 1600 2682 70 200 2100 1600 12500 -1260 1000 -85 5000 b 110 d 11900 el 12750 -10162 e2 2760 -2096 f 5000 -5000 -12000 h i -750 j -550 k -200 200 1 -220 m -3500 n 01 o2 -580 Trial Bal -12000 -750 Nancy salary -550 Juan salary -220 -3500 Leon Salary -580 tax expense q r s t u -219 -17 -236 Depreciation Expense ($ 219 = $ 10,500 / 4 yrs / 12 months) -200 Amortization Expense V -200 w y No entry COGS entry above (per perpetual Adj Trial Bal Check: 0 Check: 0 HW #5, Ch 15 Partially completed "Comprehensive Problem" (Webworks). Use Perpetual FIFO Shortened version of HW set 5's Webworks problem. Below is a template with several of the items already completed for you. 1. Complete the remaining items: h., n., O., adjusting entries q., r., s., t., W., X. 2. Create Webworks' monthly financial statements for January: Income Statement, Statement of Retained Earnings, Balance Sheet Liabilities INCOME STATEMENT Expenses + Own. Equity Sal Pav Int Pay Uneam Note Rey Pav Unreal Gain Revenue Gain/ Sales Other A/P Stock R/E Exp Description 2360 220 15 600 3000 2000 18249 350 5000 110 11900 have: 19 keybd @$118 + 20 flash @ $22 buy 80 keybd @$120 + 100 flash @ $23 -10162 COGS: 85 keybd (19@$118, 66@$120) -2096 COGS: 92 flash (20@$ 22, 72 @$23) 12750 2760 BALANCE SHEET Assets Allow Trad Mdse. Supp Pre- A-E-S Lic Cash AIR Doubt Sec Inviv Inv paids (LT) Agmt Equin A/D Fum A/D Beg Bal 4767 1800 -180 1600 2682 70 200 2100 1600 12500 -1260 1000 -85 5000 b 110 d 11900 el 12750 -10162 e2 2760 -2096 f 5000 -5000 -12000 h i -750 j -550 k -200 200 1 -220 m -3500 n 01 o2 -580 Trial Bal -12000 -750 Nancy salary -550 Juan salary -220 -3500 Leon Salary -580 tax expense q r s t u -219 -17 -236 Depreciation Expense ($ 219 = $ 10,500 / 4 yrs / 12 months) -200 Amortization Expense V -200 w y No entry COGS entry above (per perpetual Adj Trial Bal Check: 0 Check: 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started