"Comprehensive Problem" (Webworks) Skip part B (T-accounts are part Debits & Credits... this is strictly OPTIONAL) Ignore problem's instruction to use periodic FIFO. Use perpetual FIFO for the COGS entries. CORRECTIONS: Relating to item w. : QRS securities are debt securities that are classified as available-for-sale. The fair value at the beginning of the month is $2,100. RST securities are considered equity securities (included in trading securities) that were bought in Ch. 14 (item j) for $18 per share in cash. The question has a typo and should instead read "On March 31, the QRS securities have a fair value of $2,275. RST Company is selling for $18 per share, and Webworks owns 100 shares." For item x., the interest is for the Note Payable, and the rate is 6% per year (from Ch 14 Webworks' problem, item e)

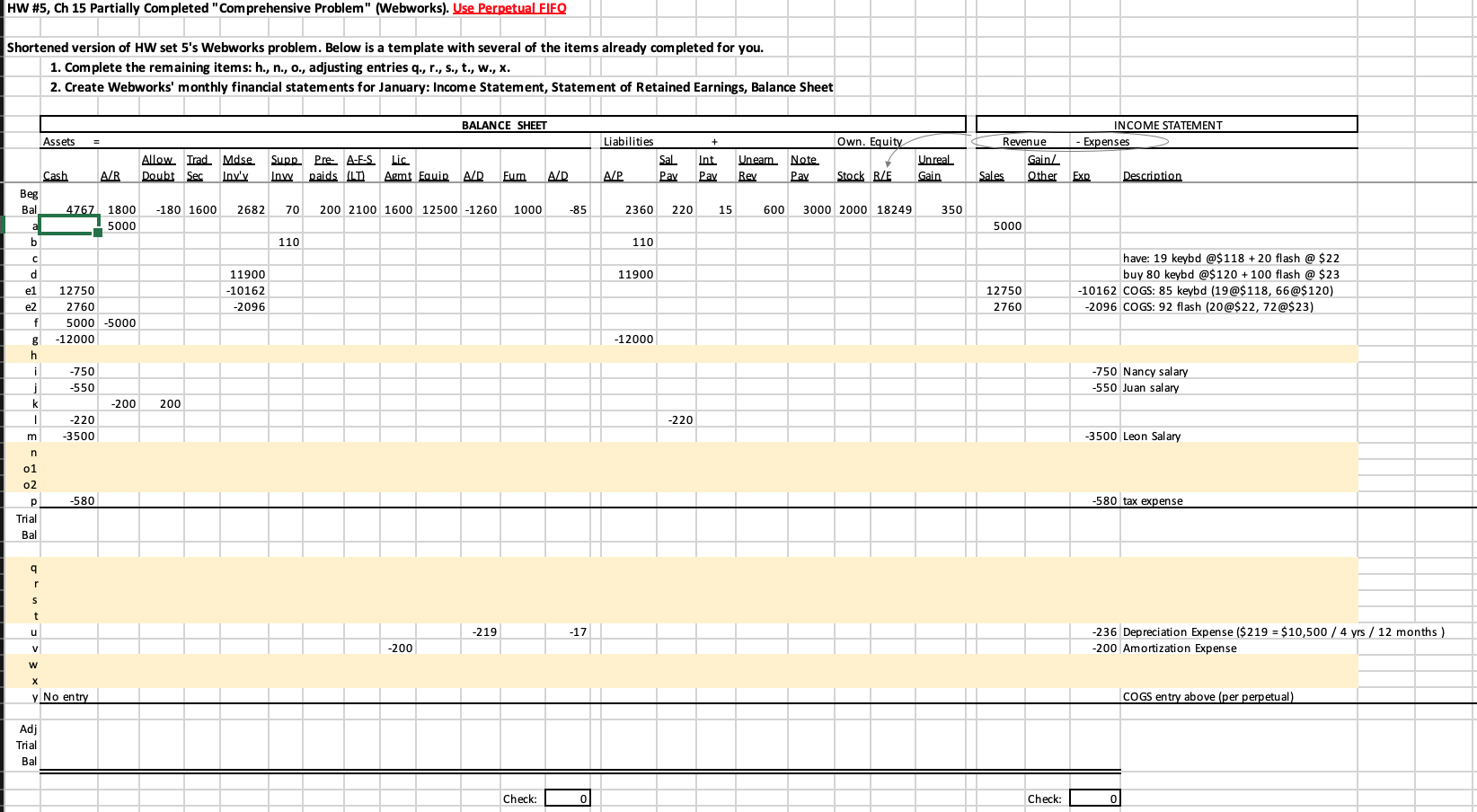

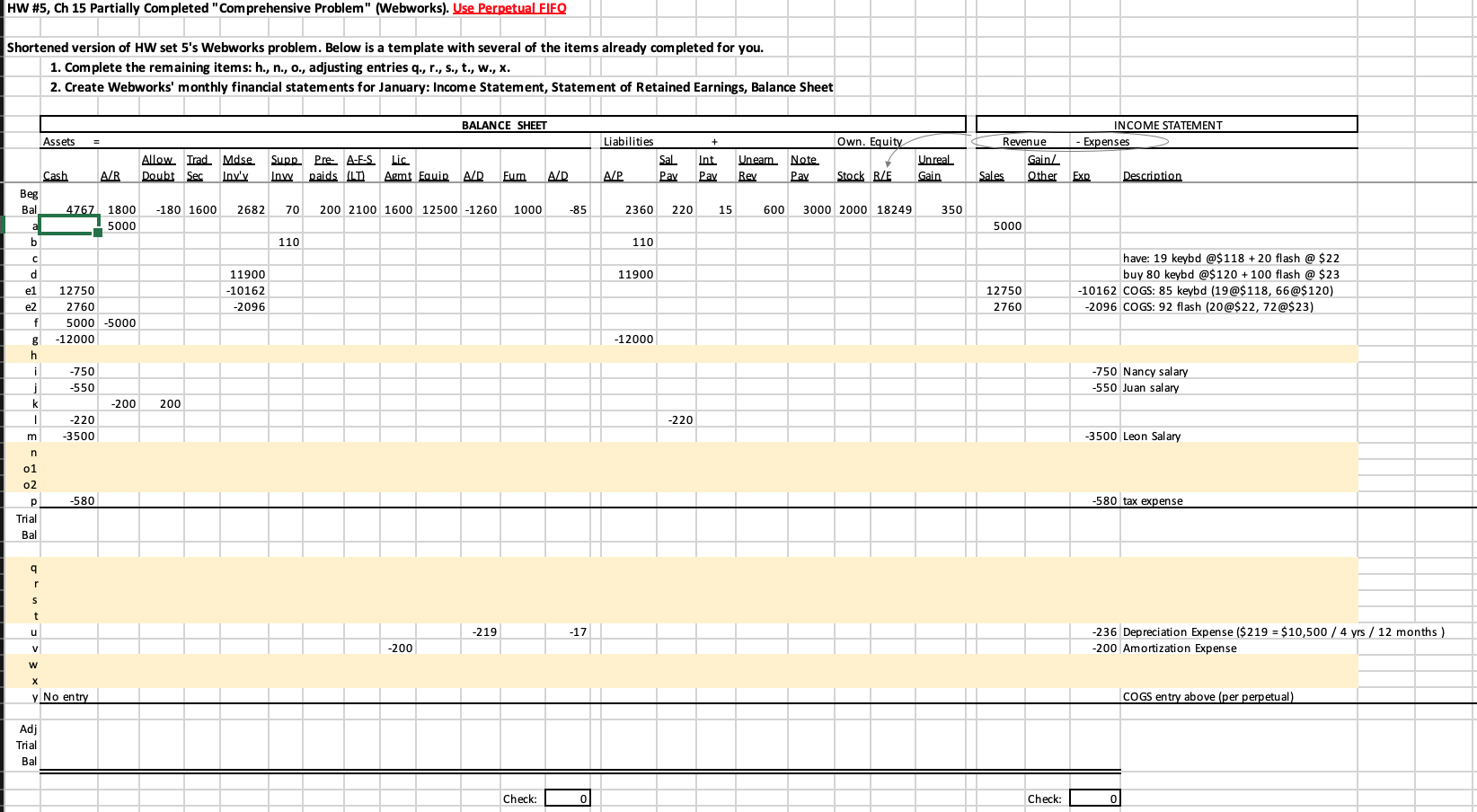

HW #5, Ch 15 Partially completed "Comprehensive Problem" (Webworks). Use Perpetual FIFO Shortened version of HW set 5's Webworks problem. Below is a template with several of the items already completed for you. 1. Complete the remaining items: h., n., O., adjusting entries q., r., s., t., W., X. 2. Create Webworks' monthly financial statements for January: Income Statement, Statement of Retained Earnings, Balance Sheet Liabilities INCOME STATEMENT Expenses + Own. Equity Sal Pav Int Pay Uneam Note Rey Pav Unreal Gain Revenue Gain/ Sales Other A/P Stock R/E Exp Description 2360 220 15 600 3000 2000 18249 350 5000 110 11900 have: 19 keybd @$118 + 20 flash @ $22 buy 80 keybd @$120 + 100 flash @ $23 -10162 COGS: 85 keybd (19@$118, 66@$120) -2096 COGS: 92 flash (20@$ 22, 72 @$23) 12750 2760 BALANCE SHEET Assets Allow Trad Mdse. Supp Pre- A-E-S Lic Cash AIR Doubt Sec Inviv Inv paids (LT) Agmt Equin A/D Fum A/D Beg Bal 4767 1800 -180 1600 2682 70 200 2100 1600 12500 -1260 1000 -85 5000 b 110 d 11900 el 12750 -10162 e2 2760 -2096 f 5000 -5000 -12000 h i -750 j -550 k -200 200 1 -220 m -3500 n 01 o2 -580 Trial Bal -12000 -750 Nancy salary -550 Juan salary -220 -3500 Leon Salary -580 tax expense q r s t u -219 -17 -236 Depreciation Expense ($ 219 = $ 10,500 / 4 yrs / 12 months) -200 Amortization Expense V -200 w y No entry COGS entry above (per perpetual Adj Trial Bal Check: 0 Check: 0 HW #5, Ch 15 Partially completed "Comprehensive Problem" (Webworks). Use Perpetual FIFO Shortened version of HW set 5's Webworks problem. Below is a template with several of the items already completed for you. 1. Complete the remaining items: h., n., O., adjusting entries q., r., s., t., W., X. 2. Create Webworks' monthly financial statements for January: Income Statement, Statement of Retained Earnings, Balance Sheet Liabilities INCOME STATEMENT Expenses + Own. Equity Sal Pav Int Pay Uneam Note Rey Pav Unreal Gain Revenue Gain/ Sales Other A/P Stock R/E Exp Description 2360 220 15 600 3000 2000 18249 350 5000 110 11900 have: 19 keybd @$118 + 20 flash @ $22 buy 80 keybd @$120 + 100 flash @ $23 -10162 COGS: 85 keybd (19@$118, 66@$120) -2096 COGS: 92 flash (20@$ 22, 72 @$23) 12750 2760 BALANCE SHEET Assets Allow Trad Mdse. Supp Pre- A-E-S Lic Cash AIR Doubt Sec Inviv Inv paids (LT) Agmt Equin A/D Fum A/D Beg Bal 4767 1800 -180 1600 2682 70 200 2100 1600 12500 -1260 1000 -85 5000 b 110 d 11900 el 12750 -10162 e2 2760 -2096 f 5000 -5000 -12000 h i -750 j -550 k -200 200 1 -220 m -3500 n 01 o2 -580 Trial Bal -12000 -750 Nancy salary -550 Juan salary -220 -3500 Leon Salary -580 tax expense q r s t u -219 -17 -236 Depreciation Expense ($ 219 = $ 10,500 / 4 yrs / 12 months) -200 Amortization Expense V -200 w y No entry COGS entry above (per perpetual Adj Trial Bal Check: 0 Check: 0