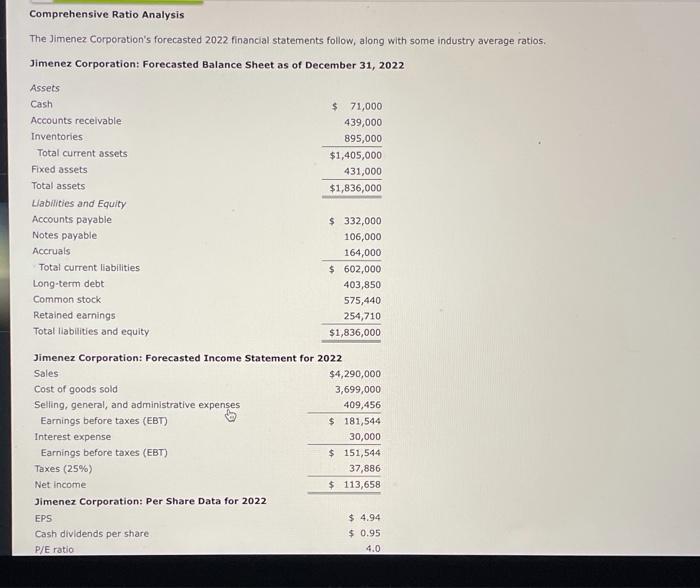

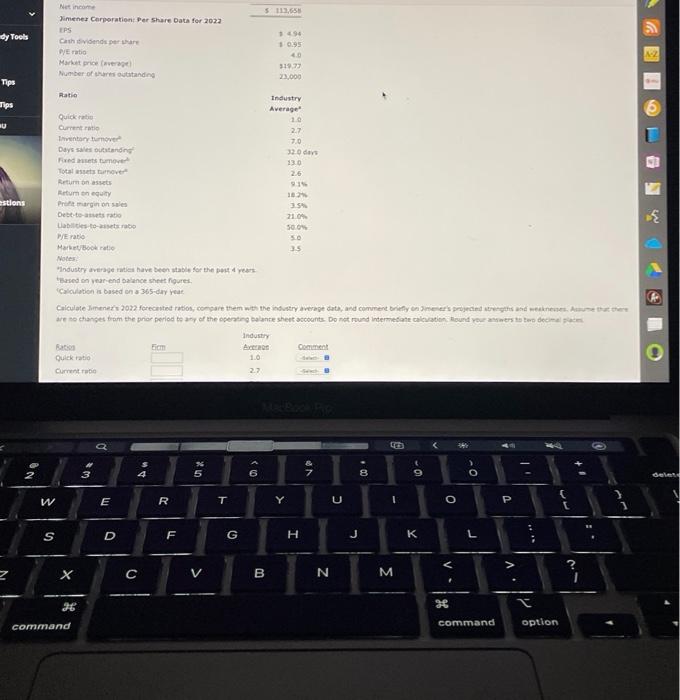

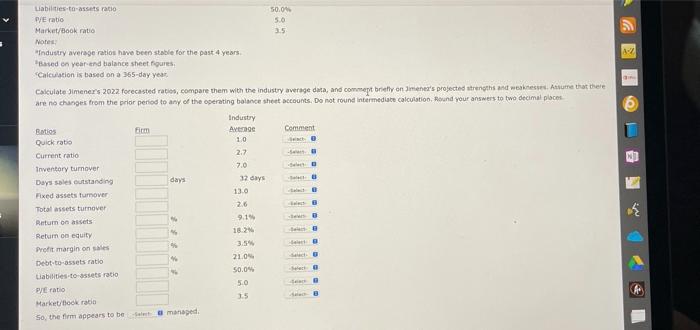

Comprehensive Ratio Analysis The Jimenez Corporation's forecasted 2022 financial statements follow, along with some industry average ratios, Jimenez Corporation: Forecasted Balance Sheet as of December 31, 2022 $ 71,000 439,000 895,000 $1,405,000 431,000 $1,836,000 Assets Cash Accounts receivable Inventories Total current assets Fixed assets Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $ 332,000 106,000 164,000 $ 602,000 403,850 575,440 254,710 $1,836,000 Jimenez Corporation: Forecasted Income Statement for 2022 Sales $4,290,000 Cost of goods sold 3,699,000 Selling, general, and administrative expenses 409,456 Earnings before taxes (EBT) $ 181,544 Interest expense 30,000 Earnings before taxes (EBT) $ 151,544 Taxes (25%) 37,886 Net Income $ 113,658 Jimenez Corporation: Per Share Data for 2022 EPS $ 4.94 Cash dividends per share $ 0.95 P/E ratio 4.0 5113.558 dy Tools Net Jimenez Corporation Per Share Data for 2023 IPS Cith dividends per PE ratio Market price Number of outstanding 10 1095 40 51973 23.000 Tips Tips U estions Ratio Industry Average Quick rate Current rutie 27 Inventory tumove 7.0 Days sales outstanding 320ders Fredets tumor 13.0 Total sets over 26 Return ons 91 Return on equity 10 Protmargin on sale 25 Debt test ratio 21.01 Latestobo 500 P/E ratio MarketBook 35 Notes Industry average rates have been stable for the past years Based on year-end balance sheet figures Calculation is based on 365-day year Calculate Jments 2012 forecasted ratios, compare them with the houstry average date and comment bonneer's projected with are no changes from the prior period of the operating Dalaneshest accounts. Do not round Intermediate action Round your store decoma Industry Eicm A Comment Quick ratio 1.0 Current 2.7 NO UN .00 3 6 4 5 il 9 O I W E R Y C o P S D F G H L ; A A. 2 X > B N M 36 ke command command option Liabilities to assets ratio 50.00 PE ratio 5.0 Market/Book ratio 15 Note industry average ratios have been stable for the past 4 years Based on year and balance sheet figures, Calculation is based on a 365-day year Calculate mener's 2022 forecasted ratios, compare them with the industry average data, and compt briefly on Jimenez's projected strengths and weakness. Assume that there are no changes from the prior period to any of the operating balance sheet accounts. Do not round Intermediate calculation, Hound your answers to two decimal places Industry Ratios Firm Average Comment Quick ratio 1.0 Current ratio 2.7 Inventory turnover 7.0 Days soles outstanding days 32 days Fixed assets tumover 13.0 Total assets turnover 2.6 Return on sets 9.14 Return on equity 18 Profit margin on sale Debt-to-assets ratio 21.04 50.0% Se Liabilities to assets ratio 5.0 Byt ratio 1.5 Marketbook ratio managed So, the firm appears to be +