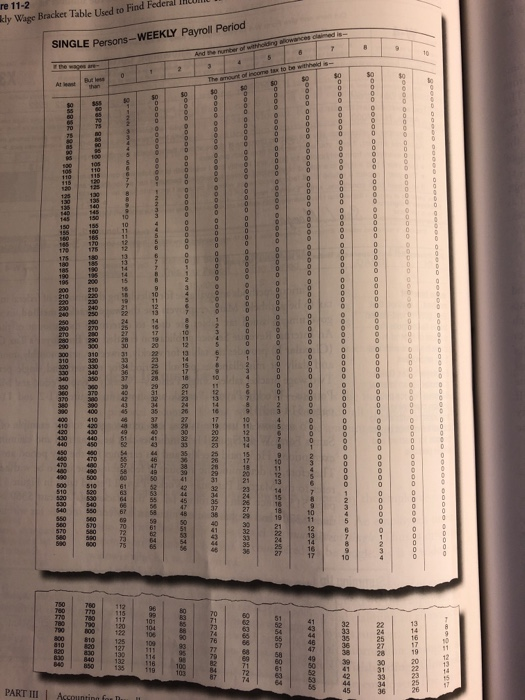

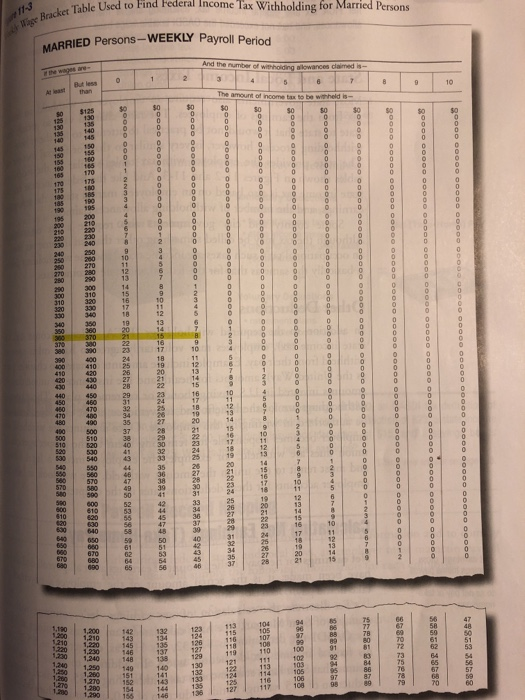

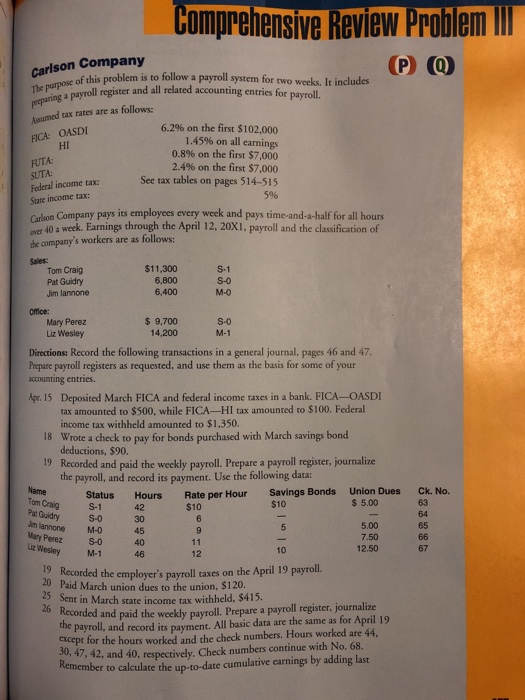

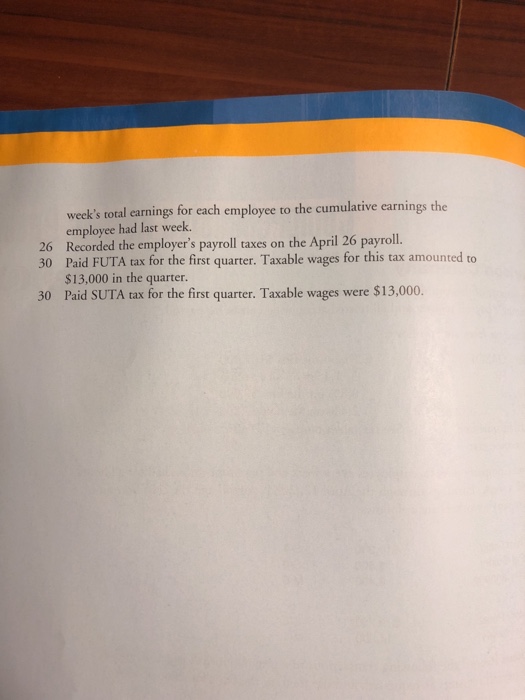

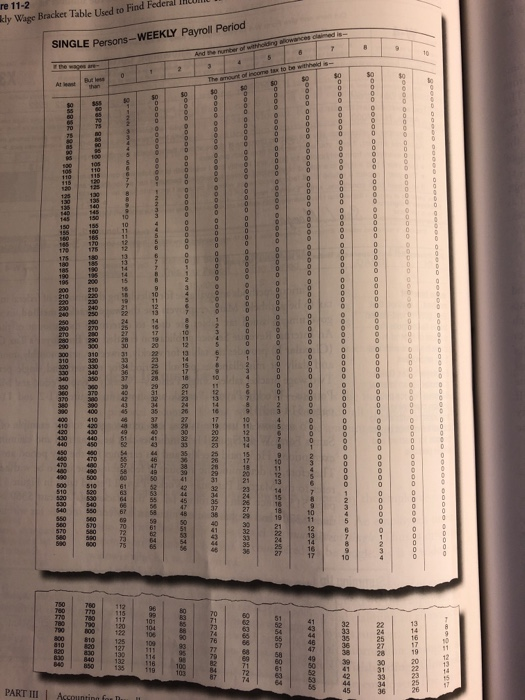

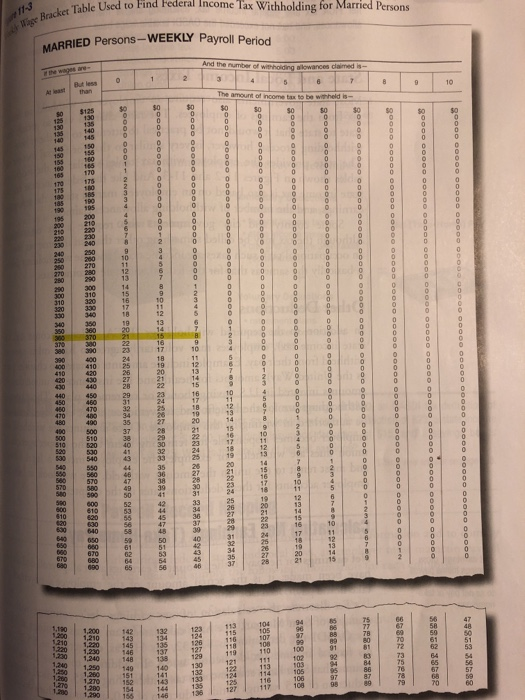

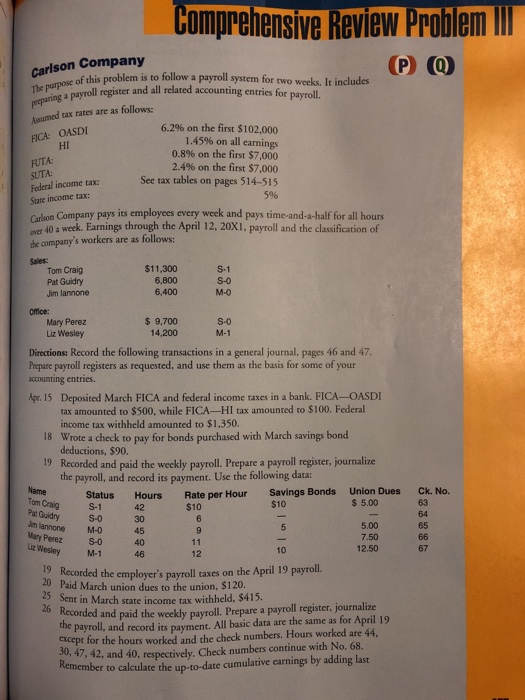

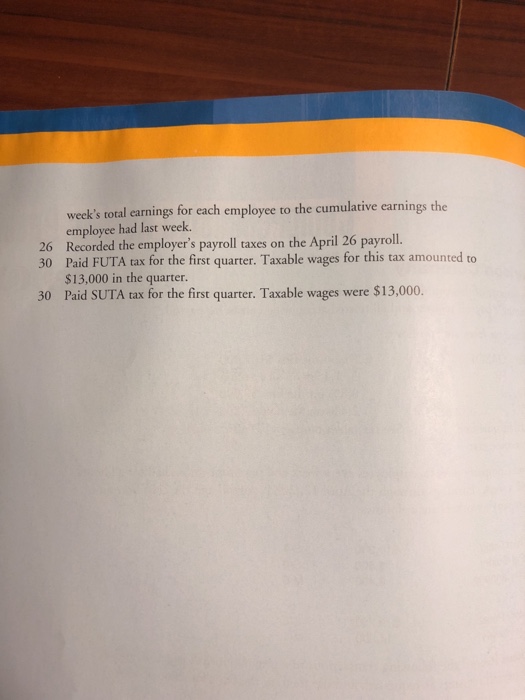

Comprehensive Review Problem carlson Company P (Q of this problem is to follow a payroll system for two weeks. It includes egister and all related accounting entries for payroll. Asumed tax rates are as follows 6.2% on the first $102,000 1.45% on all earnings 0.8% on the first S7.000 24% on the first $7,000 See tax tables on pages 514-515 HI SUTA: Federal income tax: State income tax: Crson Company pays its employees every week and pays time-and-a-half for all hours ever 40 a week. Earnings through the April 12, 20X1, payroll and the classification of the company's workers are as follows: S-1 Tom Craig Pat Guidry Jim lannone $11,300 6,800 6,400 M-0 $9,700 14,200 S-0 M-1 Mary Perez Liz Wesley Directions: Record the following transactions in a general journal, pages 46 and 47. Prepare payroll registers as requested, and use them as the basis for some of your accounting enties. Apr. 15 Deposited March FICA and federal income taxes in a bank. FICA-OASDI tax amounted to $500, while FICA-HI tax amounted to $100. Federal income tax withheld amounted to $1,350. 18 Wrote a check to pay for bonds purchased with March savings bond deductions, $90 19 Recorded and paid the weekly payroll. Prepare a payroll register, journalize the payroll, and record its payment. Use the following data: Status Hours Rate per Hour Savings Bonds Union Dues Ck. No. $5.00 63 64 65 Craig S-1 Pat GuidrySO 30 m lannoneM-0 Mary Perez S-O 4 Liz WesleyM-1 $10 $10 5.00 7.50 12.50 10 67 12 19 Recorded the employer's payroll taxes on the April 19 payroll. 20 Paid March union dues to the union, $120. 25 Sent in March state income tax withheld, $415. 26 Recorded and paid the weekly payroll. Prepare a payroll register, journalize payroll, and record its payment. All basic data are the same as for April 19 except for the hours worked and the check numbers. Hours worked are 44 30,47, 42, and 40, respectively. Check numbers continue with No. 68. Remember to calculate the up-to-date cumulative carnings by adding last Comprehensive Review Problem carlson Company P (Q of this problem is to follow a payroll system for two weeks. It includes egister and all related accounting entries for payroll. Asumed tax rates are as follows 6.2% on the first $102,000 1.45% on all earnings 0.8% on the first S7.000 24% on the first $7,000 See tax tables on pages 514-515 HI SUTA: Federal income tax: State income tax: Crson Company pays its employees every week and pays time-and-a-half for all hours ever 40 a week. Earnings through the April 12, 20X1, payroll and the classification of the company's workers are as follows: S-1 Tom Craig Pat Guidry Jim lannone $11,300 6,800 6,400 M-0 $9,700 14,200 S-0 M-1 Mary Perez Liz Wesley Directions: Record the following transactions in a general journal, pages 46 and 47. Prepare payroll registers as requested, and use them as the basis for some of your accounting enties. Apr. 15 Deposited March FICA and federal income taxes in a bank. FICA-OASDI tax amounted to $500, while FICA-HI tax amounted to $100. Federal income tax withheld amounted to $1,350. 18 Wrote a check to pay for bonds purchased with March savings bond deductions, $90 19 Recorded and paid the weekly payroll. Prepare a payroll register, journalize the payroll, and record its payment. Use the following data: Status Hours Rate per Hour Savings Bonds Union Dues Ck. No. $5.00 63 64 65 Craig S-1 Pat GuidrySO 30 m lannoneM-0 Mary Perez S-O 4 Liz WesleyM-1 $10 $10 5.00 7.50 12.50 10 67 12 19 Recorded the employer's payroll taxes on the April 19 payroll. 20 Paid March union dues to the union, $120. 25 Sent in March state income tax withheld, $415. 26 Recorded and paid the weekly payroll. Prepare a payroll register, journalize payroll, and record its payment. All basic data are the same as for April 19 except for the hours worked and the check numbers. Hours worked are 44 30,47, 42, and 40, respectively. Check numbers continue with No. 68. Remember to calculate the up-to-date cumulative carnings by adding last