Question

Comprehensive Tax Return Case Study Please complete Tax Software Case Study attached. Please know that even though the Assignment is found in Chapter 11 from

Comprehensive Tax Return Case Study

Please complete Tax Software Case Study attached.

Please know that even though the Assignment is found in Chapter 11 from the previous version of the text, it only covers concepts studied in the prior chapters. We will not be covering Chapter 11 in this course. However, Chapter 11 is simply used since the tax software assignment problem is located therein.

The following marking scheme will be used to calculate your grade.

- 15% - Calculate Total income

- 15% - Calculate Net income

- 20% - Calculate Taxable income

- 20% - Calculate total Federal non-refundable tax credits

- 15% - Calculate Federal taxes payable

- 15% - Prepared Final income tax return using tax preparation software

This assignment aligns with all course learning outcomes found in the course outline.

Case Study uses T1 Profile Software - Access is available free of charge to users of Byrd & Chen's Canadian Tax Principles.

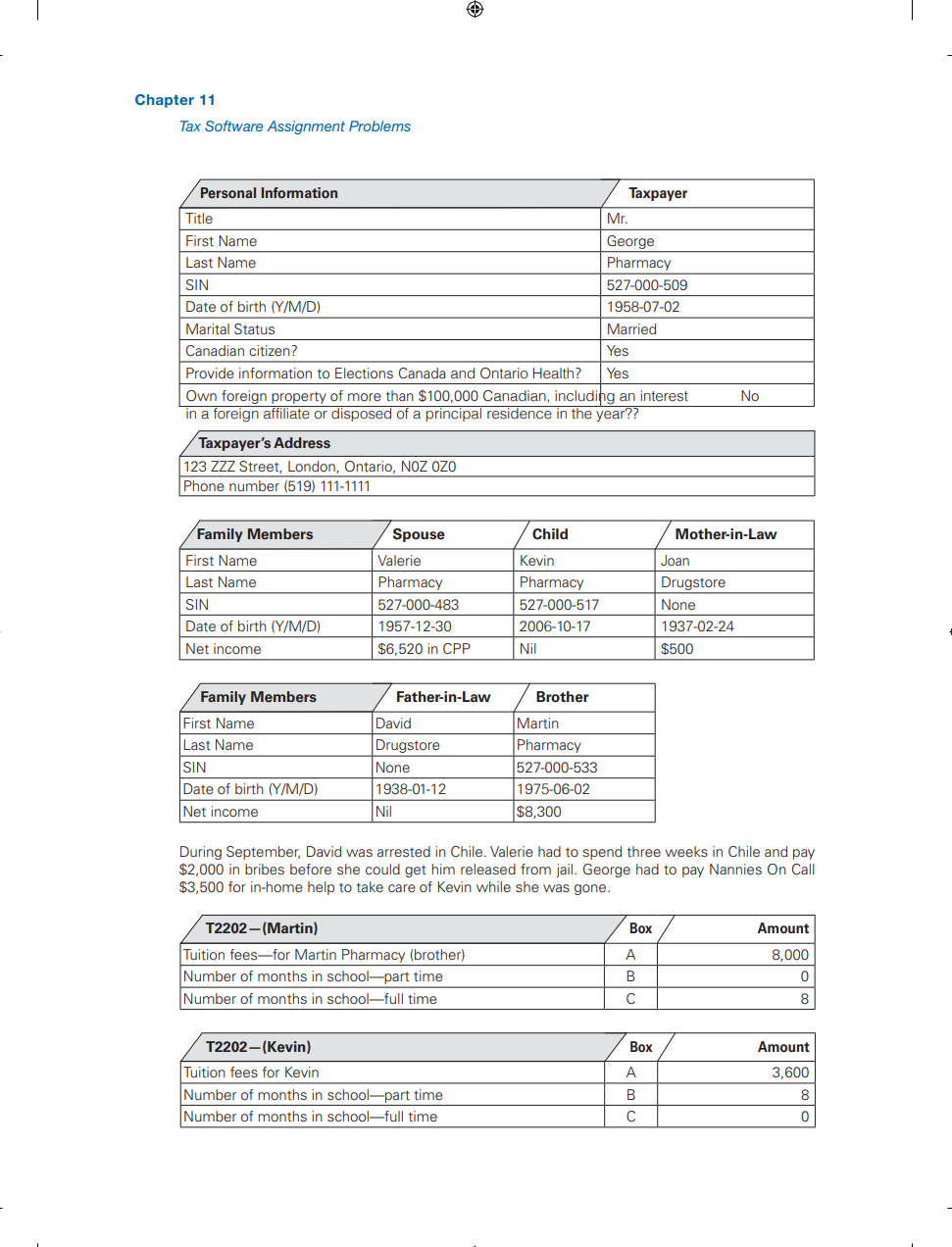

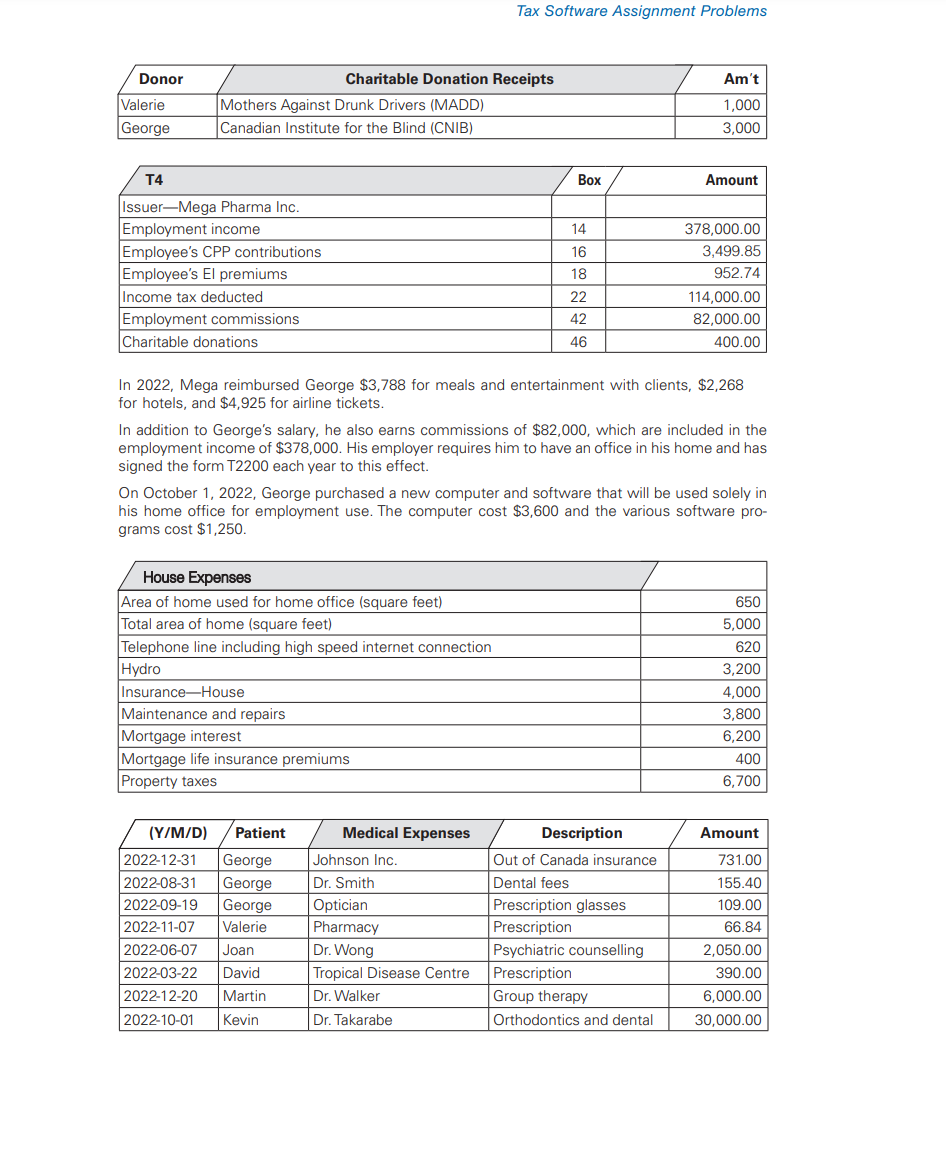

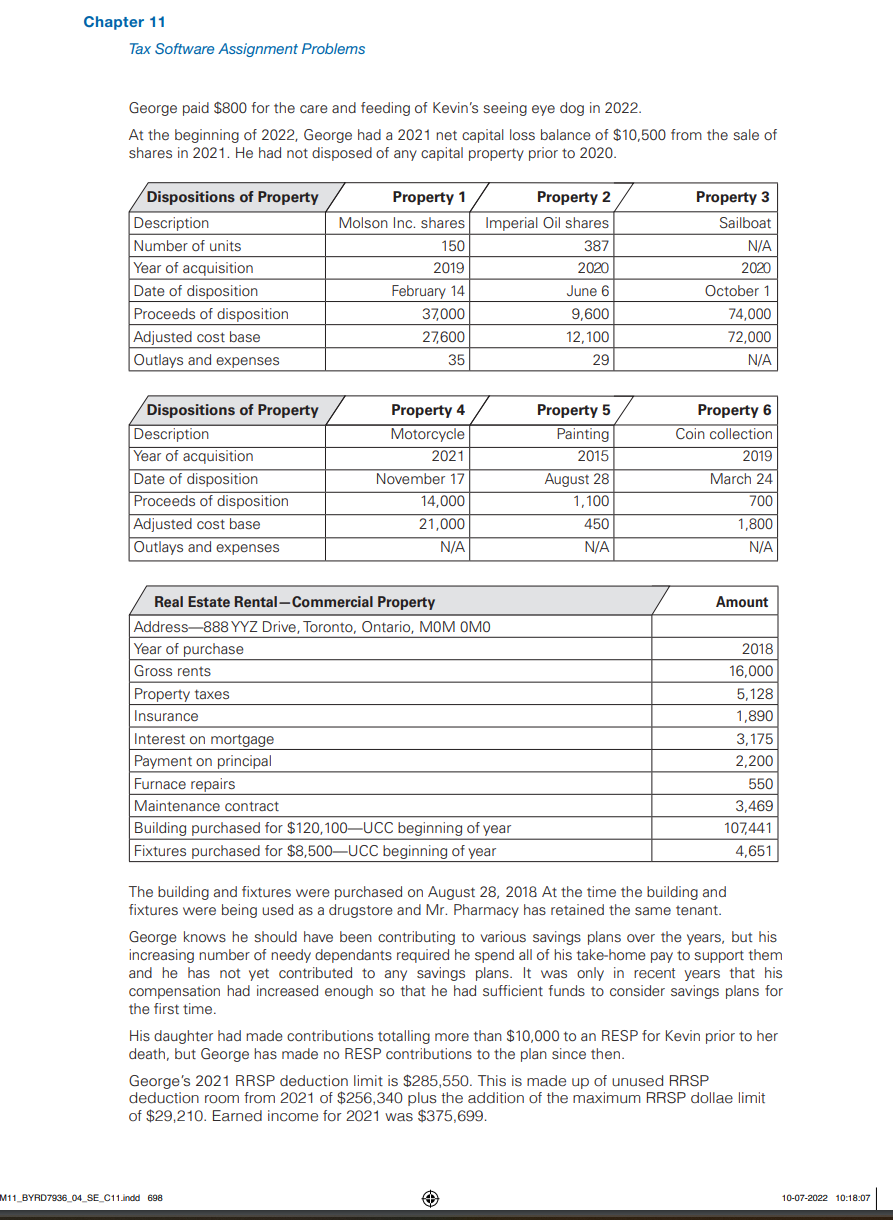

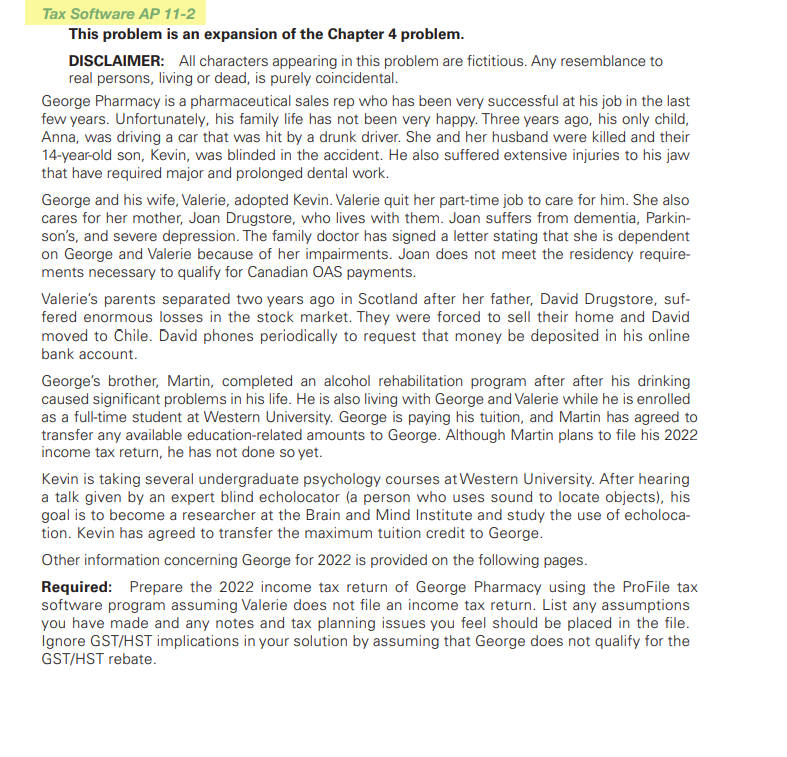

hapter 11 Tax Software Assignment Problems During September, David was arrested in Chile. Valerie had to spend three weeks in Chile and pay $2,000 in bribes before she could get him released from jail. George had to pay Nannies On Call $3,500 for in-home help to take care of Kevin while she was gone. Tax Software Assignment Problems In 2022, Mega reimbursed George $3,788 for meals and entertainment with clients, $2,268 for hotels, and $4,925 for airline tickets. In addition to George's salary, he also earns commissions of $82,000, which are included in the employment income of $378,000. His employer requires him to have an office in his home and has signed the form T2200 each year to this effect. On October 1, 2022, George purchased a new computer and software that will be used solely in his home office for employment use. The computer cost $3,600 and the various software programs cost $1,250. George paid $800 for the care and feeding of Kevin's seeing eye dog in 2022. At the beginning of 2022, George had a 2021 net capital loss balance of $10,500 from the sale of shares in 2021 . He had not disposed of any capital property prior to 2020 . The building and fixtures were purchased on August 28, 2018 At the time the building and fixtures were being used as a drugstore and Mr. Pharmacy has retained the same tenant. George knows he should have been contributing to various savings plans over the years, but his increasing number of needy dependants required he spend all of his take-home pay to support them and he has not yet contributed to any savings plans. It was only in recent years that his compensation had increased enough so that he had sufficient funds to consider savings plans for the first time. His daughter had made contributions totalling more than $10,000 to an RESP for Kevin prior to her death, but George has made no RESP contributions to the plan since then. George's 2021 RRSP deduction limit is $285,550. This is made up of unused RRSP deduction room from 2021 of $256,340 plus the addition of the maximum RRSP dollae limit of $29,210. Earned income for 2021 was $375,699. This problem is an expansion of the Chapter 4 problem. DISCLAIMER: All characters appearing in this problem are fictitious. Any resemblance to real persons, living or dead, is purely coincidental. George Pharmacy is a pharmaceutical sales rep who has been very successful at his job in the last few years. Unfortunately, his family life has not been very happy. Three years ago, his only child, Anna, was driving a car that was hit by a drunk driver. She and her husband were killed and their 14 -year-old son, Kevin, was blinded in the accident. He also suffered extensive injuries to his jaw that have required major and prolonged dental work. George and his wife, Valerie, adopted Kevin. Valerie quit her part-time job to care for him. She also cares for her mother, Joan Drugstore, who lives with them. Joan suffers from dementia, Parkinson's, and severe depression. The family doctor has signed a letter stating that she is dependent on George and Valerie because of her impairments. Joan does not meet the residency requirements necessary to qualify for Canadian OAS payments. Valerie's parents separated two years ago in Scotland after her father, David Drugstore, suffered enormous losses in the stock market. They were forced to sell their home and David moved to Chile. David phones periodically to request that money be deposited in his online bank account. George's brother, Martin, completed an alcohol rehabilitation program after after his drinking caused significant problems in his life. He is also living with George and Valerie while he is enrolled as a full-time student at Western University. George is paying his tuition, and Martin has agreed to transfer any available education-related amounts to George. Although Martin plans to file his 2022 income tax return, he has not done so yet. Kevin is taking several undergraduate psychology courses at Western University. After hearing a talk given by an expert blind echolocator (a person who uses sound to locate objects), his goal is to become a researcher at the Brain and Mind Institute and study the use of echolocation. Kevin has agreed to transfer the maximum tuition credit to George. Other information concerning George for 2022 is provided on the following pages. Required: Prepare the 2022 income tax return of George Pharmacy using the ProFile tax software program assuming Valerie does not file an income tax return. List any assumptions you have made and any notes and tax planning issues you feel should be placed in the file. Ignore GST/HST implications in your solution by assuming that George does not qualify for the GST/HST rebateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started