Question

Compuland: October 1995 Transactions The transactions below pertain to Compulands second month (October) of operations. Paid $11,000 to the supplier to complete payment on the

Compuland: October 1995 Transactions

Compuland: October 1995 Transactions

The transactions below pertain to Compulands second month (October) of operations.

Paid $11,000 to the supplier to complete payment on the furniture and fixtures bought on September 1, 1995 (refer to transaction 4 of September).

Paid $40,000 to the supplier to complete payment of the 40 computers that were bought on September 22, 1995 (refer to transaction 10 of September).

The customer who owed $31,000 (refer to transaction 11 of September) paid the amount to Compuland.

Purchased and received office supplies for $1,200 by paying cash in October.

Purchased 60 computers in October for $1,000 each, and paid $25,000 cash to the supplier, with the remaining amount to be paid in November.

Sold 50 computers in October for $1,400 each, received $20,000 cash, with the remaining amount to be collected in November.

Paid $2,400 to the employee on October 21st towards wages for the period September 21 to October 20th.

Rachel figured that that the income tax on the October 1995 profits of Compuland would be $500 the tax will be paid in December.

Rachel took $600 as dividends in cash from Compuland.

At the end of October, office supplies inventory on hand was $500.

Required: Prepare the following for October:

Income Statement for October 1995.

Statement of Stockholders Equity for October 1995

Balance Sheet as at October 31, 1995

Hint: It is useful to remember that certain information such as the information used to calculate depreciation etc. carry over from the September data.

for september data search chegg for compuland or use:

https://www.chegg.com/homework-help/questions-and-answers/rachel-started-compuland-inc-computer-retail-business-september-1-1995-follows-description-q26339617?trackid=40f466e5&strackid=11fc2458&ii=1

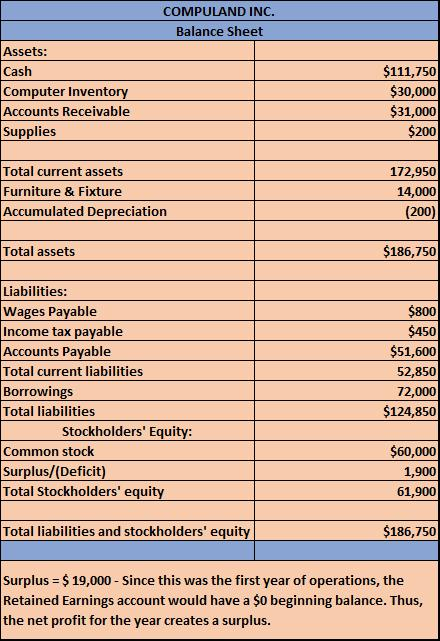

COMPULAND INC. Balance Sheet Assets: Cash Computer Invento Accounts Receivable Supplies $111,750 $30,000 $31,000 $200 Total current assets Furniture & Fixture Accumulated Depreciation 172,950 14,000 200 Total assets $186,750 Liabilities: Wages Payable Income tax pavable Accounts Payable Total current liabilities Borrowings Total liabilities $800 S450 $51,600 52,850 72,000 $124,850 Stockholders' Equity Common stock Surplus/(Deficit) Total Stockholders' equity $60,000 1,900 61,900 Total liabilities and stockholders' equity $186,750 Surplus 19,000 Since this was the first year of operations, the Retained Earnings account would have a $0 beginning balance. Thus, the net profit for the year creates a surplusStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started