Answered step by step

Verified Expert Solution

Question

1 Approved Answer

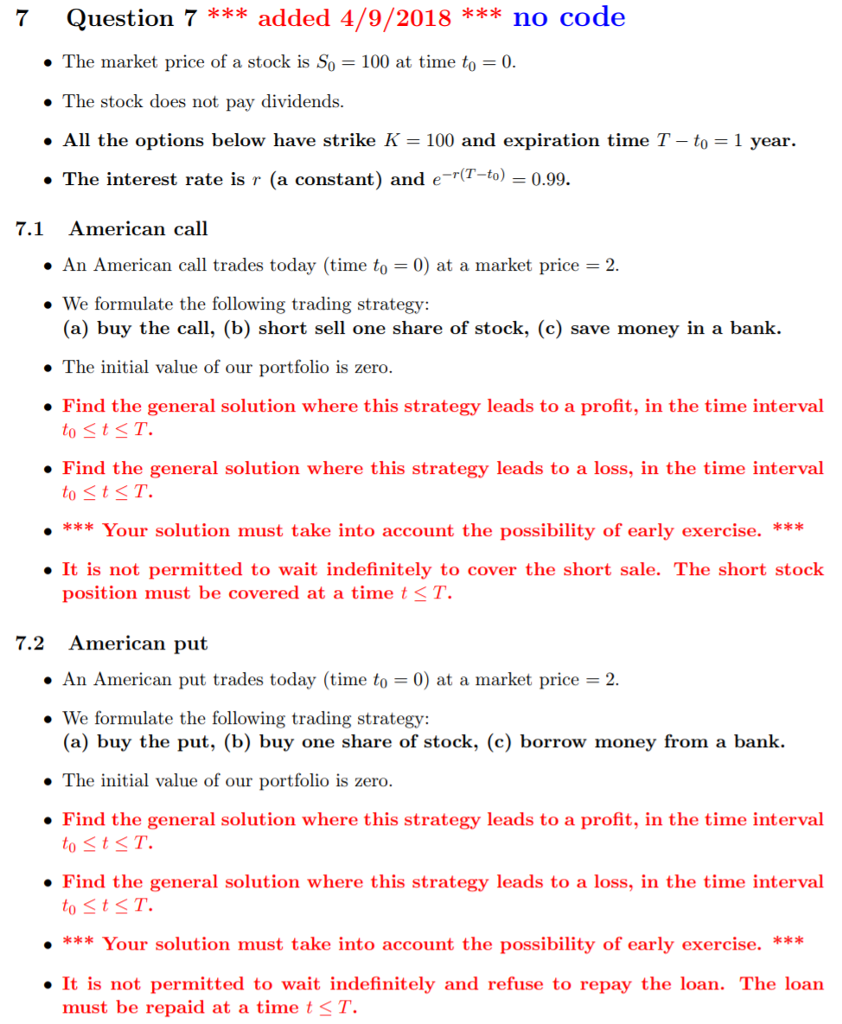

Computational Finance. Please show all work. 7 Question 7 added 4/9/2018*** no code The market price of a stock is So-100 at time to 0

Computational Finance. Please show all work.

7 Question 7 added 4/9/2018*** no code The market price of a stock is So-100 at time to 0 . The stock does not pay dividends. All the options below have strike K = 100 and expiration time T-to = 1 year. The interest rate is r (a constant) and eo) 0.99. 7.1 American call . An American call trades today (time to 0) at a market price-2 . We formulate the following trading strategy (a) buy the call, (b) short sell one share of stock, (c) save money in a bank . The initial value of our portfolio is zero. . Find the general solution where this strategy leads to a profit, in the time interval 0 Find the general solution where this strategy leads to a loss, in the time interval oStT. Your solution must take into account the possibility of early exercise. . It is not permitted to wait indefinitely to cover the short sale. The short stock position must be covered at a time tStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started