Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computations Current ratio _________. Return on Equity _________. Asset Turnover _________. Payout Ratio _________. Price-earnings ratio _________. Debt/Assets ratio _________. Profit margin _________. Inventory Turnover

Computations

- Current ratio _________.

- Return on Equity _________.

- Asset Turnover _________.

- Payout Ratio _________.

- Price-earnings ratio _________.

- Debt/Assets ratio _________.

- Profit margin _________.

- Inventory Turnover _________.

- Inventory Turnover in Days_________.

- Quick/Acid Test Ratio _________.

- Earnings Per Share _________.

- Return on Assets _________.

- Gross Profit Rate _________.

- Times Interest Earned _________.

- Working Capital __________.

Please show work for them. I am struggling with this.

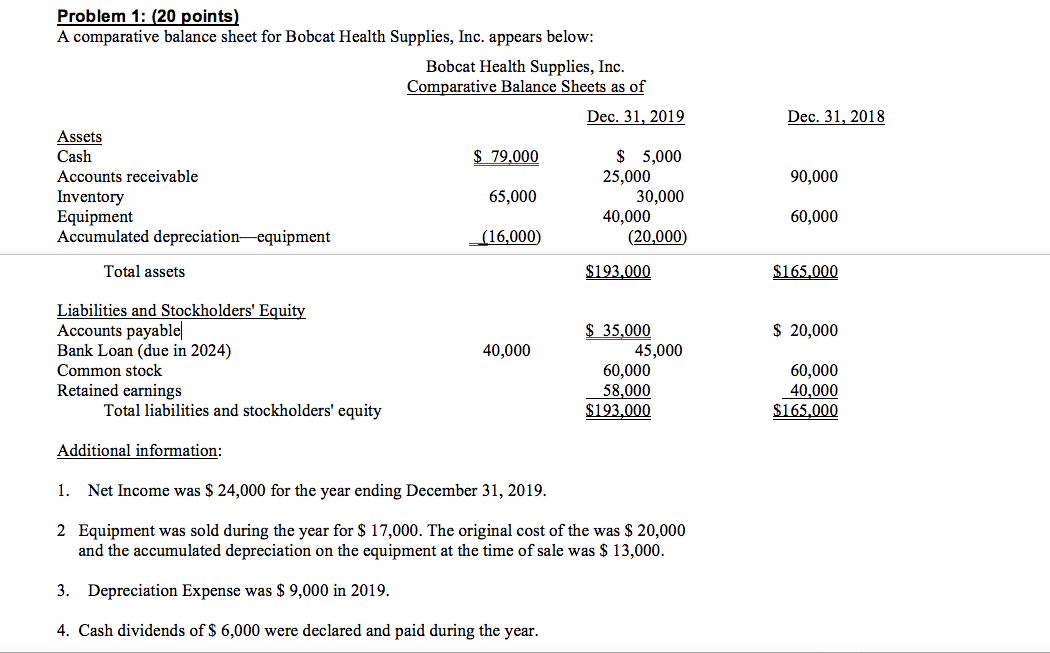

Dec. 31, 2018 Problem 1: (20 points) A comparative balance sheet for Bobcat Health Supplies, Inc. appears below: Bobcat Health Supplies, Inc. Comparative Balance Sheets as of Dec. 31, 2019 Assets Cash $ 79,000 $ 5,000 Accounts receivable 25,000 Inventory 65,000 30,000 Equipment 40,000 Accumulated depreciation equipment _(16,000 (20,000 90,000 60,000 Total assets $193,000 $165.000 $ 20,000 40,000 Liabilities and Stockholders' Equity Accounts payable Bank Loan (due in 2024) Common stock Retained earnings Total liabilities and stockholders' equity $ 35,000 45,000 60,000 58,000 $193,000 60,000 40,000 $165.000 Additional information: 1. Net Income was $ 24,000 for the year ending December 31, 2019. 2 Equipment was sold during the year for $ 17,000. The original cost of the was $ 20,000 and the accumulated depreciation on the equipment at the time of sale was $ 13,000. 3. Depreciation Expense was $ 9,000 in 2019. 4. Cash dividends of $ 6,000 were declared and paid during the year. Problem 2: Financial Statement Analysis: (30 points) Using Kohl's financial statements and the additional information given below, compute these ratios for the most current year shown fiscal year 2019 - which ended on February 1, 2020. Show all computations. (round to 2 decimal places; (15% or. 15) Additional Financial Information for Kohl's Inc. a. The market price per share on February 1, 2020, was $ 41 per share. b. 157.4 million weighted-average shares of stock were outstanding during the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started