Answered step by step

Verified Expert Solution

Question

1 Approved Answer

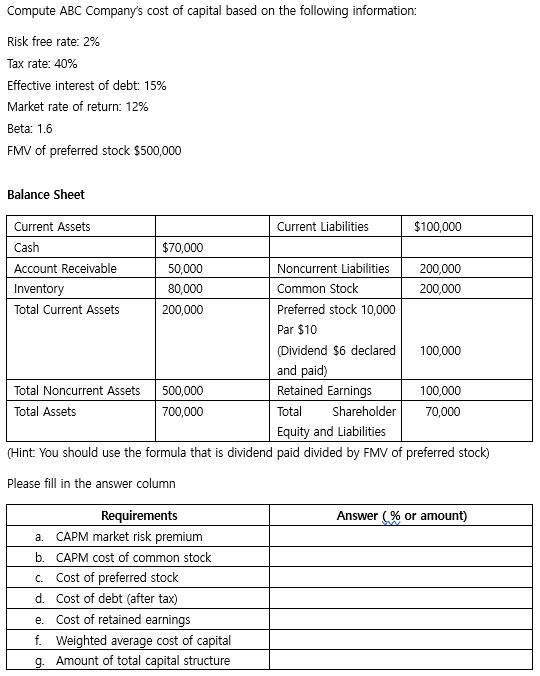

Compute ABC Company's cost of capital based on the following information: Risk free rate: 2% Tax rate: 40% Effective interest of debt: 15% Market

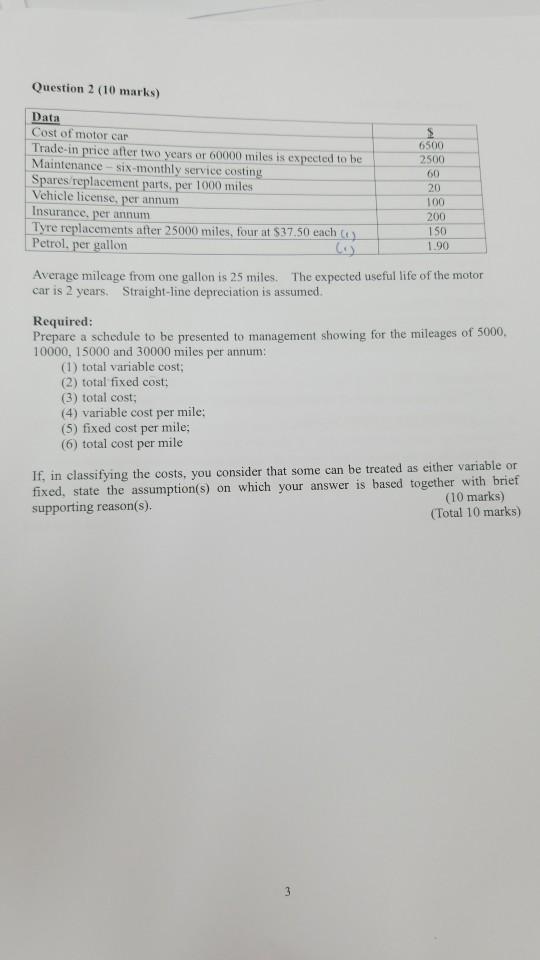

Compute ABC Company's cost of capital based on the following information: Risk free rate: 2% Tax rate: 40% Effective interest of debt: 15% Market rate of return: 12% Beta: 1.6 FMV of preferred stock $500,000 Balance Sheet Current Assets Current Liabilities $100,000 Cash $70,000 Account Receivable 50,000 Noncurrent Liabilities 200,000 Inventory 80,000 Common Stock 200,000 Total Current Assets 200,000 Preferred stock 10,000 Par $10 (Dividend $6 declared 100,000 and paid) Total Noncurrent Assets 500,000 Retained Earnings 100,000 Total Assets 700,000 Total Shareholder 70,000 Equity and Liabilities (Hint: You should use the formula that is dividend paid divided by FMV of preferred stock) Please fill in the answer column Requirements a. CAPM market risk premium b. CAPM cost of common stock c. Cost of preferred stock d. Cost of debt (after tax) e. Cost of retained earnings f. Weighted average cost of capital g. Amount of total capital structure Answer (% or amount) Question 2 (10 marks) Data Cost of motor car Trade-in price after two years or 60000 miles is expected to be Maintenance-six-monthly service costing Spares/replacement parts, per 1000 miles Vehicle license, per annum Insurance, per annum Tyre replacements after 25000 miles, four at $37.50 each() Petrol, per gallon (+). 6500 2500 60 20 100 200 150 1.90 Average mileage from one gallon is 25 miles. The expected useful life of the motor car is 2 years. Straight-line depreciation is assumed. Required: Prepare a schedule to be presented to management showing for the mileages of 5000, 10000, 15000 and 30000 miles per annum: (1) total variable cost; (2) total fixed cost; (3) total cost; (4) variable cost per mile; (5) fixed cost per mile; (6) total cost per mile If, in classifying the costs, you consider that some can be treated as either variable or fixed, state the assumption(s) on which your answer is based together with brief supporting reason(s). (10 marks) (Total 10 marks)

Step by Step Solution

★★★★★

3.68 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a CAPM market risk premium The CAPM market risk premium is the difference between the market rate of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started