Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have an outstanding student loan with required payments of $500 per month for the next four years. The interest rate on the loan

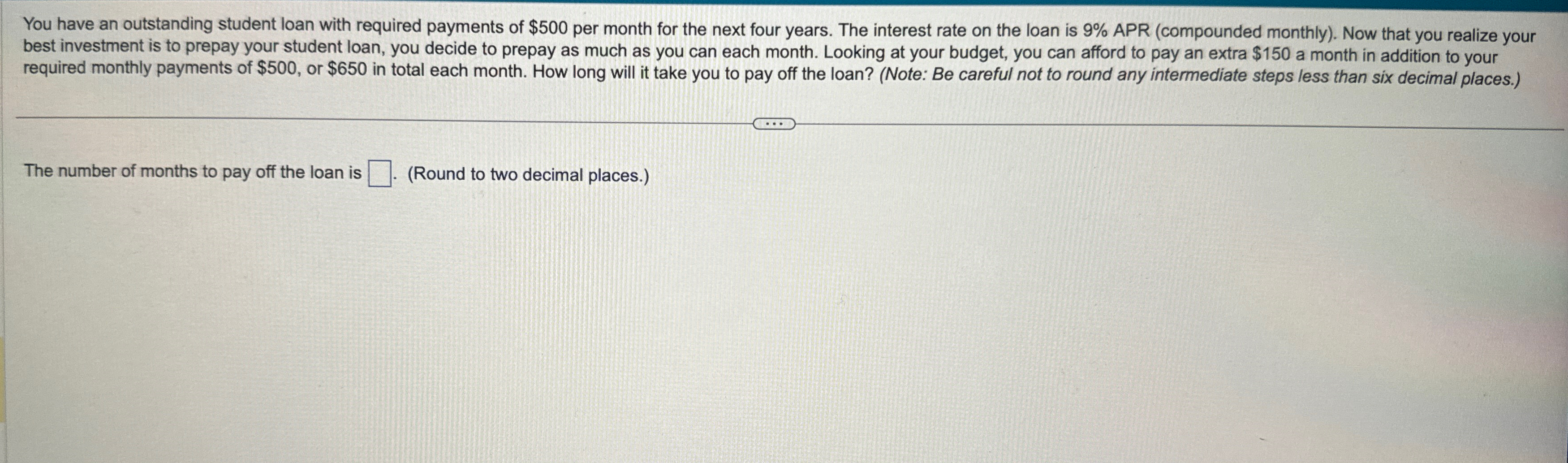

You have an outstanding student loan with required payments of $500 per month for the next four years. The interest rate on the loan is 9% APR (compounded monthly). Now that you realize your best investment is to prepay your student loan, you decide to prepay as much as you can each month. Looking at your budget, you can afford to pay an extra $150 a month in addition to your required monthly payments of $500, or $650 in total each month. How long will it take you to pay off the loan? (Note: Be careful not to round any intermediate steps less than six decimal places.) The number of months to pay off the loan is (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate the number of months to pay off the loan with prepayments 1 Calculate the mon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started