Answered step by step

Verified Expert Solution

Question

1 Approved Answer

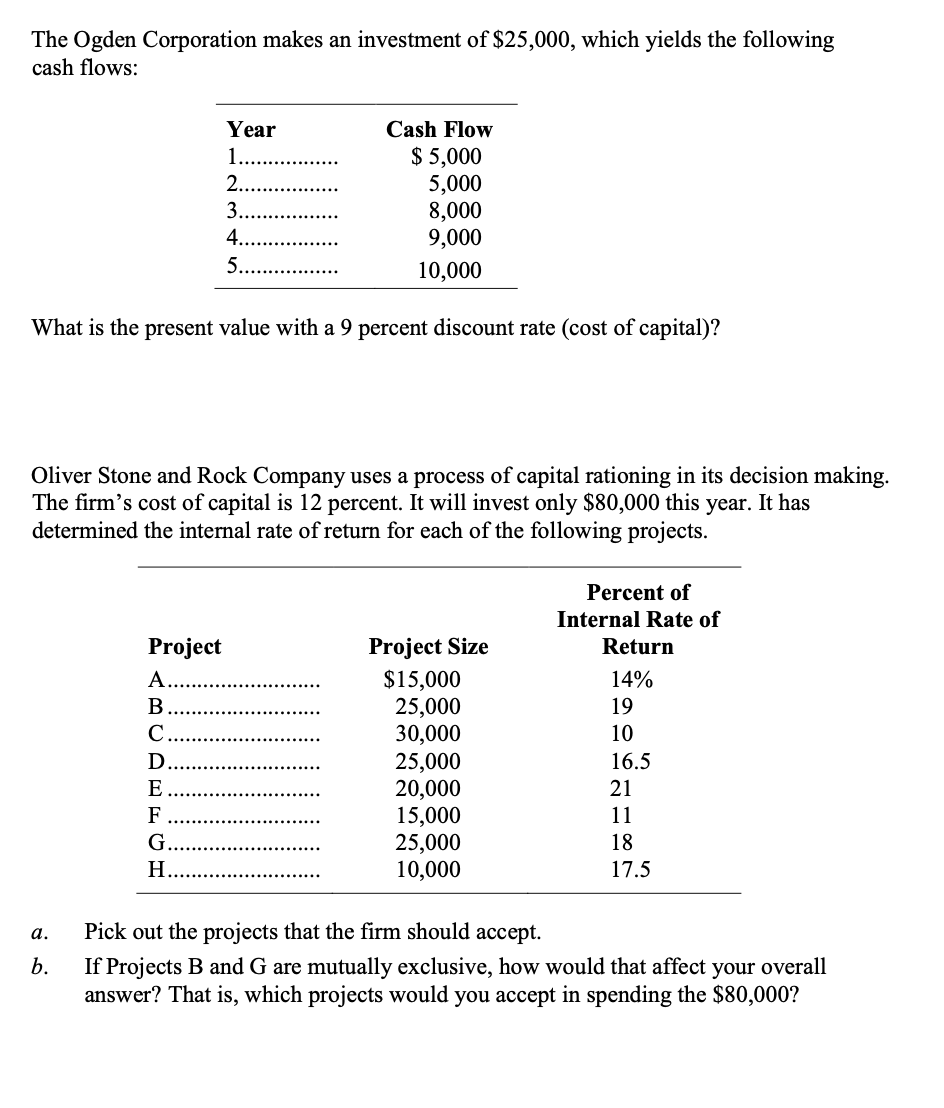

The Ogden Corporation makes an investment of $25,000, which yields the following cash flows: Year Cash Flow 1. $5,000 2..... 5,000 3. 8,000 4...

The Ogden Corporation makes an investment of $25,000, which yields the following cash flows: Year Cash Flow 1. $5,000 2..... 5,000 3. 8,000 4... 9,000 5... 10,000 What is the present value with a 9 percent discount rate (cost of capital)? Oliver Stone and Rock Company uses a process of capital rationing in its decision making. The firm's cost of capital is 12 percent. It will invest only $80,000 this year. It has determined the internal rate of return for each of the following projects. a. b. Percent of Internal Rate of Project Project Size Return A.. $15,000 14% B 25,000 19 C 30,000 10 25,000 16.5 E 20,000 21 F 15,000 11 G 25,000 18 H 10,000 17.5 Pick out the projects that the firm should accept. If Projects B and G are mutually exclusive, how would that affect your overall answer? That is, which projects would you accept in spending the $80,000?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started