compute and analyze trend analysis of the company a) what does your trend analysis suggest may happen next year?

compute ratios for each indicated in exhibit 3 and compare to the industry averages provided. (a) for each ratio category(liquidity, activity, solvency, profitability),which do you believe is the most important ratio to analyze for Anandam?why?

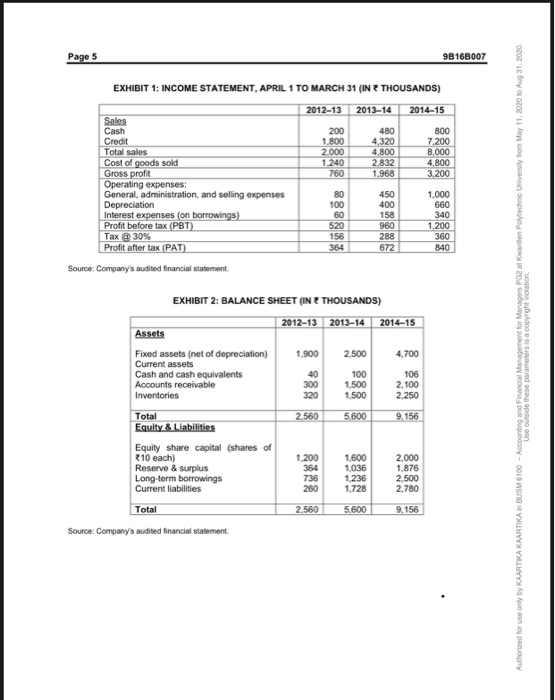

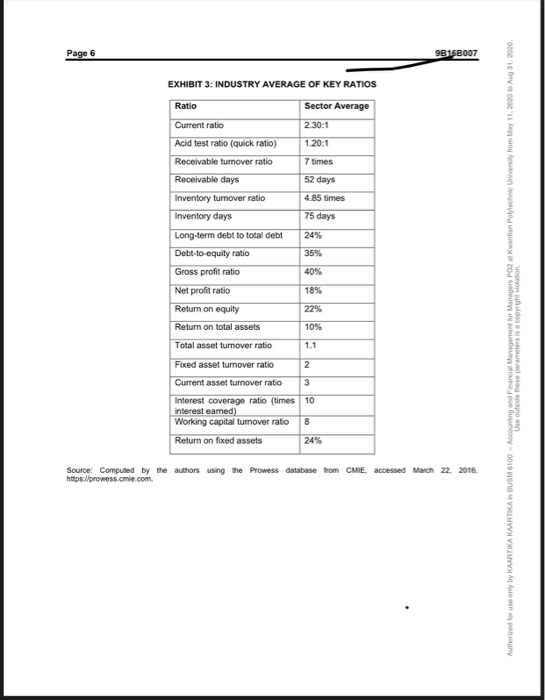

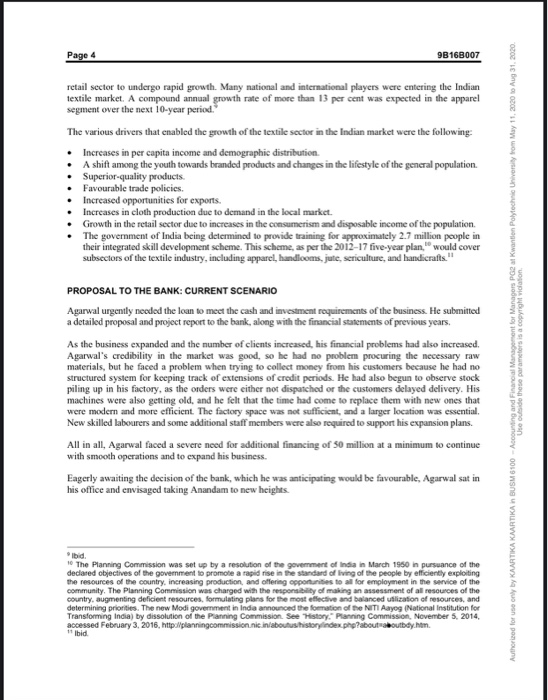

Page 5 9B16B007 EXHIBIT 1: INCOME STATEMENT, APRIL 1 TO MARCH 31 (IN THOUSANDS) 2012-13 2013-14 2014-15 200 1.800 2.000 1.240 760 480 4,320 4.800 2.832 1.968 800 7.200 8.000 4.800 3.200 Sales Cash Credit Total sales Cost of goods sold Gross profit Operating expenses: General, administration, and selling expenses Depreciation Interest expenses (on borrowings) Profit before tax (PBT) Tax 30% Profit after tax (PAT) Source: Company's audited financial statement. 80 100 60 520 156 364 450 400 158 960 288 672 1.000 660 340 1.200 360 840 EXHIBIT 2: BALANCE SHEET (IN THOUSANDS) 2012-13 2013-14 2014-15 Assets Fixed assets (net of depreciation) 1,500 2,500 4.700 Current assets Cash and cash equivalents 40 100 106 Accounts receivable 300 1,500 2.100 Inventories 320 1,500 2.250 Total 2.560 5,600 9.156 Equity & Liabilities Equity share capital (shares of 810 each) 1.200 1.600 2,000 Reserve & surplus 364 1,036 1,876 Long-term borrowings 736 1.236 2.500 Current liabilities 260 1,728 2.780 Authorized for use only by KAARTIKA KARTIKA in BUSM 6100 - Accounting and Financial Management for Managers PG2 at Kwanten Polytechnic University from May 11, 2020 10 Aug 31, 2020 Use outside these parameters is a copyright violation 2.560 5,600 9.156 Total Source: Company's audited financial statement. Page 6 9815B007 EXHIBIT 3: INDUSTRY AVERAGE OF KEY RATIOS Sector Average Ratio Current ratio 2.30:1 1.20:1 7 times 52 days 4.85 times 75 days Acid test ratio (quick ratio) Receivable turnover ratio Receivable days Inventory turnover ratio Inventory days Long-term debt to total debt Debt-to-equity ratio Gross profit ratio Net profit ratio Return on equity Return on total assets Total asset turnover ratio 24% 35% 40% 18% 22% 10% 1.1 Authorized for use only by KAARTIKA KAARTIKA IN BUSM 6100 - Accounting and Financial Management for Manager P2Kwantin Polytechnic University from May 11, 2020 to Aug 31, 2020 Use outside these parameters is copyright violation 2 Fixed asset turnover ratio Current asset turnover ratio 3 Interest coverage ratio (times 10 interest eamed) Working capital turnover ratio 8 Return on fixed assets 24% Source: Computed by the authors using the Prowess database trom CMIE, accessed March 22. 2016, https://prowess.cmie.com Page 4 9B16B007 retail sector to undergo rapid growth. Many national and international players were entering the Indian textile market. A compound annual growth rate of more than 13 per cent was expected in the apparel segment over the next 10-year period. The various drivers that enabled the growth of the textile sector in the Indian market were the following: Increases in per capita income and demographic distribution A shift among the youth towards branded products and changes in the lifestyle of the general population. Superior-quality products. Favourable trade policies. Increased opportunities for exports. Increases in cloth production due to demand in the local market. Growth in the retail sector due to increases in the consumerism and disposable income of the population The government of India being determined to provide training for approximately 2.7 million people in their integrated skill development scheme. This scheme, as per the 2012-17 five-year plan would cover subsectors of the textile industry, including apparel, handlooms, jute, sericulture, and handicrafts." PROPOSAL TO THE BANK: CURRENT SCENARIO Agarwal urgently needed the loan to meet the cash and investment requirements of the business. He submitted a detailed proposal and project report to the bank, along with the financial statements of previous years. As the business expanded and the number of clients increased, his financial problems had also increased. Agarwal's credibility in the market was good, so he had no problem procuring the necessary raw materials, but he faced a problem when trying to collect money from his customers because he had no structured system for keeping track of extensions of credit periods. He had also begun to observe stock piling up in his factory, as the orders were either not dispatched or the customers delayed delivery. His machines were also getting old, and he felt that the time had come to replace them with new ones that were modern and more efficient. The factory space was not sufficient, and a larger location was essential New skilled labourers and some additional staff members were also required to support his expansion plans. All in all, Agarwal faced a severe need for additional financing of 50 million at a minimum to continue with smooth operations and to expand his business. Eagerly awaiting the decision of the bank, which he was anticipating would be favourable, Agarwal sat in his office and envisaged taking Anandam to new heights Authorized for use only by KAARTIKA KARTIKA BUSM 6100 - Accounting and Financial Management for Managers PG2 at Kwantin Polytechnic University from May 11, 2020 10 Aug 31, 2020 Useide these parameters is a copyright vidation 1 The Planning Commission was set up by a resolution of the government of India in March 1950 in pursuance of the declared objectives of the government to promote a rapid rise in the standard of living of the people by efficiently exploiting the resources of the country, increasing production, and offering opportunities to all for employment in the service of the community. The Planning Commission was charged with the responsibility of making an assessment of all resources of the country, augmenting deficient resources, formulating plans for the most effective and balanced utilization of resources, and determining priorities. The new Modi government in India announced the formation of the NITI Aayog (National Institution for Transforming India) by dissolution of the Planning Commission See History Planning Commission. November 5, 2014, accessed February 3, 2016. http://planningcommission.nic.in aboutus historylindex.php?about aboutboy.htm