Question

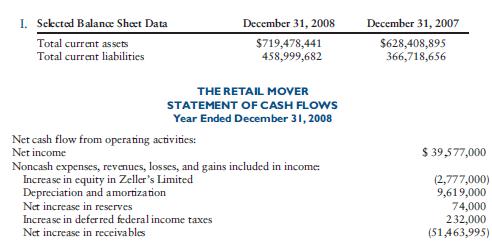

This case represents an actual retail company. The dates and format have been changed. Required: a. Compute and comment on the following for 2007, 2008,

This case represents an actual retail company. The dates and format have been changed.

Required:

a. Compute and comment on the following for 2007, 2008, and 2011:

1. Working capital

2. Current ratio

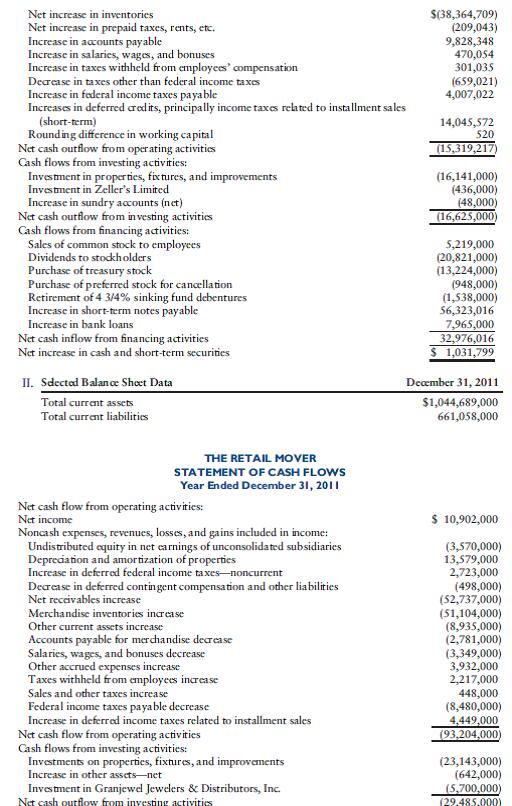

b. Comment on the difference between net income and net cash outflow from operating activities for the years ended December 31, 2008, and December 31, 2011.

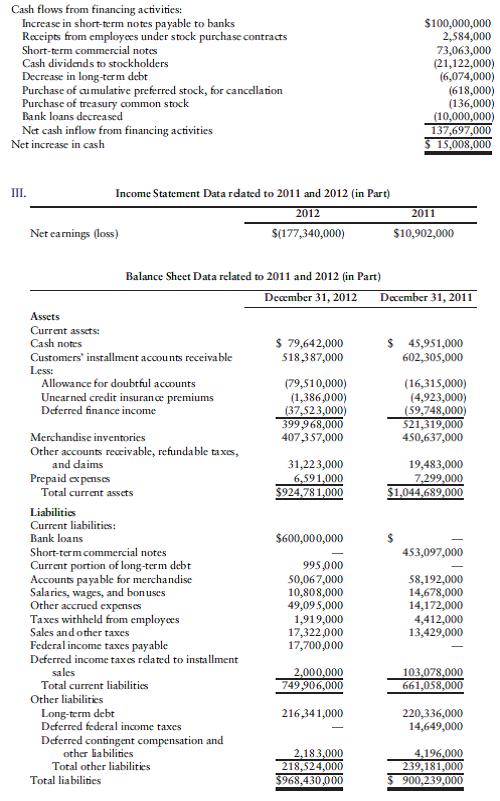

c. This company reported a loss of $177,340,000 for 2012. Reviewing the balance sheet data, speculate on major reasons for this loss.

d. Considering (a), (b), and (c), comment on the wisdom of the short-term bank loan in 2012. (Consider the company’s perspective and the bank’s perspective.)

I. Selected Balance Sheet Data Total current assets Total current liabilities THE RETAIL MOVER STATEMENT OF CASH FLOWS Year Ended December 31, 2008 Net cash flow from operating activities: Net income December 31, 2008 $719,478,441 458,999,682 Noncash expenses, revenues, losses, and gains included in income: Increase in equity in Zeller s Limited Depreciation and amortization Net increase in reserves Increase in deferred federal income taxes Net increase in receivables December 31, 2007 $628,408,895 366,718,656 $ 39,577,000 (2,777,000) 9,619,000 74,000 232,000 (51,463,995) Net increase in inventories Net increase in prepaid taxes, rents, etc. Increase in accounts payable Increase in salaries, wages, and bonuses Increase in taxes withheld from employees compensation Decrease in taxes other than federal income taxes Increase in federal income taxes payable Increases in deferred credits, principally income taxes related to installment sales (short-term) Rounding difference in working capital Net cash outflow from operating activities Cash flows from investing activities: Investment in properties, fixtures, and improvements Investment in Zeller s Limited Increase in sundry accounts (net) Net cash outflow from investing activities Cash flows from financing activities: Sales of common stock to employees Dividends to stockholders Purchase of treasury stock Purchase of preferred stock for cancellation Retirement of 4 3/4% sinking fund debentures Increase in short-term notes payable Increase in bank loans Net cash inflow from financing activities Net increase in cash and short-term securities II. Selected Balance Sheet Data Total current assets Total current liabilities THE RETAIL MOVER STATEMENT OF CASH FLOWS Year Ended December 31, 2011 Net cash flow from operating activities: Net income Noncash expenses, revenues, losses, and gains included in income: Undistributed equity in net earnings of unconsolidated subsidiaries Depreciation and amortization of properties Increase in deferred federal income taxes-noncurrent Decrease in deferred contingent compensation and other liabilities Net receivables increase Merchandise inventories increase Other current assets increase Accounts payable for merchandise decrease Salaries, wages, and bonuses decrease Other accrued expenses increase Taxes withheld from employees increase Sales and other taxes increase Federal income taxes payable decrease Increase in deferred income taxes related to installment sales Net cash flow from operating activities Cash flows from investing activities: Investments on properties, fixtures, and improvements Increase in other assets-net Investment in Granjewel Jewelers & Distributors, Inc. Net cash outflow from investing activities $(38,364,709) (209,043) 9,828,348 470,054 301,035 (659,021) 4,007,022 14,045,572 520 (15,319,217) (16,141,000) (436,000) (48,000) (16,625,000) 5,219,000 (20,821,000) (13,224,000) (948,000) (1,538,000) 56,323,016 7,965,000 32,976,016 $ 1,031,799 December 31, 2011 $1,044,689,000 661,058,000 $ 10,902,000 (3,570,000) 13,579,000 2,723,000 (498,000) (52,737,000) (51,104,000) (8,935,000) (2,781,000) (3,349,000) 3,932,000 2,217,000 448,000 (8,480,000). 4,449,000 (93,204,000) (23,143,000) (642,000) (5,700,000) (29.485.000) Cash flows from financing activities: Increase in short-term notes payable to banks Receipts from employees under stock purchase contracts Short-term commercial notes Cash dividends to stockholders Decrease in long-term debt Purchase of cumulative preferred stock, for cancellation Purchase of treasury common stock Bank loans decreased Net cash inflow from financing activities Net increase in cash III. Net earnings (loss) Income Statement Data rdated to 2011 and 2012 (in Part) 2012 $(177,340,000) Assets Current assets: Cash notes Customers installment accounts receivable Less: Allowance for doubtful accounts Unearned credit insurance premiums Deferred finance income Prepaid expenses Balance Sheet Data related to 2011 and 2012 (in Part) December 31, 2012 Merchandise inventories Other accounts receivable, refundable taxes, and daims Total current assets Liabilities Current liabilities: Bank loans Short-term commercial notes Current portion of long-term debt Accounts payable for merchandise Salaries, wages, and bonuses Other accrued expenses Taxes withheld from employees Sales and other taxes Federal income taxes payable Deferred income taxes related to installment sales Total current liabilities Other liabilities Long-term debt Deferred federal income taxes Total liabilities Deferred contingent compensation and other liabilities Total other liabilities $ 79,642,000 518,387,000 (79,510,000) (1,386,000) (37,523,000) 399,968,000 407,357,000 31,223,000 6,591,000 $924,781,000 $600,000,000 995,000 50,067,000 10,808,000 49,095,000 1,919,000 17,322,000 17,700,000 2,000,000 749,906,000 216,341,000 2,183,000 218,524,000 $968,430,000 $100,000,000 2,584,000 73,063,000 (21,122,000) (6,074,000) (618,000) (136,000) (10,000,000) 137,697,000 15,008,000 2011 $10,902,000 December 31, 2011 $ 45,951,000 602,305,000 (16,315,000) (4,923,000) (59,748,000) 521,319,000 450,637,000 19,483,000 7,299,000 $1,044,689,000 453,097,000 58,192,000 14,678,000 14,172,000 4,412,000 13,429,000 103,078,000 661,058,000 220,336,000 14,649,000 4,196,000 239,181,000 $ 900,239,000

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Current assets are the assets which can be converted into cash within a year Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started