Answered step by step

Verified Expert Solution

Question

1 Approved Answer

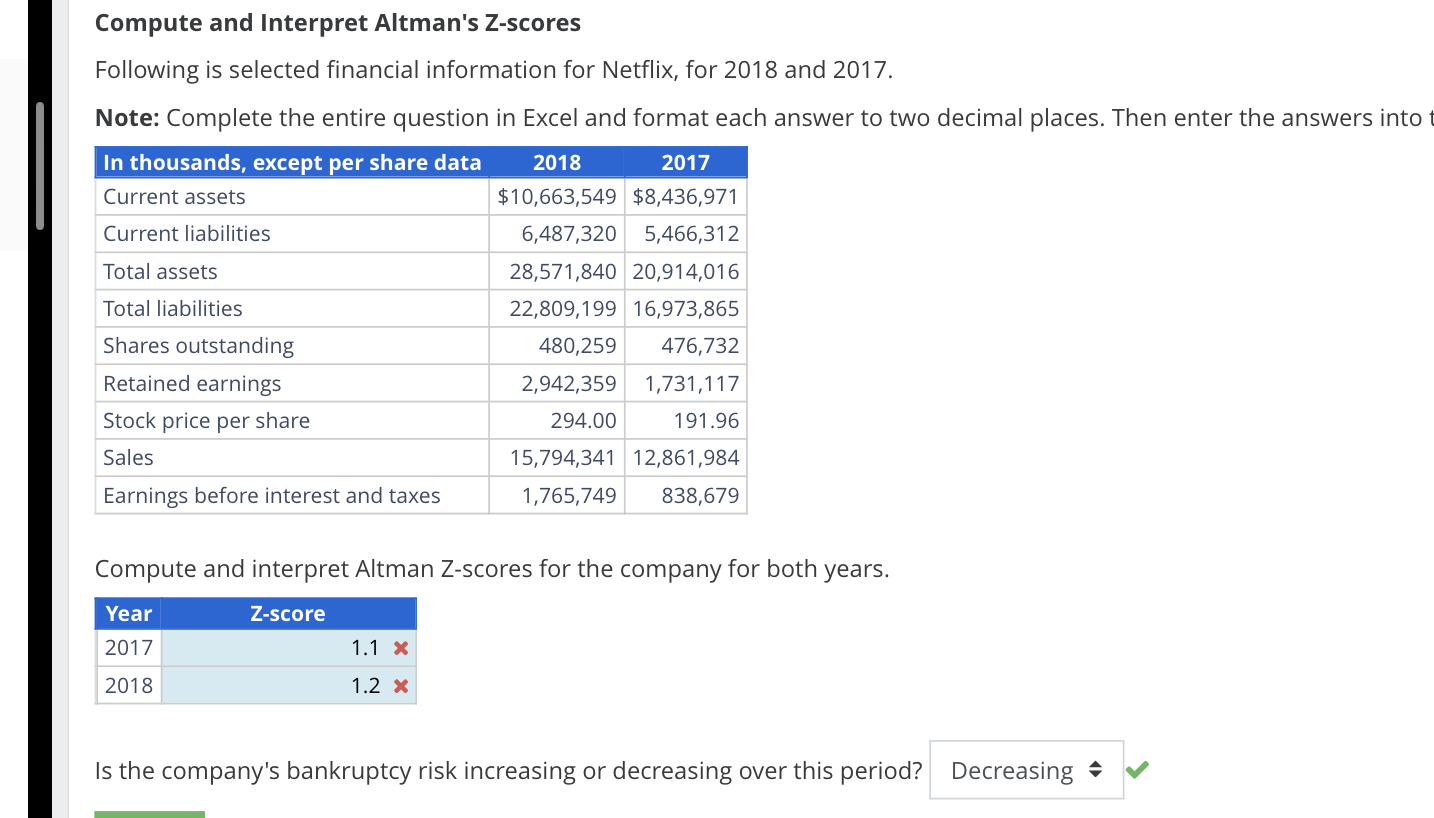

Compute and Interpret Altman's Z - scores Following is selected financial information for Netflix, for 2 0 1 8 and 2 0 1 7 .

Compute and Interpret Altman's Zscores

Following is selected financial information for Netflix, for and

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into

Compute and interpret Altman Zscores for the company for both years.

Is the company's bankruptcy risk increasing or decreasing over this period?Following is selected financial information for Netflix, for and

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

In thousands, except per share data

Current assets $ $

Current liabilities

Total assets

Total liabilities

Shares outstanding

Retained earnings

Stock price per share

Sales

Earnings before interest and taxes

Compute and interpret Altman Zscores for the company for both years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started