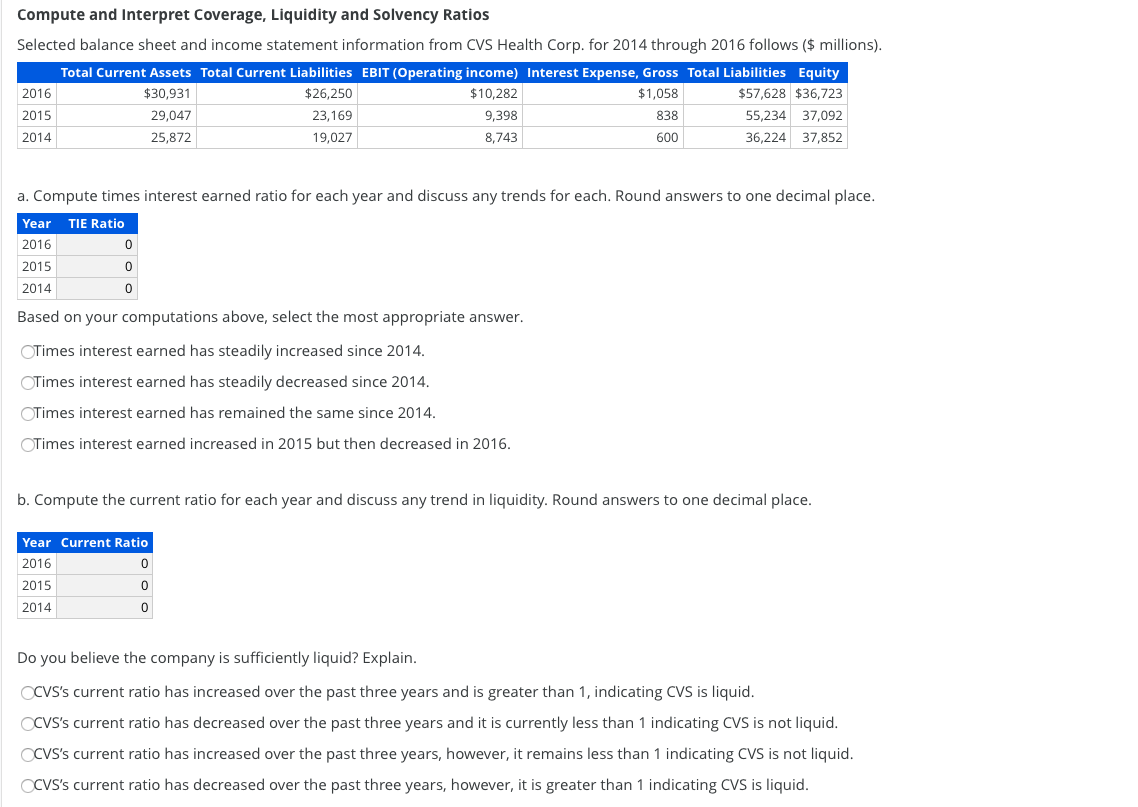

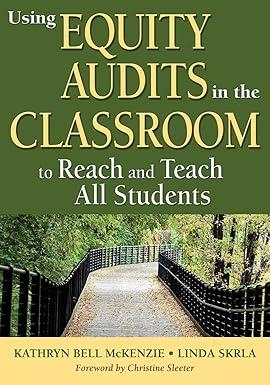

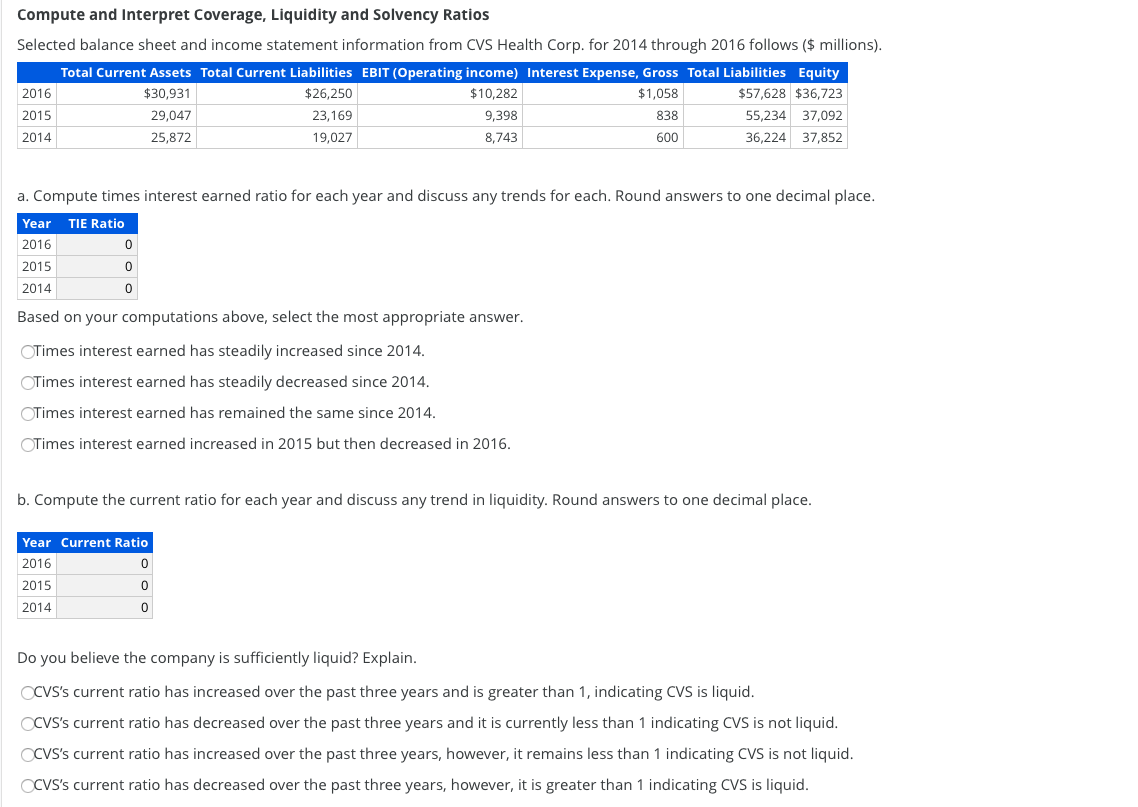

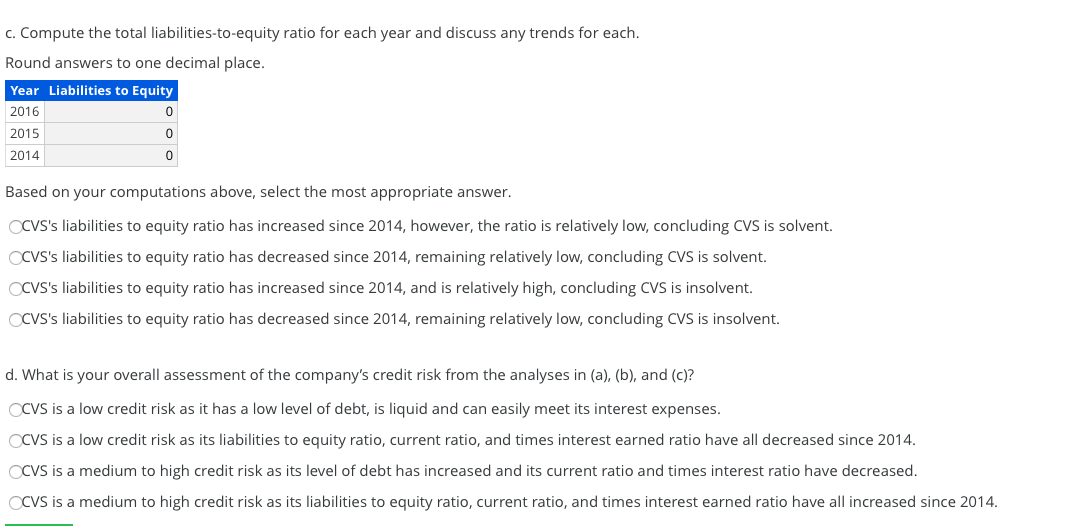

Compute and Interpret Coverage, Liquidity and Solvency Ratios Selected balance sheet and income statement information from CVS Health Corp. for 2014 through 2016 follows ($ millions). Total Current Assets Total Current Liabilities EBIT (Operating income) Interest Expense, Gross Total Liabilities Equity 2016 $30,931 $26,250 $10,282 $1,058 $57,628 $36,723 2015 29,047 23,169 9,398 838 55,234 37,092 2014 25,872 19,027 8,743 600 36,224 37,852 a. Compute times interest earned ratio for each year and discuss any trends for each. Round answers to one decimal place. Year TIE Ratio 2016 2015 2014 Based on your computations above, select the most appropriate answer Times interest earned has steadily increased since 2014. Times interest earned has steadily decreased since 2014. Times interest earned has remained the same since 2014. Times interest earned increased in 2015 but then decreased in 2016. b. Compute the current ratio for each year and discuss any trend in liquidity. Round answers to one decimal place. Year Current Ratio 2016 2015 2014 Do you believe the company is sufficiently liquid? Explain. OCVS's current ratio has increased over the past three years and is greater than 1, indicating CVS is liquid. OCVS's current ratio has decreased over the past three years and it is currently less than 1 indicating CVS is not liquid. OCVS's current ratio has increased over the past three years, however, it remains less than 1 indicating CVS is not liquid. OCVS's current ratio has decreased over the past three years, however, it is greater than 1 indicating CVS is liquid. C. Compute the total liabilities-to-equity ratio for each year and discuss any trends for each. Round answers to one decimal place. Year Liabilities to Equity 2016 2015 2014 Based on your computations above, select the most appropriate answer. OCVS's liabilities to equity ratio has increased since 2014, however, the ratio is relatively low, concluding CVS is solvent. CVS's liabilities to equity ratio has decreased since 2014, remaining relatively low, concluding CVS is solvent. CVS's liabilities to equity ratio has increased since 2014, and is relatively high, concluding CVS is insolvent. OCVS's liabilities to equity ratio has decreased since 2014, remaining relatively low, concluding CVS is insolvent. d. What is your overall assessment of the company's credit risk from the analyses in (a), (b), and (c)? CVS is a low credit risk as it has a low level of debt, is liquid and can easily meet its interest expenses. CVS is a low credit risk as its liabilities to equity ratio, current ratio, and times interest earned ratio have all decreased since 2014. OCVS is a medium to high credit risk as its level of debt has increased and its current ratio and times interest ratio have decreased. CVS is a medium to high credit risk as its liabilities to equity ratio, current ratio, and times interest earned ratio have all increased since 2014