Answered step by step

Verified Expert Solution

Question

1 Approved Answer

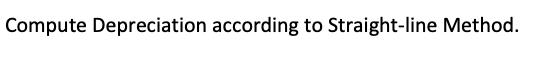

Compute Depreciation according to Straight-line Method. Cost Price: $9,40,000 Salvage Value : 45000 Useful Life: 5 Years 2. Cost Price: $9,40,000 Salvage Value: 45000

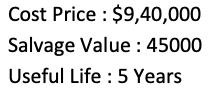

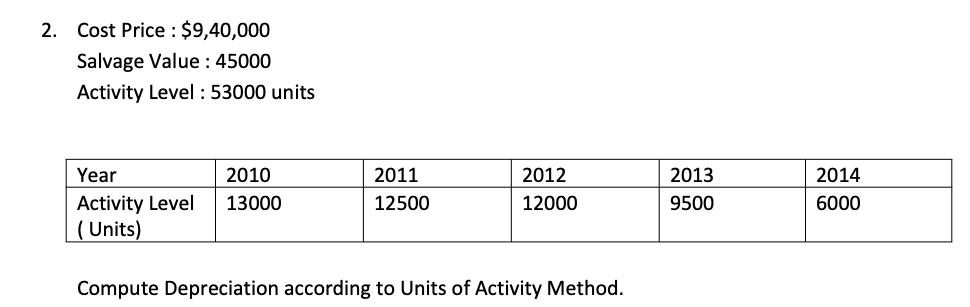

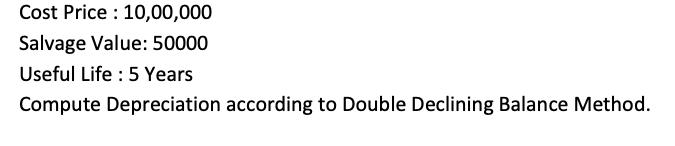

Compute Depreciation according to Straight-line Method. Cost Price: $9,40,000 Salvage Value : 45000 Useful Life: 5 Years 2. Cost Price: $9,40,000 Salvage Value: 45000 Activity Level : 53000 units Year 2010 Activity Level 13000 (Units) 2011 12500 2012 12000 Compute Depreciation according to Units of Activity Method. 2013 9500 2014 6000 3. Cost Price: $9,40,000 Salvage Value: 45000 Useful Life: 5 Years Compute Depreciation according to Double Declining Balance Method. 4. Cost Price : Salvage Value: 50000 Useful Life: 5 Years Compute Depreciation according to Straight-line Method. 5. Cost Price: $10,00,000 Salvage Value: 50000 Activity Level : 53000 units Year 2010 Activity Level 15000 (Units) 2011 10000 2012 5000 2013 15000 2014 5000 Cost Price: 10,00,000 Salvage Value: 50000 Useful Life: 5 Years Compute Depreciation according to Double Declining Balance Method.

Step by Step Solution

★★★★★

3.42 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation Cost Sawage value Useful li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started