Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute for the standard costs and variances. 7. Prepare the journal entry to record actual fixed overhead costs incurred. 8. Prepare the journal entry to

Compute for the standard costs and variances.

7. Prepare the journal entry to record actual fixed overhead costs incurred. 8. Prepare the journal entry to record the fixed overhead variances 9. Prepare the journal entry to transfer the completed units from Work in Process Inventory to Finished Goods Inventory 10. Prepare the journal entry to close all variances to Cost of Goods Sold.

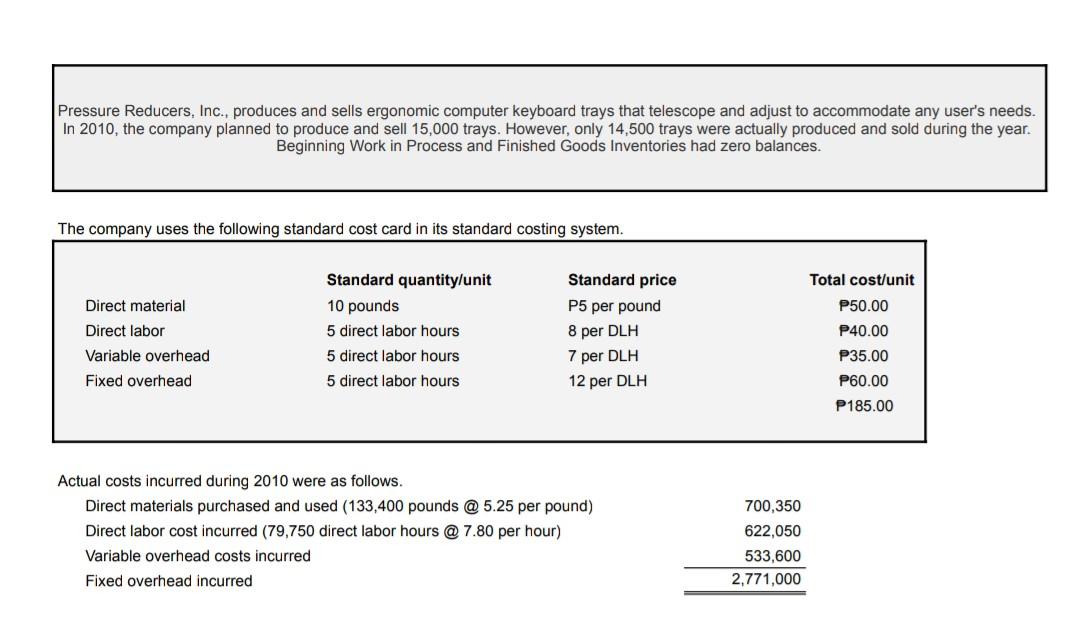

Pressure Reducers, Inc., produces and sells ergonomic computer keyboard trays that telescope and adjust to accommodate any user's needs. In 2010, the company planned to produce and sell 15,000 trays. However, only 14,500 trays were actually produced and sold during the year. Beginning Work in Process and Finished Goods Inventories had zero balances. The company uses the following standard cost card in its standard costing system. Direct material Standard quantity/unit 10 pounds 5 direct labor hours Direct labor Variable overhead Fixed overhead Standard price P5 per pound 8 per DLH 7 per DLH 12 per DLH Total cost/unit P50.00 P40.00 P35.00 P60.00 P185.00 5 direct labor hours 5 direct labor hours 700,350 Actual costs incurred during 2010 were as follows. Direct materials purchased and used (133,400 pounds @ 5.25 per pound) Direct labor cost incurred (79,750 direct labor hours @ 7.80 per hour) Variable overhead costs incurred Fixed overhead incurred 622,050 533,600 2,771,000 Pressure Reducers, Inc., produces and sells ergonomic computer keyboard trays that telescope and adjust to accommodate any user's needs. In 2010, the company planned to produce and sell 15,000 trays. However, only 14,500 trays were actually produced and sold during the year. Beginning Work in Process and Finished Goods Inventories had zero balances. The company uses the following standard cost card in its standard costing system. Direct material Standard quantity/unit 10 pounds 5 direct labor hours Direct labor Variable overhead Fixed overhead Standard price P5 per pound 8 per DLH 7 per DLH 12 per DLH Total cost/unit P50.00 P40.00 P35.00 P60.00 P185.00 5 direct labor hours 5 direct labor hours 700,350 Actual costs incurred during 2010 were as follows. Direct materials purchased and used (133,400 pounds @ 5.25 per pound) Direct labor cost incurred (79,750 direct labor hours @ 7.80 per hour) Variable overhead costs incurred Fixed overhead incurred 622,050 533,600 2,771,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started