Answered step by step

Verified Expert Solution

Question

1 Approved Answer

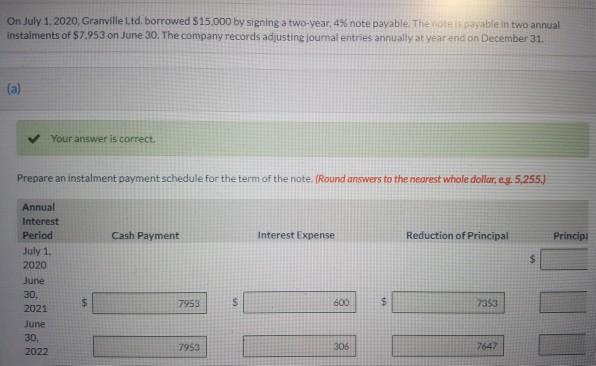

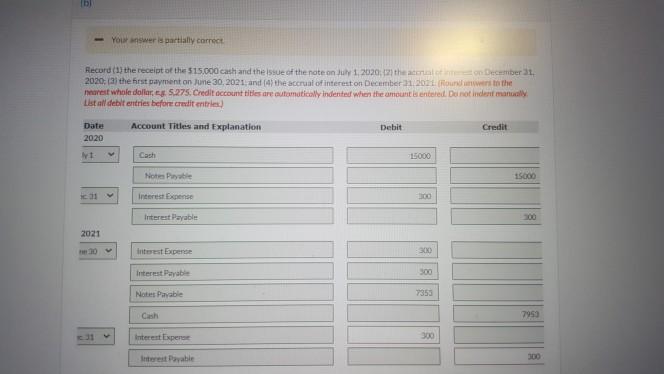

compute interest expense debit and interest payable credit on dec 31,2021. On July 1, 2020, Granville Ltd. borrowed $15.000 by signing a two-year 4% note

compute interest expense debit and interest payable credit on dec 31,2021.

On July 1, 2020, Granville Ltd. borrowed $15.000 by signing a two-year 4% note payable Thetlable in two annual instalments of $7.953 on June 30. The company records adjustine journal entries annually at year and on December 31. (a) Your answer is correct. Prepare an instalment payment schedule for the term of the note (Round answers to the nearest whole dollar, eg. 5.255.) Cash Payment Interest Expense Reduction of Principal Principi Annual Interest Period July 1 2020 June 30, 2021 June 30. 2022 7953 5 600 $ 7353 7953 305 7647 Your answer is partially correct Record (1) the receipt of the 515.000 cash and the issue of the rate on July 1, 2020, the articton December 2020, (2) the first payment on June 30, 2021. and the accrual of interest on December 2011. Round write the nearest whole dollar. 5.275. Credit account titles are automatically indented when the amounts entered Dorot inden manually List all debit entries before credit entries) Account Titles and Explanation Date 2020 Debit Credit 15000 Note Paste 15000 interest Expense Interest Payable 2021 interest Expense 300 Interest Payable Notes Payable Cash 7959 Interest Expert 300 Interest PayableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started