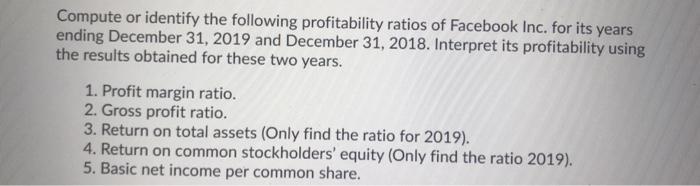

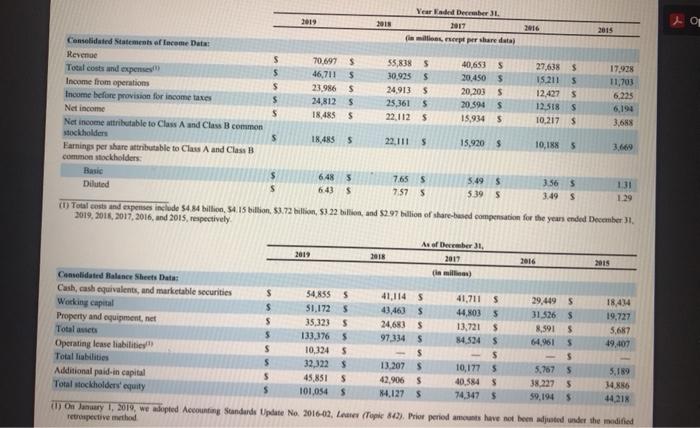

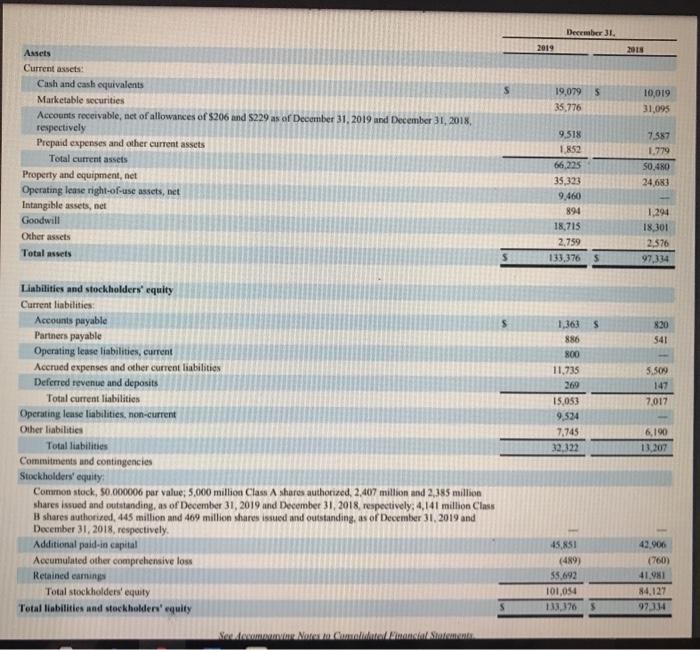

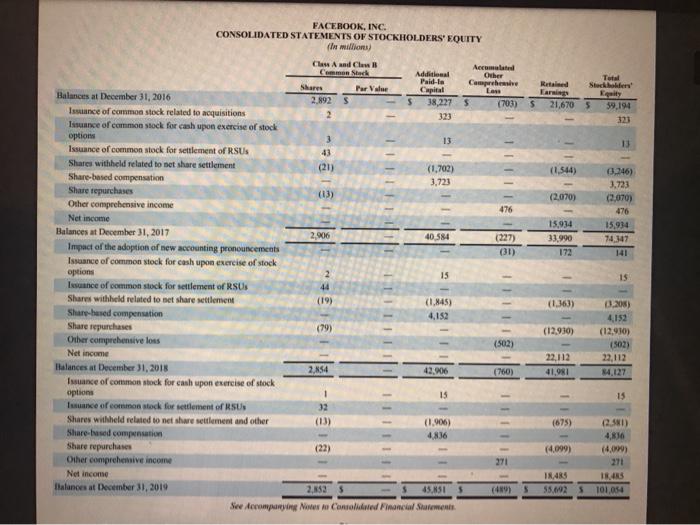

Compute or identify the following profitability ratios of Facebook Inc. for its years ending December 31, 2019 and December 31, 2018. Interpret its profitability using the results obtained for these two years. 1. Profit margin ratio. 2. Gross profit ratio. 3. Return on total assets (Only find the ratio for 2019). 4. Return on common stockholders' equity (Only find the ratio 2019). 5. Basic net income per common share. 01 2016 3.49 Year Kaded December 2019 2018 2017 2015 Consolidated statements of recome Data la repper share data Revenge S 70.6975 55,838 40,6535 27,638 $ Total costs and expenses 17.928 5 46,711 $ 30,925S 20,450 $ 15.211 5 Income from operations 11,703 $ 23.986 5 24,913 $ 20,203 s 12.427 $ Income before provision for income taxes 6,225 5 24,812 $ 25.361 $ 20.594 $ 12.518 S Net income 6,194 S 18,485 $ 22.1125 15,934 s 10,217 $ 3,685 Net income attributable to Class A and Class B common Mockholders S 18,485 $ 5 15,920 $ 10,188 5 3,649 Earnings per share attributable to Class A and Class B common stockholders Basic 6 48 5 765 S $ 3.56 5 131 Diluted $ 643 $ 7.575 5.39 S 3.49 s 1.29 (1) Total costs and expenses include 5484 billion, 54 15 billion, 83.72 billion, 53 22 billion and $2.97 billion of share-based compensation for the years ended December 3019, 2016, 2017, 2016, and 2015, respectively As of December 31 2018 2017 2016 2015 Consolidated Balance Sheets Data in million) Cash, cash equivalents, and marketable securities $ 54,8555 41,114 5 41,711 5 29.449 S Working capital 18,414 $ $1,1725 43.463 $ 44.803 5 31 526 $ 19,727 Property and equipment, net 5 35.3235 24,683 Total acts 13,721 $ 8,591 5 5.687 5 133.376 5 97,334 $ 84,524 $ 64,961 5 19,407 Operating lease liabilities $ 10,324 $ 5 $ $ Total liabilities $ 32,322 $ 13.207 $ Additional paid-in capital 10,177 5 5 5.189 5 45,851 5 42.906 $ Total stockholders' equity 40,5845 38.227 5 34.86 $ 101,054 S 84,127 $ 74.347 $ $ 44218 On January 1, 2018, we adopted Accounting Standards Update No. 2016-02. Lewe (Top 80). Prior period amounts have not been justed under the modified retrospective method December 31. 2019 S 5 19,079 35.776 10,019 31,095 7.587 1.779 Assets Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net of allowances of S206 and $229 as of December 31, 2019 and December 31, 2018, respectively Prepaid expenses and other current assets Total current assets Property and equipment, net Operating lease right-of-use assets, net Intangible assets, net Goodwill Other assets Total assets 50,480 24,683 9,518 1852 66.225 35,323 9.460 894 18,715 2,759 133,376 5 1,291 18,301 2,576 97,334 5 s 820 541 Liabilities and stockholders' equity Current liabilities Accounts payable Partners payable Operating lease liabilities, current Accrued expenses and other current liabilities Deferred revenue and deposits Total current liabilities Operating lense liabilities, non-current Other liabilities Total liabilities Commitments and contingencies Stockholders' equity Common stock, 50.000006 par value; 5,000 million Class A shares authorized 2,407 million and 2.385 million shares issued and outstanding, as of December 31, 2019 and December 31, 2018 respectively; 4,141 million Class shares authorized 445 million and 409 million shares issued and outstanding, as of December 31, 2019 and December 31, 2018, respectively Additional paid-in capital Accumulated other comprehensive loss Retained eaming Total stockholders equity Total liabilities and stockholders' equity 1,363 886 800 11.735 269 15.053 9,524 7.745 32,322 5.500 147 7,017 6,190 13.207 45,851 (489) 55,692 101,054 133,376 43,906 (760) 41.981 84,127 97.314 5 Skocaman Nicoleta dentaram FACEBOOK, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY la miliona Total Rated Stockholfers TA 21.6705 39.194 323 13 (1.544) (2,070) 0.346) 3.723 2.070) 476 15,934 74347 141 1 III IIS 16 III 15,934 33.990 172 Claw and Claw Accumulated Common Stack Additional Other Paid-la Comparati Shares Par Value Capital Lane Balances at December 31, 2016 2.892 S 38,227 $ (703) Issunce of common stock related to acquisitions 2 323 Issuance of common stock for cash upon exercise of stock options 3 Issuance of common stock for settlement of RSUS 43 Shares withheld related to net share settlement (21) (1,702) Share-based compensation 3.723 Share repurchases Other comprehensive income 476 Net income Balances at December 31, 2017 2,906 40.584 (227) Impact of the adoption of new accounting pronouncements () Issance of common stock for cash upon exercise of stock options 2 15 Issance of common stock for settlement of RSUS Shares withheld related to set share settlement (19) (1.845) Share-based compensation 4,152 Share repurchases (79) Other comprehensive lous (502) Net income Balances at December 31, 2018 2.54 42,906 (760) Imance of common stock for cash upon exercise of stock options 1 15 Instance of common stock for settlement of RSU 32 Shares withheld related to not share settlement and other (13) (1,906) Share-ased compensation 4836 Share repurchases (22) Other comprehensive income 271 Net income Ilalances at December 31, 2019 2.53 45,850 See Accompany in Consoled Financial Statement 15 1IIIIIIIIIIIIIIIIII (1363) all - $ @ 13 - @alla (12.930) 0.203) 4,152 (12,930) (502) 22,112 54,127 22,112 41,981 15 IIIII (675) (4.099) 4,816 (4.00) 18,483 55.792 18.RS 101 054 5