Question

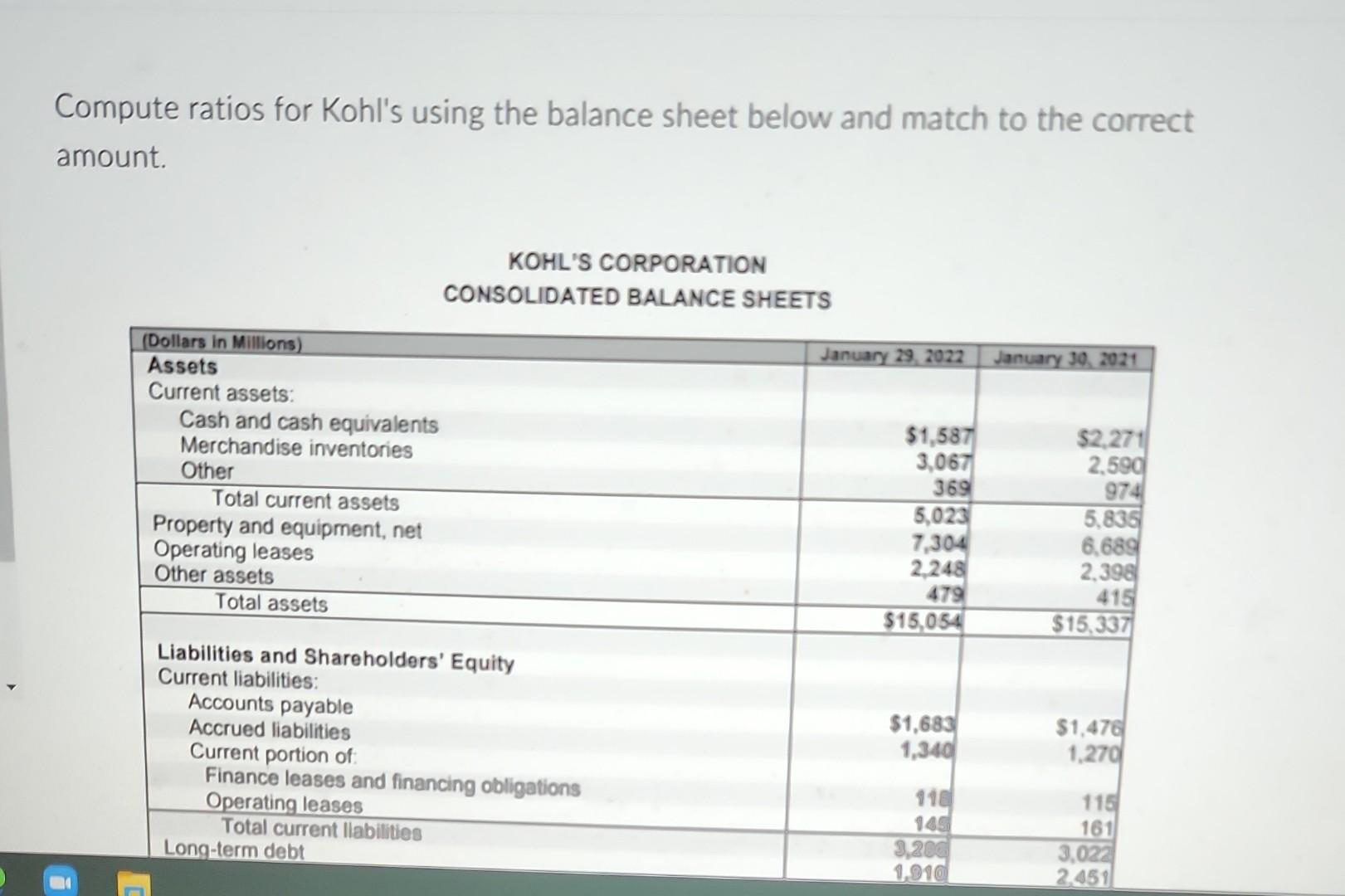

Compute ratios for Kohl's using the balance sheet below and match to the correct amount. (Dollars in Millions) Assets Current assets: Cash and cash

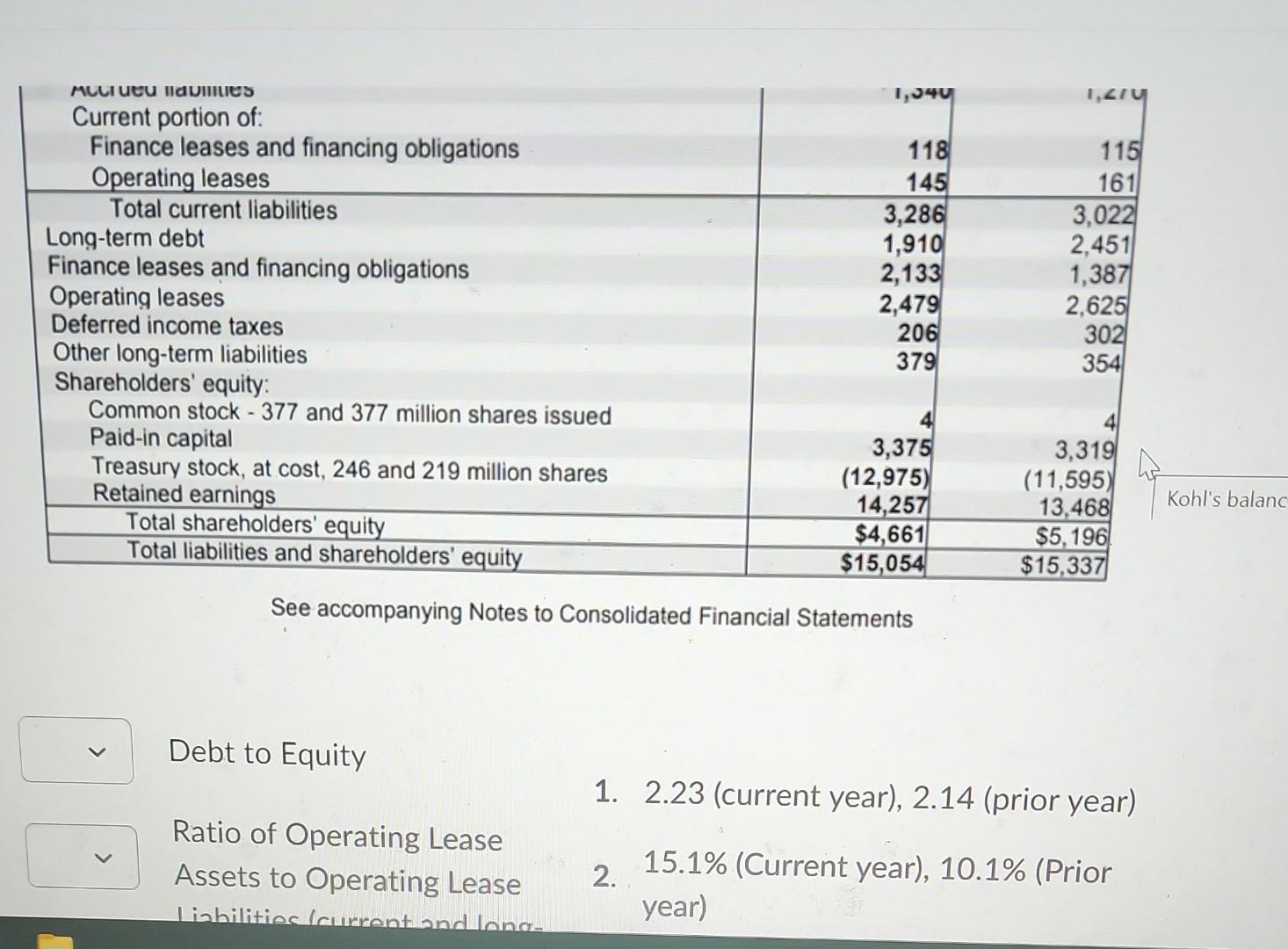

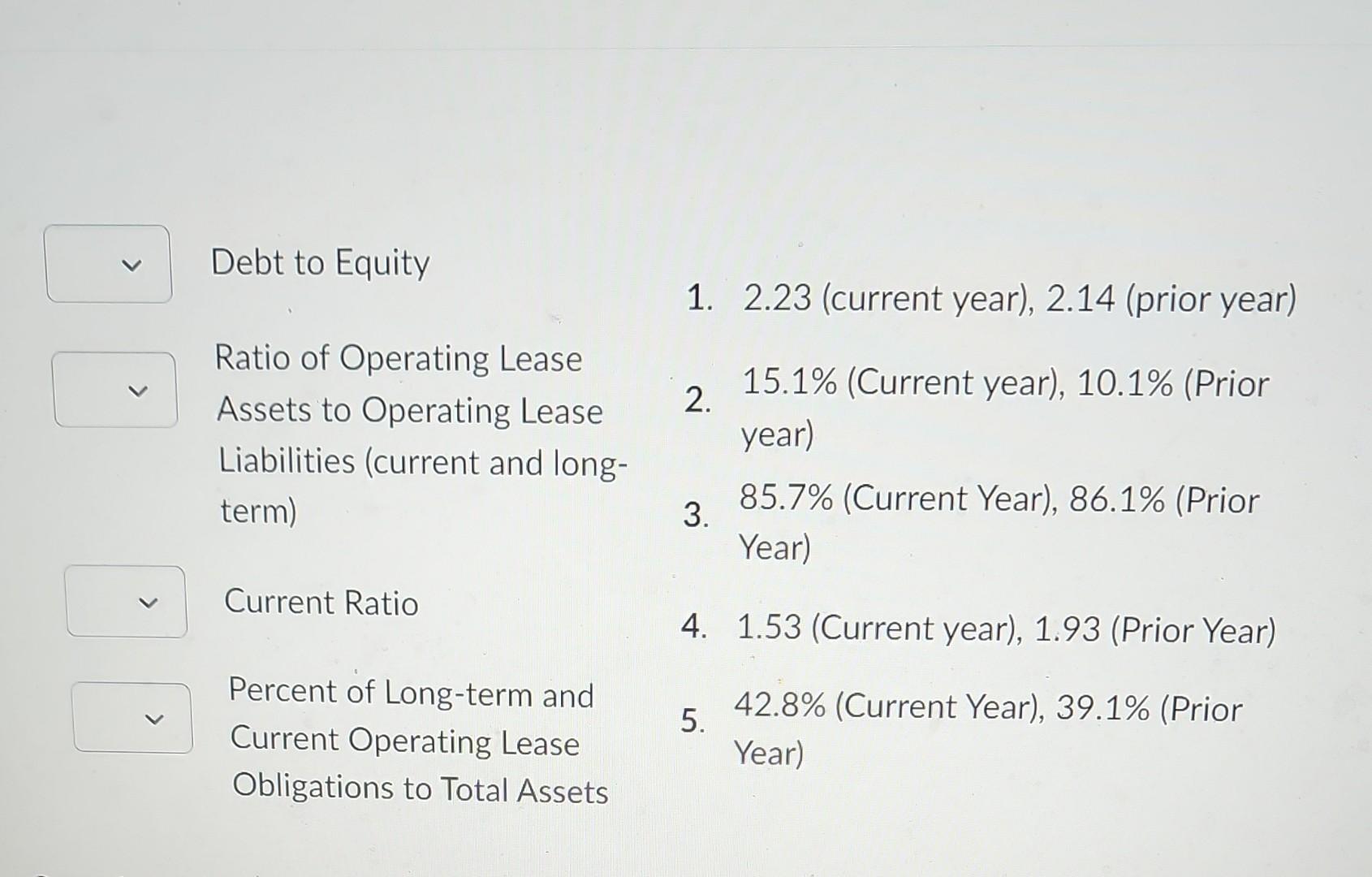

Compute ratios for Kohl's using the balance sheet below and match to the correct amount. (Dollars in Millions) Assets Current assets: Cash and cash equivalents Merchandise inventories Other Total current assets Property and equipment, net Operating leases Other assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued liabilities Current portion of: KOHL'S CORPORATION CONSOLIDATED BALANCE SHEETS Finance leases and financing obligations Operating leases Total current liabilities Long-term debt January 29, 2022 $1,587 3,067 369 5,023 7,304 2,248 479 $15,054 $1,683 1,340 118 3,200 1,910 January 30, 2021 $2,271 2,590 974 5,835 6,689 2,398 415 $15,337 $1,476 1,270 115 161 3,022 2.451 Mccrued as Current portion of: Finance leases and financing obligations Operating leases Total current liabilities Long-term debt Finance leases and financing obligations Operating leases Deferred income taxes Other long-term liabilities Shareholders' equity: Common stock - 377 and 377 million shares issued Paid-in capital Treasury stock, at cost, 246 and 219 million shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Debt to Equity Ratio of Operating Lease Assets to Operating Lease Liabilities (current and long- 1,340 118 145 See accompanying Notes to Consolidated Financial Statements 2. 3,286 1,910 2,133 2,479 206 379 3,375 (12,975) 14,257 $4,661 $15,054 ru 115 161 3,022 2,451 1,387 2,625 302 354 3,319 (11,595) 13,468 $5,196 $15,337 1. 2.23 (current year), 2.14 (prior year) 15.1% (Current year), 10.1% (Prior year) Kohl's balanc > 00 Debt to Equity Ratio of Operating Lease Assets to Operating Lease Liabilities (current and long- term) Current Ratio Percent of Long-term and Current Operating Lease Obligations to Total Assets 1. 2.23 (current year), 2.14 (prior year) 15.1% (Current year), 10.1% (Prior year) 2. 85.7% (Current Year), 86.1% (Prior Year) 4. 1.53 (Current year), 1.93 (Prior Year) 42.8% (Current Year), 39.1% (Prior Year) 3. 5.

Step by Step Solution

3.33 Ratings (105 Votes)

There are 3 Steps involved in it

Step: 1

Ratio Formula Workings Answer Current Ratio Current AssetsCurrent Liabilities 46492769 168 Retu...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started