Question

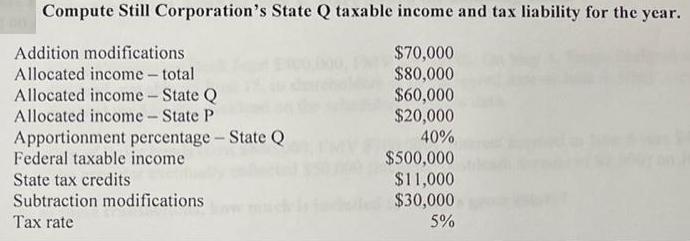

Compute Still Corporation's State Q taxable income and tax liability for the year. $70,000 Addition modifications Allocated income - total $80,000 Allocated income -

Compute Still Corporation's State Q taxable income and tax liability for the year. $70,000 Addition modifications Allocated income - total $80,000 Allocated income - State Q $60,000 Allocated income - State P $20,000 40% Apportionment percentage - State Q Federal taxable income State tax credits Subtraction modifications Tax rate $500,000 $11,000 $30,000 5%

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Taxable Income Taxable is computed based on the income earned by the assessee during the assessment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Taxation How Modern Taxes Conquered The World

Authors: Philipp Genschel, Laura Seelkopf

1st Edition

0192897578, 978-0192897572

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App