Answered step by step

Verified Expert Solution

Question

1 Approved Answer

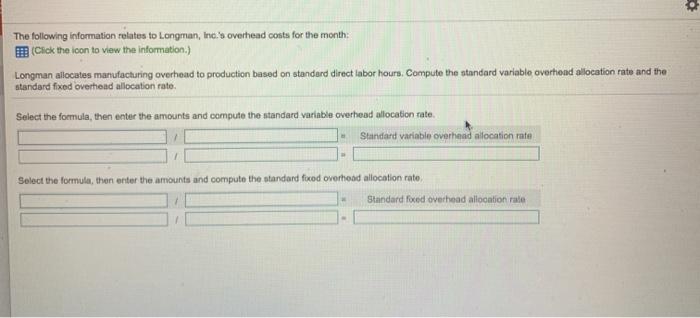

The following information relates to Longman, Inc.'s overhead costs for the month: (Click the icon to view the information.) Longman allocates manufacturing overhead to

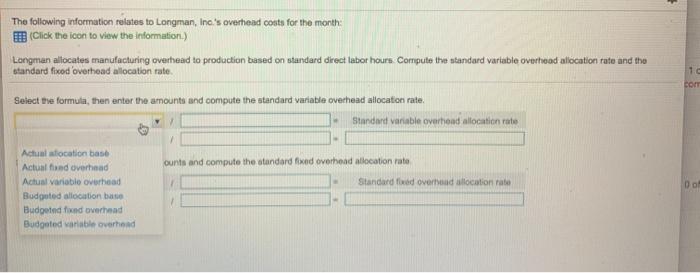

The following information relates to Longman, Inc.'s overhead costs for the month: (Click the icon to view the information.) Longman allocates manufacturing overhead to production based on standard direct labor hours. Compute the standard variable overhead allocation rate and the standard fixed overhead allocation rate. Select the formula, then enter the amounts and compute the standard variable overhead allocation rate. Standard variable overhead allocation rate Select the formula, then enter the amounts and compute the standard foxed overhead allocation rate. Standard foxed overhead allocation rate The following information relates to Longman, Inc.'s overhead costs for the month: (Click the icon to view the information.) Longman allocates manufacturing overhead to production based on standard direct labor hours. Compute the standard variable overhead allocation rate and the standard fixed overhead allocation rate. Select the formula, then enter the amounts and compute the standard variable overhead allocation rate. Actual alocation base Actual fixed overhead Actual variable overhead Budgeted allocation base Budgeted fixed overhead Budgeted variable overhead Standard variable overhead allocation rate ounts and compute the standard fixed overhead allocation rate Standard fixed overhead allocation rate 1c comm 0 of cturing overhead to production based ocation rate. er the amounts and ter the amounts and i Data Table Static budget variable overhead Static budget fixed overhead Static budget direct labor hours Static budget number of units Print DUI Done $ 7,700 $ 3,300 -. X 1,100 hours 4,800 units on rate rate

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Static Budgeted Variable Overhead Static Budgeted Di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started