Answered step by step

Verified Expert Solution

Question

1 Approved Answer

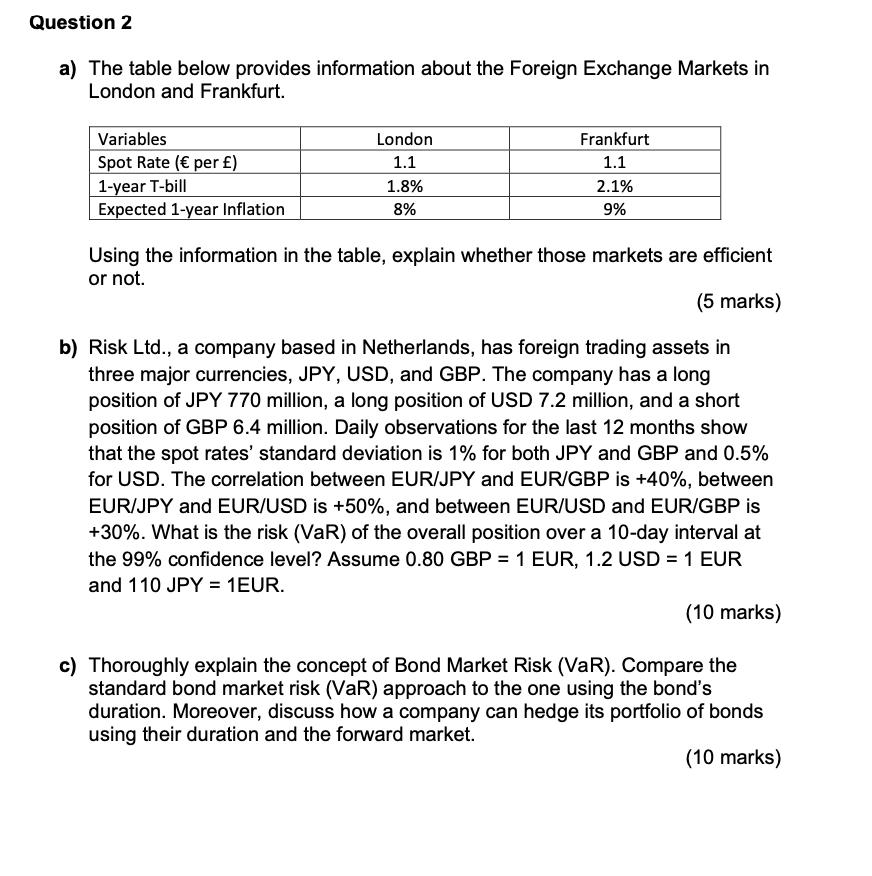

Question 2 a) The table below provides information about the Foreign Exchange Markets in London and Frankfurt. Variables Spot Rate ( per ) 1-year

Question 2 a) The table below provides information about the Foreign Exchange Markets in London and Frankfurt. Variables Spot Rate ( per ) 1-year T-bill Expected 1-year Inflation London 1.1 1.8% 8% Frankfurt 1.1 2.1% 9% Using the information in the table, explain whether those markets are efficient or not. (5 marks) b) Risk Ltd., a company based in Netherlands, has foreign trading assets in three major currencies, JPY, USD, and GBP. The company has a long position of JPY 770 million, a long position of USD 7.2 million, and a short position of GBP 6.4 million. Daily observations for the last 12 months show that the spot rates' standard deviation is 1% for both JPY and GBP and 0.5% for USD. The correlation between EUR/JPY and EUR/GBP is +40%, between EUR/JPY and EUR/USD is +50%, and between EUR/USD and EUR/GBP is +30%. What is the risk (VaR) of the overall position over a 10-day interval at the 99% confidence level? Assume 0.80 GBP = 1 EUR, 1.2 USD = 1 EUR and 110 JPY = 1EUR. (10 marks) c) Thoroughly explain the concept of Bond Market Risk (VaR). Compare the standard bond market risk (VaR) approach to the one using the bond's duration. Moreover, discuss how a company can hedge its portfolio of bonds using their duration and the forward market. (10 marks)

Step by Step Solution

★★★★★

3.64 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The foreign exchange markets in London and Frankfurt are not efficient The reason for this is that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started