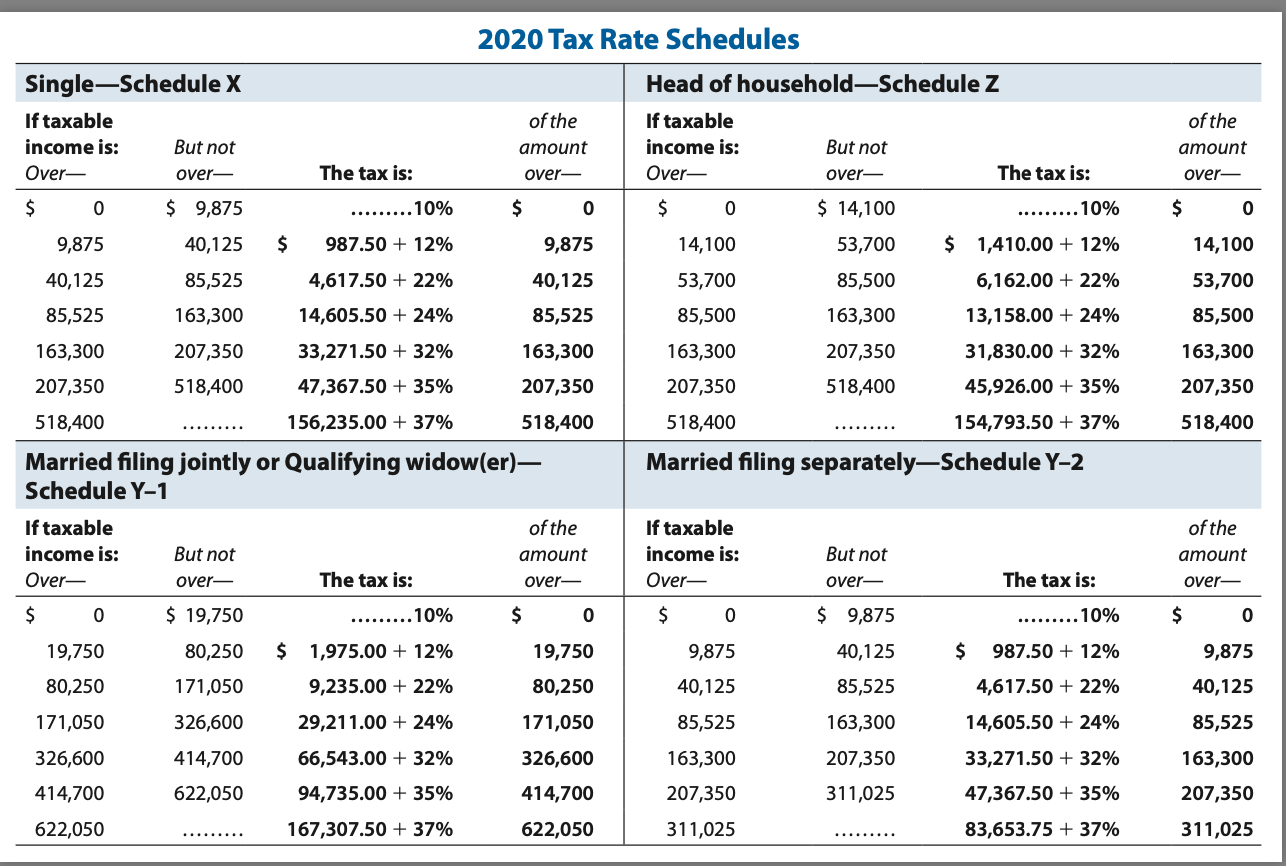

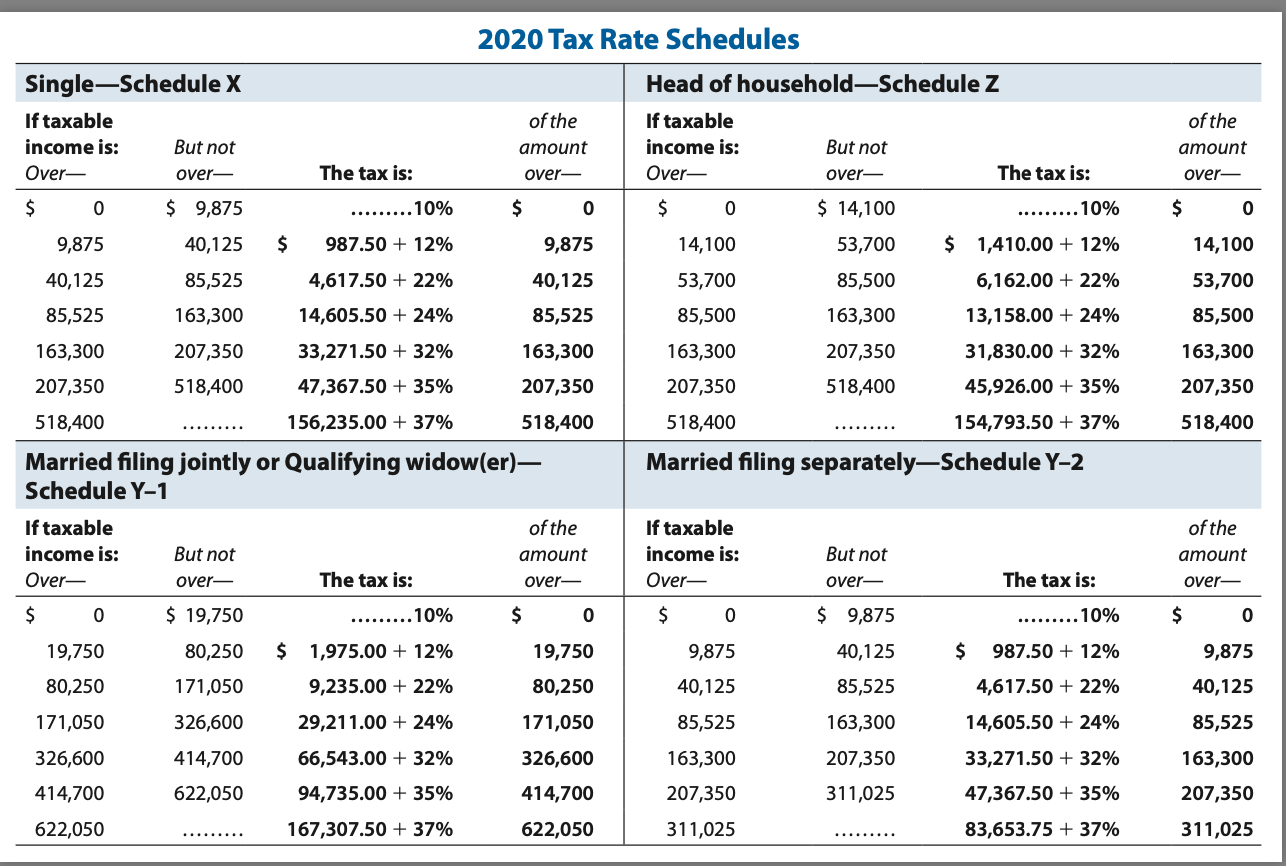

Compute the 2020 tax liability and the marginal and average tax rates for the following taxpayers. Click here to access the 2020 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (i.e. .67073 would be rounded to .6707 and entered as 67.07%). a. Chandler, who files as a single taxpayer, has taxable income of $133,200. Tax liability: $ Marginal rate: % Average rate: % b. Lazare, who files as a head of household, has taxable income of $70,200. Tax liability: $ Marginal rate: NIE % Average rate: % 2020 Tax Rate Schedules Head of householdSchedule Z Single-Schedule X If taxable income is: But not Over- over- of the amount over- If taxable income is: Over- But not over- of the amount over- The tax is: The tax is: $ 0 $ 9,875 ......... 10% $ $ 0 $ 14,100 10% $ 0 $ 1,410.00 + 12% 14,100 53,700 85,500 53,700 85,500 163,300 6,162.00 + 22% 163,300 9,875 40,125 $ 987.50 + 12% 9,875 40,125 85,525 4,617.50 + 22% 40,125 85,525 163,300 14,605.50 + 24% 85,525 163,300 207,350 33,271.50 + 32% 163,300 207,350 518,400 47,367.50 + 35% 207,350 518,400 156,235.00 + 37% 518,400 Married filing jointly or Qualifying widow(er)- Schedule Y-1 14,100 53,700 85,500 163,300 207,350 518,400 207,350 13,158.00 + 24% 31,830.00 + 32% 45,926.00 + 35% 154,793.50 + 37% 207,350 518,400 518,400 Married filing separatelySchedule Y-2 If taxable income is: Over- of the amount If taxable income is: Over- of the amount But not But not over- The tax is: over- over- The tax is: over $ 0 $ 19,750 ......... 10% $ 0 $ 0 $ 9,875 ......... 10% $ 0 80,250 $ 1,975.00 + 12% 19,750 9,875 $ 987.50 + 12% 9,875 40,125 85,525 171,050 9,235.00 + 22% 80,250 40,125 4,617.50 + 22% 40,125 19,750 80,250 171,050 326,600 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 + 24% 414,700 66,543.00 + 32% 326,600 163,300 33,271.50 + 32% 207,350 311,025 85,525 163,300 207,350 414,700 622,050 94,735.00 + 35% 414,700 207,350 47,367.50 + 35% 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% 311,025