Question

Compute the amount of Cost of goods manufactured . Cost of goods sold for the year ended October 28, 2018 is filled in for you.

Compute the amount of Cost of goods manufactured. Cost of goods sold for the year ended October 28, 2018 is filled in for you.

| Deere and Company | |

| Summary of Cost of Goods Sold | |

| for the year ended October 28, 2018 amounts in millions | |

| Cost of goods manufactured | |

| Add: Beginning finished goods inventory (Oct. 29, 2017) |

|

| Cost of goods available for sale | |

| Less: Ending finished goods inventory (Oct. 28, 2018) |

|

| Cost of goods sold | $ 25,571.2 |

9. Using the cost of goods manufactured amount you computed in #8 above and the inventory balances for work in process from Deere and Companys footnote, compute Total manufacturing costs for the year.

| Deere and Company | |

| Schedule of Cost of Goods Manufactured | |

| for the year ended October 28, 2018 amounts in millions | |

| Total manufacturing costs for the year | |

| Add: Beginning work in process inventory (Oct. 29, 2017) |

|

| Total cost of work in process during the year | |

| Less: Ending work in process inventory (Oct. 28, 2018) | |

| Cost of goods manufactured |

|

Please show Calculations

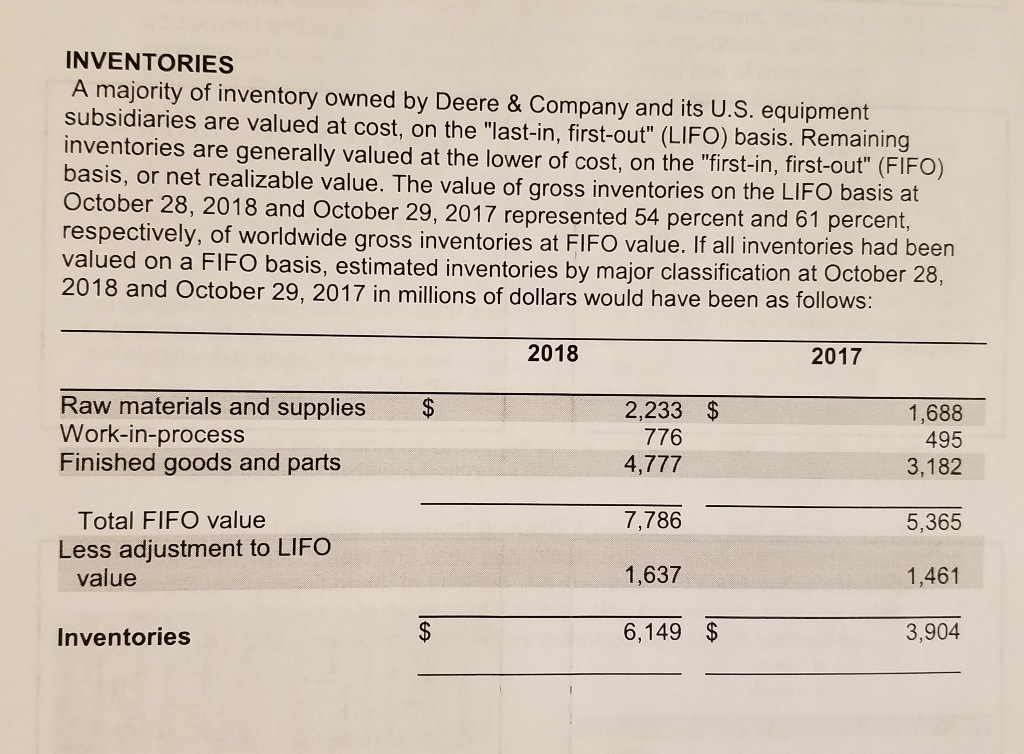

INVENTORIES A majority of inventory owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO October 28, 2018 and October 29, 2017 represented 54 percent and 61 percent, respectively, of worldwide gross inventories at FIFO value. If all inventories had been valued on a FIFO basis, estimated inventories by 2018 and October 29, 2017 in millions of dollars would have been as follows: basis at major classification at October 28, 2018 2017 Raw materials and supplies Work-in-process Finished goods and parts 2,233 $ 1,688 495 3,182 776 4,777 7,786 1,637 6,149 $ Total FIFO value 5,365 1,461 3,904 Less adjustment to LIFO value InventoriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started