Answered step by step

Verified Expert Solution

Question

1 Approved Answer

compute the chargeable income and income tax payable for melati for the ya 2019 assuming that she files the tax separately with her spouse. both

compute the chargeable income and income tax payable for melati for the ya 2019 assuming that she files the tax separately with her spouse. both child relief would be claimed by melati. indicate nil or exempt where necessary

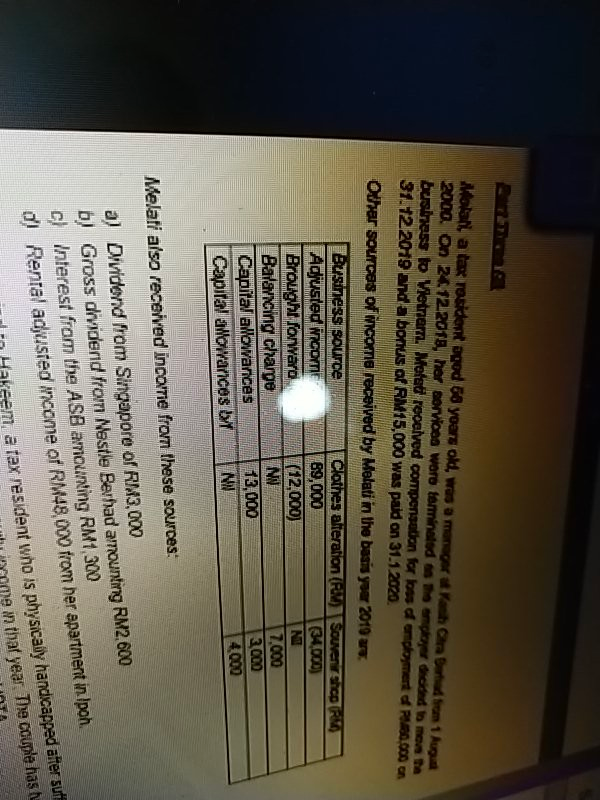

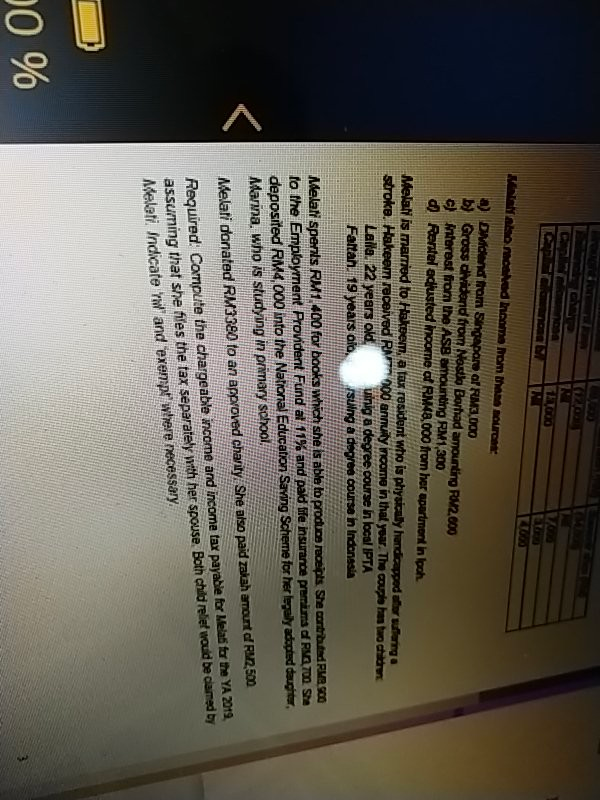

Molali, a tax resident apod 68 yoars old, was a manager at han er en 1 fuga 2000. On 24.12.2018, her sorvice woro terminated the employer dested to me the business to Vietnam. Motel received compensation for loos dondoyment of PASO C00 31.12.2019 and a bonus of RM15,000 was paid on 31.1.2020 Other sources of income received by Melati in the basis year 2019 an Business source Clothes alteration (PW) Souvenir Adjusted com 89,000 (34,000) Brought forward (12,000) NI Balaricing Chame N 7.000 3.000 13,000 Capital allowances MU 4.000 Capital allowances by Melati also received income from these sources: a) Dividend from Singapore of RM3,000 b) Gross dividend frown Neste Berhad amounting RM2.600 c) Interest from the ASB amounting RM1,300 d! Rental adjusted income of RM48.000 from her apartment in Ipoh a tex resident who is physically handicapped after sur in that year. The couple has LO Wala akomoted home Nom man nur Didend from Singapore of RM3,000 b) Gross dividend from Nostlo Borhad amounting RM2.000 c) Interest from the ASB amounting RM1,300 d) Rental adjusted Income of RM48,000 from her apartment in Ipoh Melali is married to Hakeem, a tax resident who is physically handicapped after storinga stroke. Hakeem received RAT 100 annuity income in that your. The couple has two children Lalla. 22 years old. uinig a degree course in local IPTA Faltan 19 years old, suing a degree course h Indonesia T Melati spenis RM1.400 for books which she is able to produce receipts. She contributed RM50 to the Employment Provident Fund at 11% and paid life insurance prema of ROTO Se deposited RM4,000 into the National Education Saving Scheme for her legally acepted daughter, Marina, who is studying in primary school Melati donated RM3380 to an approved charity. She also paid zalah amountd R22,500 Required: Compute the chargeable income and income tax payable for Melats for the YA 2019 assuming that she files the tax separately with her spouse Both child relel would be cared by Asteleti. Indicate and 'exempt where necessary 0 % Molali, a tax resident apod 68 yoars old, was a manager at han er en 1 fuga 2000. On 24.12.2018, her sorvice woro terminated the employer dested to me the business to Vietnam. Motel received compensation for loos dondoyment of PASO C00 31.12.2019 and a bonus of RM15,000 was paid on 31.1.2020 Other sources of income received by Melati in the basis year 2019 an Business source Clothes alteration (PW) Souvenir Adjusted com 89,000 (34,000) Brought forward (12,000) NI Balaricing Chame N 7.000 3.000 13,000 Capital allowances MU 4.000 Capital allowances by Melati also received income from these sources: a) Dividend from Singapore of RM3,000 b) Gross dividend frown Neste Berhad amounting RM2.600 c) Interest from the ASB amounting RM1,300 d! Rental adjusted income of RM48.000 from her apartment in Ipoh a tex resident who is physically handicapped after sur in that year. The couple has LO Wala akomoted home Nom man nur Didend from Singapore of RM3,000 b) Gross dividend from Nostlo Borhad amounting RM2.000 c) Interest from the ASB amounting RM1,300 d) Rental adjusted Income of RM48,000 from her apartment in Ipoh Melali is married to Hakeem, a tax resident who is physically handicapped after storinga stroke. Hakeem received RAT 100 annuity income in that your. The couple has two children Lalla. 22 years old. uinig a degree course in local IPTA Faltan 19 years old, suing a degree course h Indonesia T Melati spenis RM1.400 for books which she is able to produce receipts. She contributed RM50 to the Employment Provident Fund at 11% and paid life insurance prema of ROTO Se deposited RM4,000 into the National Education Saving Scheme for her legally acepted daughter, Marina, who is studying in primary school Melati donated RM3380 to an approved charity. She also paid zalah amountd R22,500 Required: Compute the chargeable income and income tax payable for Melats for the YA 2019 assuming that she files the tax separately with her spouse Both child relel would be cared by Asteleti. Indicate and 'exempt where necessary 0 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started