Answered step by step

Verified Expert Solution

Question

1 Approved Answer

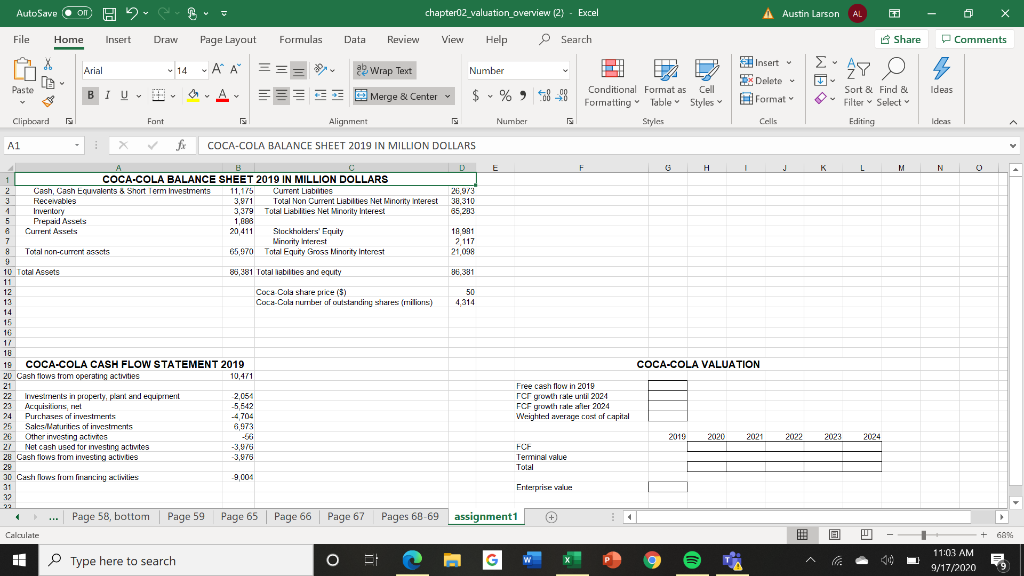

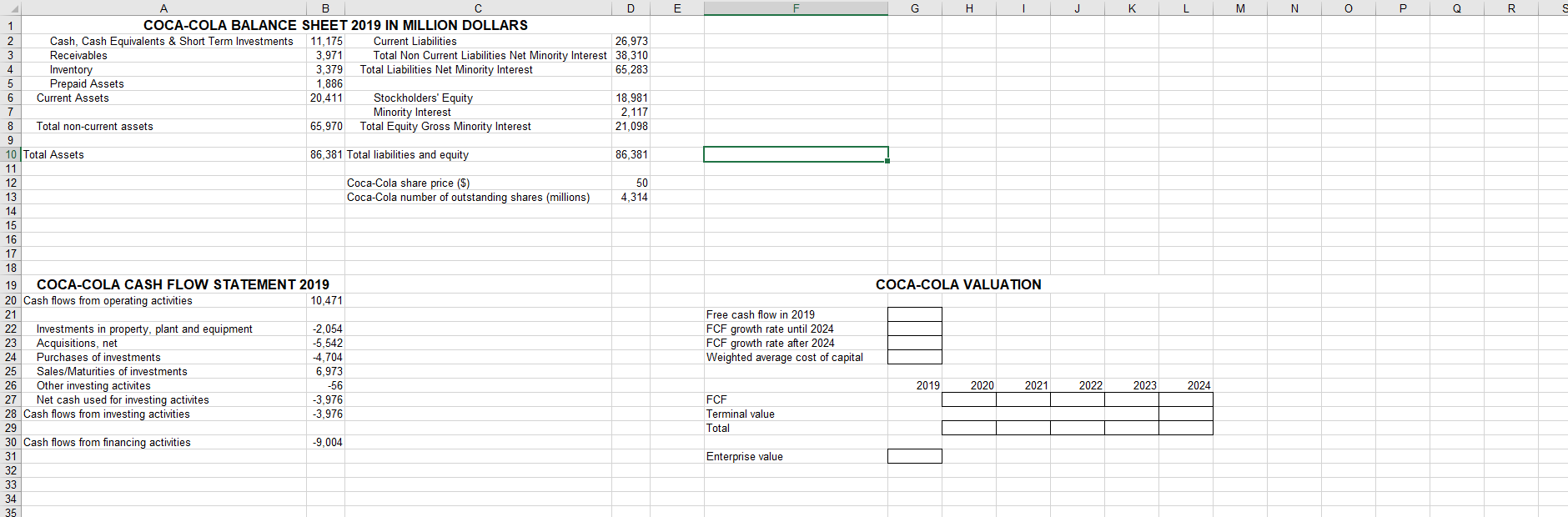

Compute the Coca-Cola's enterprise value in 2019 using the efficient market approach in Chapter 2, the Coca-Cola's balance sheet in 2019, and the Coca-Cola's current

Compute the Coca-Cola's enterprise value in 2019 using the efficient market approach in Chapter 2, the Coca-Cola's balance sheet in 2019, and the Coca-Cola's current share price and number of outstanding shares below the balance sheet

AutoSave on A2 chapter02_valuation_overview (2) - Excel A Austin Larson AL Ga File Home Insert Draw Page Layout Formulas Data Review View Help O Search Share Comments v X [ Arial 14 ay Wrap Text Number Insert DR Delete - AA === A- 270 Paste Ideas BIU Merge & Center $ % 248_98 Format Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Clipboard Font Alignment Number Cells Editing Ideas A1 COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS D E F 6 1 J K L M N 26,973 38.310 85.233 1 COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS 2 Cash, Cash Equivalents & Short Term Investments 11,175 Current Liabilities 3 Receivables 3,971 Total Non Current Liabilities Net Minority interest 1 Inventory 3,379 Total Liabilities Net Minority interest 5 Prepaid Assets 1.688 Current Assets 20411 Stockholders' Equity 7 Minority interest 8 Total non-cum arats 65,970 Total Equity Gross Minority Interest 9 10 Total Assets 85,381 Totaltabilties and equity 11 12 Coca Cola sale price (3) 12 Coca-Cola number of outstanding shares (milions) 14 15 16 18.991 2 117 21,098 86,381 50 4,314 COCA-COLA VALUATION 18 19 COCA-COLA CASH FLOW STATEMENT 2019 20 Cash flows from operating activities 10,471 21 22 Investments in properly. parand equipment 2,054 23 Acquisitions, net -5,542 24 Purchases of investments -4704 25 Salon Maturities of investments 6.973 26 Other investing actos 27 Net cash used for investing activites -3,976 28 Cash flows from investing activities 3,976 29 30 Castillows fum financing activities 9,004 31 32 Free cash flow in 2019 rcr growthrale until 2024 FCF growth rate aer 2024 Weighted average cost of capital 2019 2020 2021 2022 2023 2024 FCF Terminal value Total Enterprise value 22 ... Page 58, bottom Page 59 Page 65 Page 66 Page 67 Pages 68-69 assignment1 Calculate A 68% HE Type here to search O W 11:03 AM 9/17/2020 E G H J K L M N o Q R A B D 1 COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS 2 Cash, Cash Equivalents & Short Term Investments 11,175 Current Liabilities 26,973 3 Receivables 3,971 Total Non Current Liabilities Net Minority Interest 38,310 4 Inventory 3,379 Total Liabilities Net Minority Interest 65,283 5 Prepaid Assets 1.886 6 Current Assets 20,411 Stockholders' Equity 18,981 7 Minority Interest 2,117 8 Total non-current assets 65,970 Total Equity Gross Minority Interest 21,098 9 10 Total Assets 86,381 Total liabilities and equity 86,381 11 12 Coca-Cola share price ($) 50 13 Coca-Cola number of outstanding shares (millions) 4.314 14 15 16 17 18 19 COCA-COLA CASH FLOW STATEMENT 2019 20 Cash flows from operating activities 10,471 21 22 Investments in property, plant and equipment -2,054 23 Acquisitions, net -5,542 24 Purchases of investments 4,704 25 Sales/Maturities of investments 6,973 26 Other investing activites -56 27 Net cash used for investing activites -3,976 28 Cash flows from investing activities -3.976 29 30 Cash flows from financing activities -9,004 31 32 33 34 35 COCA-COLA VALUATION Free cash flow in 2019 FCF growth rate until 2024 FCF growth rate after 2024 Weighted average cost of capital 2019 2020 2021 2022 2023 2024 FCF Terminal value Total Enterprise value AutoSave on A2 chapter02_valuation_overview (2) - Excel A Austin Larson AL Ga File Home Insert Draw Page Layout Formulas Data Review View Help O Search Share Comments v X [ Arial 14 ay Wrap Text Number Insert DR Delete - AA === A- 270 Paste Ideas BIU Merge & Center $ % 248_98 Format Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter Select Clipboard Font Alignment Number Cells Editing Ideas A1 COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS D E F 6 1 J K L M N 26,973 38.310 85.233 1 COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS 2 Cash, Cash Equivalents & Short Term Investments 11,175 Current Liabilities 3 Receivables 3,971 Total Non Current Liabilities Net Minority interest 1 Inventory 3,379 Total Liabilities Net Minority interest 5 Prepaid Assets 1.688 Current Assets 20411 Stockholders' Equity 7 Minority interest 8 Total non-cum arats 65,970 Total Equity Gross Minority Interest 9 10 Total Assets 85,381 Totaltabilties and equity 11 12 Coca Cola sale price (3) 12 Coca-Cola number of outstanding shares (milions) 14 15 16 18.991 2 117 21,098 86,381 50 4,314 COCA-COLA VALUATION 18 19 COCA-COLA CASH FLOW STATEMENT 2019 20 Cash flows from operating activities 10,471 21 22 Investments in properly. parand equipment 2,054 23 Acquisitions, net -5,542 24 Purchases of investments -4704 25 Salon Maturities of investments 6.973 26 Other investing actos 27 Net cash used for investing activites -3,976 28 Cash flows from investing activities 3,976 29 30 Castillows fum financing activities 9,004 31 32 Free cash flow in 2019 rcr growthrale until 2024 FCF growth rate aer 2024 Weighted average cost of capital 2019 2020 2021 2022 2023 2024 FCF Terminal value Total Enterprise value 22 ... Page 58, bottom Page 59 Page 65 Page 66 Page 67 Pages 68-69 assignment1 Calculate A 68% HE Type here to search O W 11:03 AM 9/17/2020 E G H J K L M N o Q R A B D 1 COCA-COLA BALANCE SHEET 2019 IN MILLION DOLLARS 2 Cash, Cash Equivalents & Short Term Investments 11,175 Current Liabilities 26,973 3 Receivables 3,971 Total Non Current Liabilities Net Minority Interest 38,310 4 Inventory 3,379 Total Liabilities Net Minority Interest 65,283 5 Prepaid Assets 1.886 6 Current Assets 20,411 Stockholders' Equity 18,981 7 Minority Interest 2,117 8 Total non-current assets 65,970 Total Equity Gross Minority Interest 21,098 9 10 Total Assets 86,381 Total liabilities and equity 86,381 11 12 Coca-Cola share price ($) 50 13 Coca-Cola number of outstanding shares (millions) 4.314 14 15 16 17 18 19 COCA-COLA CASH FLOW STATEMENT 2019 20 Cash flows from operating activities 10,471 21 22 Investments in property, plant and equipment -2,054 23 Acquisitions, net -5,542 24 Purchases of investments 4,704 25 Sales/Maturities of investments 6,973 26 Other investing activites -56 27 Net cash used for investing activites -3,976 28 Cash flows from investing activities -3.976 29 30 Cash flows from financing activities -9,004 31 32 33 34 35 COCA-COLA VALUATION Free cash flow in 2019 FCF growth rate until 2024 FCF growth rate after 2024 Weighted average cost of capital 2019 2020 2021 2022 2023 2024 FCF Terminal value Total Enterprise valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started