Answered step by step

Verified Expert Solution

Question

1 Approved Answer

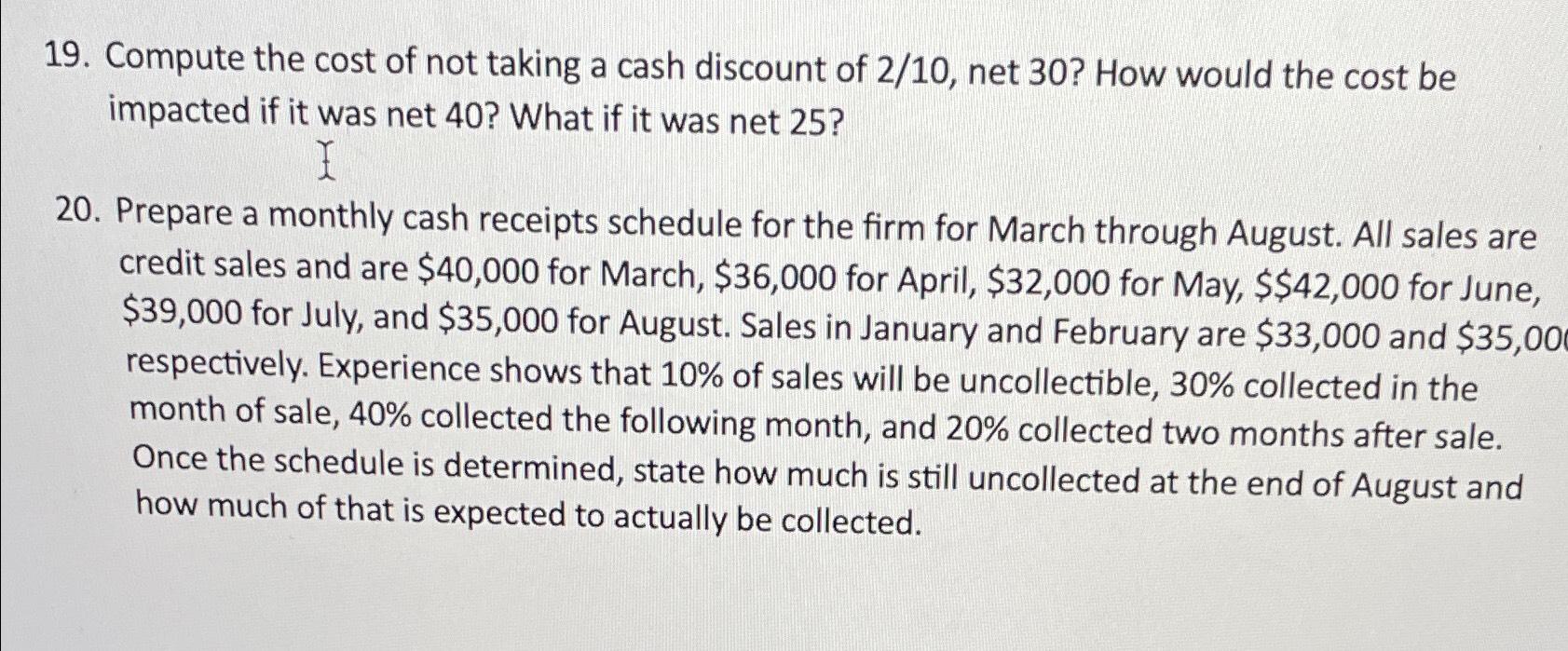

Compute the cost of not taking a cash discount of 2 1 0 , net 3 0 ? How would the cost be impacted if

Compute the cost of not taking a cash discount of net How would the cost be impacted if it was net What if it was net

Prepare a monthly cash receipts schedule for the firm for March through August. All sales are credit sales and are $ for March, $ for April, $ for May, $$ for June, $ for July, and $ for August. Sales in January and February are $ and $ respectively. Experience shows that of sales will be uncollectible, collected in the month of sale, collected the following month, and collected two months after sale. Once the schedule is determined, state how much is still uncollected at the end of August and how much of that is expected to actually be collected.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started