Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the depreciation expense for each of the two years using units of production depreciation. Clean Air Company makes and sells cloth masks. The company

Compute the depreciation expense for each of the two years using units of production depreciation.

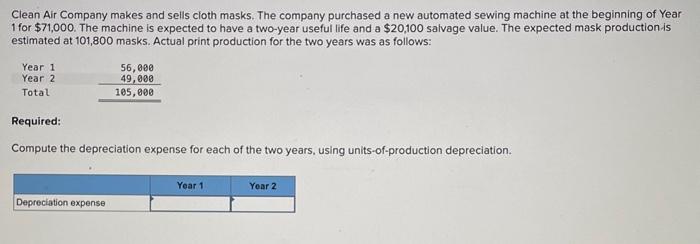

Clean Air Company makes and sells cloth masks. The company purchased a new automated sewing machine at the beginning of Year 1 for $71,000. The machine is expected to have a two-year useful life and a $20,100 salvage value. The expected mask production is estimated at 101,800 masks. Actual print production for the two years was as follows: Required: Compute the depreciation expense for each of the two years, using units-of-production depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started