Answered step by step

Verified Expert Solution

Question

1 Approved Answer

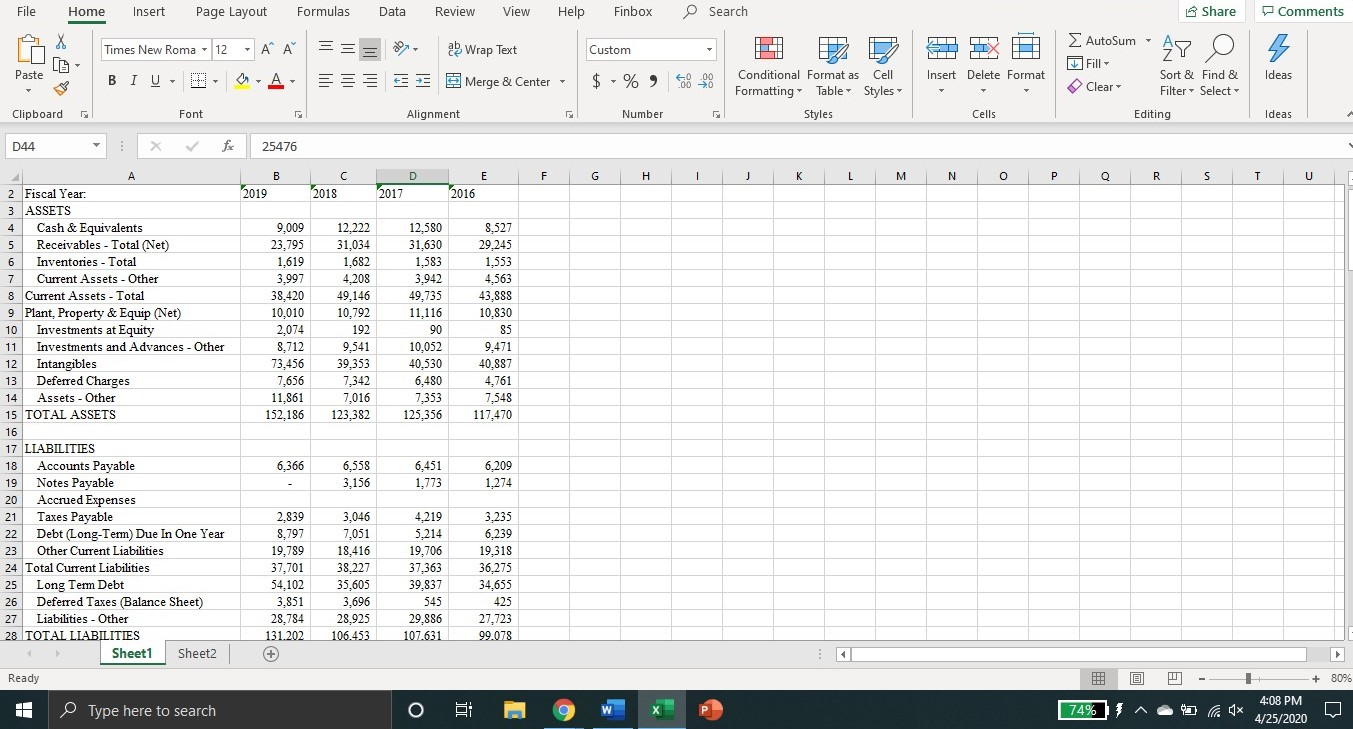

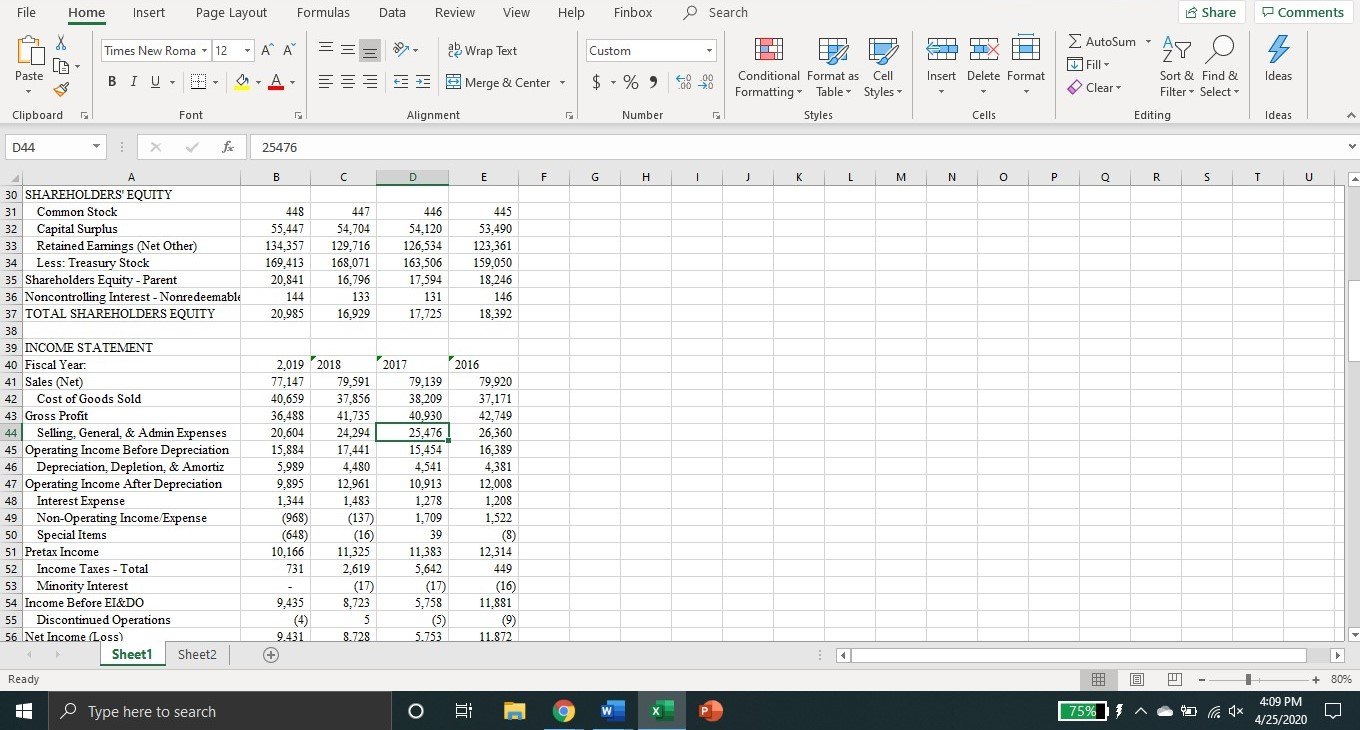

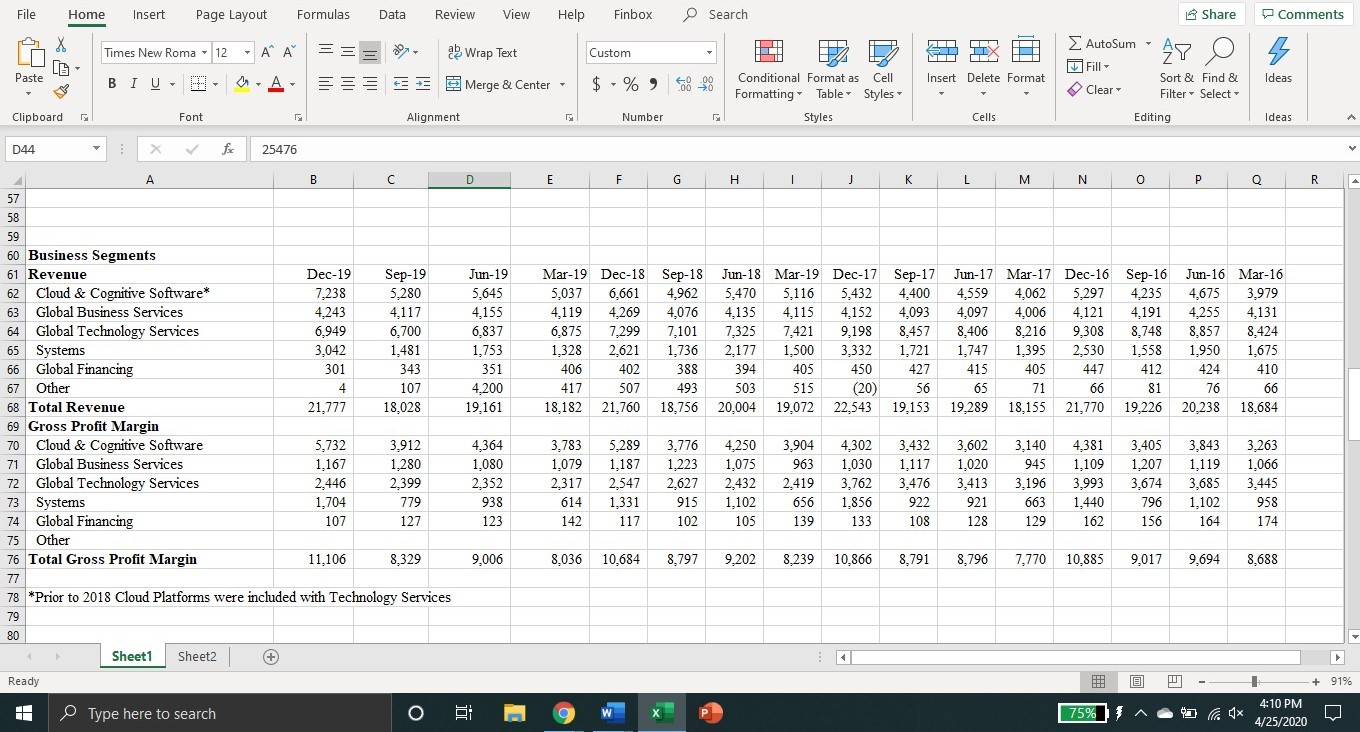

Compute the five component ratios of a decomposition of ROE (net profit margin, total asset turnover, return on assets, financial leverage, return on equity) for

Compute the five component ratios of a decomposition of ROE (net profit margin, total asset turnover, return on assets, financial leverage, return on equity) for IBMs fiscal years 2016-2019 (present your results)

File Home Insert Page Layout Formulas Data Review View Help Finbox Search Share Comments Times New Roma - 12 - AA = == 20 Wrap Text Custom 1 P2 P E AutoSum 47 0 4 Paste BIU - - E - A S E Merge & Center - Ideas $, % 48.00 Insert Delete Format Conditional Format as Formatting Table Styles Cell Styles Clear Sort & Find & Filter - Select Editing Clipboard Font Alignment Number Cells Ideas D44 X for 25476 2019 2018 2017 2016 8.527 29.245 1,553 4,563 43,888 10,830 2 Fiscal Year. 3 ASSETS 4 Cash & Equivalents 5 Receivables - Total (Net) 6 Inventories - Total 7 Current Assets - Other 8 Current Assets - Total 9 Plant Property & Equip (Net) 10 Investments at Equity 11 Investments and Advances - Other 12 Intangibles 13 Deferred Charges 14 Assets - Other 15 TOTAL ASSETS 16 17 LIABILITIES 18 Accounts Payable 19 Notes Payable 20 Accrued Expenses 21 Taxes Payable 22 Debt (Long-Term) Due In One Year 23 Other Current Liabilities 24 Total Current Liabilities 25 Long Term Debt 26 Deferred Taxes (Balance Sheet) 27 Liabilities - Other 28 TOTAL LIABILITIES Sheet1 Sheet2 9,009 23,795 1,619 3.997 38,420 10,010 2,074 8,712 73,456 7,656 11,861 152,186 12.222 31,034 1,682 4,208 49,146 10,792 192 9,541 39,353 7,342 7,016 123,382 12.580 31,630 1,583 3,942 49,735 11,116 90 10,052 40,530 6,480 7.353 125,356 85 9,471 40.887 4,761 7,548 117,470 6,366 6,558 3.156 6,451 1,773 6,209 1,274 2.839 8.797 19,789 37,701 54.102 3,851 28,784 131.202 + 3,046 7,051 18,416 38,227 35,605 3,696 28.925 106.453 4.219 5,214 19,706 37.363 39,837 545 29,886 107.631 3,235 6,239 19,318 36.275 34.655 425 27,723 99.078 Ready J - @ 1^ + 80% 4:08 PM 0 a 1x A/25/2020 W Type here to search O & 9 74% File Home Insert Page Layout Formulas Data Review View Help Finbox Search Share Comments Custom 41 1X MIT ZY Times New Roma - 12 - AA BIU - CA === S D. E Wrap Text Merge & Center Paste | $ - % Insert Delete Format AutoSum' Fill Sort & Find & Clear Filter Select Editing Conditional Format as Cell Formatting" Table Styles Styles Ideas Clipboard a Font Alignment Number Cells Ideas D44 X x 25476 B C D E F G H I J K L M N O P O I RI s T 1 u 448 445 30 SHAREHOLDERS' EQUITY 31 Common Stock 32 Capital Surplus 33 Retained Earnings (Net Other) 34 Less: Treasury Stock 35 Shareholders Equity - Parent 36 Noncontrolling Interest - Nonredeemable 37 TOTAL SHAREHOLDERS EQUITY 55,447 134,357 169,413 20,841 144 20.985 447 54,704 129,716 168,071 16,796 133 16.929 446 54,120 126,534 163,506 17,594 131 17,725 53.490 123,361 159,050 18,246 146 18,392 39 INCOME STATEMENT 40 Fiscal Year 41 Sales (Net) 42 Cost of Goods Sold 43 Gross Profit 44 Selling, General, & Admin Expenses 45 Operating Income Before Depreciation 46 Depreciation, Depletion, & Amortiz 47 Operating Income After Depreciation 48 Interest Expense 49 Non-Operating Income Expense 50 Special Items 51 Pretax Income 52 Income Taxes - Total 53 Minority Interest 54 Income Before EI&DO 55 Discontinued Operations 56 Net Income (Loss) Sheet1 Sheet2 Ready 2,019 77,147 40,659 36,488 20,604 15,884 5,989 9,895 1,344 (968) (648) 10,166 731 2018 79,591 37,856 41,735 24,294 17,441 4,480 12.961 1,483 (137) (16) 11,325 2.619 (17) 8,723 2017 2016 79,139 79,920 38,209 37,171 40.930 42,749 25,476 ! 26,360 15,454 16,389 4,541 4.381 10.913 12,008 1,278 1,208 1,709 1,522 39 (8) 11,383 5.642 (17) 5.758 12.314 449 (16) 11,881 9,435 9.4318 .728 5.753 11.872 - 9 75% @ ^ J . H - + 80% 4:09 PM 4x Type here to search O & 9 4/25/2020 File Home Insert Page Layout Formulas Data Review View Help Finbox Search Comments == = 0 AutoSum AY Times New Roma - 12 - AA BIU - A. A. ale Wrap Text 3 Merge & Center - nter Custom $ % % Share O Sort & Find & Filter - Select Editing Paste LG , Insert Delete Format Ideas 40.00 68 % | Conditional Format as Cell Formatting Table Styles Styles Clear Clipboard Font Alignment Number Cells Ideas D44 25476 D E F G H I J K L M N O P Q R Jun-19 5,645 4.155 6,837 1,753 351 4,200 19,161 Mar-19 Dec-18 Sep-18 5,037 6,661 4,962 4,119 4,2694,076 6,875 7.299 7,101 1,328 2,621 1,736 406 402 388 417 507 493 18,182 21,760 18,756 Jun-18 Mar-19 Dec-17 Sep-17 5,470 5,116 5,432 4,400 4,135 4,1154,152 4,093 7,325 7,421 9,198 8,457 2,177 1,500 3,332 1,721 394 405 450 427 503 515 (20) 56 20,004 19,072 22,543 19,153 Jun-17 Mar-17 Dec-16 4,559 4,062 5,297 4,097 4,006 4,121 8,406 8,216 9,308 1,747 1,395 2,530 415 405 447 71 66 19,289 18,155 21,770 Sep-16 4.235 4,191 8,748 1,558 412 81 19,226 Jun-16 Mar-16 4,675 3.979 4,255 4.131 8,857 8.424 1,950 1,675 424 410 76 66 20.238 18,684 60 Business Segments 61 Revenue Dec-19 Sep-19 62 Cloud & Cognitive Software* 7,238 5,280 63 Global Business Services 4,243 4,117 64 Global Technology Services 6,949 6,700 65 Systems 3,042 1,481 66 Global Financing 301 343 67 Other 107 68 Total Revenue 21,777 18,028 69 Gross Profit Margin 70 Cloud & Cognitive Software 5,732 3,912 71 Global Business Services 1,167 1,280 72 Global Technology Services 2.446 2,399 73 Systems 1,704 779 74 Global Financing 107 127 75 Other 76 Total Gross Profit Margin 11,106 8,329 77 78 *Prior to 2018 Cloud Platforms were included with Technology Services 4,364 1,080 2,352 938 123 3,783 1,079 2,317 614 142 5,289 1,187 2,547 1,331 117 3,776 1.223 2,627 915 102 4,250 1,075 2,432 1,102 105 3,904 963 2,419 656 139 4,302 1,030 3,762 1,856 133 3,432 1,117 3,476 922 108 3,602 1,020 3,413 921 128 3,140 945 3,196 663 129 4,381 1,109 3,993 1,440 162 3,405 1,207 3,674 796 156 3,843 1,119 3,685 1.102 164 3.263 1,066 3,445 958 174 9,006 8,036 10,684 8,797 9,202 8,239 10,866 8,791 8,796 7.770 10,885 9,017 9,694 8,688 79 80 Sheet1 Sheet2 | Ready @ + 91% -- la ax 4:10 PM Type here to search o & 9 75% 4/25/2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started