Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the following: 1. How much should be the Taxable income? 2. How much is the current Income Tax expense? 3. What amount should be

Compute the following:

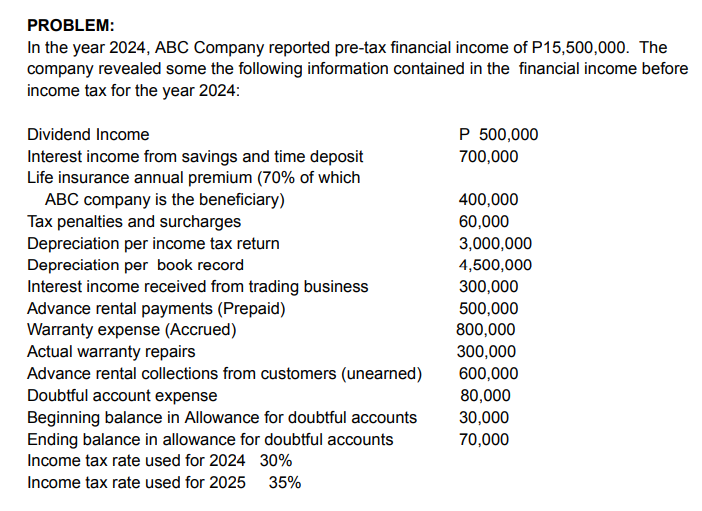

1. How much should be the Taxable income?

2. How much is the current Income Tax expense?

3. What amount should be presented as deferred tax liability on December 31?

4. What amount is the deferred tax asset on December 31?

5. How much should be the total income tax expense for 2024?

PROBLEM: In the year 2024, ABC Company reported pre-tax financial income of P15,500,000. The company revealed some the following information contained in the financial income before income tax for the year 2024: Dividend Income Interest income from savings and time deposit Life insurance annual premium (70% of which ABC company is the beneficiary) Tax penalties and surcharges P 500,000 700,000 400,000 60,000 Depreciation per income tax return 3,000,000 Depreciation per book record 4,500,000 Interest income received from trading business 300,000 Advance rental payments (Prepaid) 500,000 Warranty expense (Accrued) 800,000 Actual warranty repairs 300,000 Advance rental collections from customers (unearned) 600,000 Doubtful account expense 80,000 Beginning balance in Allowance for doubtful accounts 30,000 Ending balance in allowance for doubtful accounts Income tax rate used for 2024 30% 70,000 Income tax rate used for 2025 35%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the various taxrelated amounts well use the information provided above Heres a clear and elaborate solution Taxable Income Calculation Taxa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started