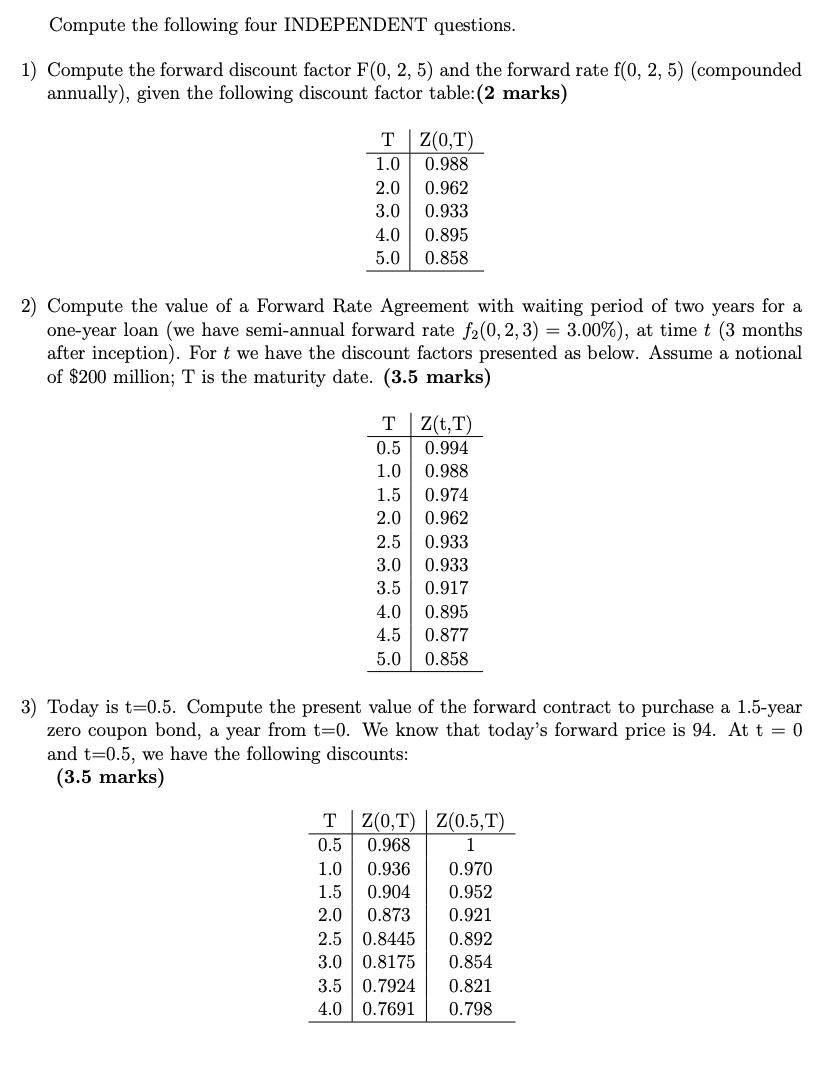

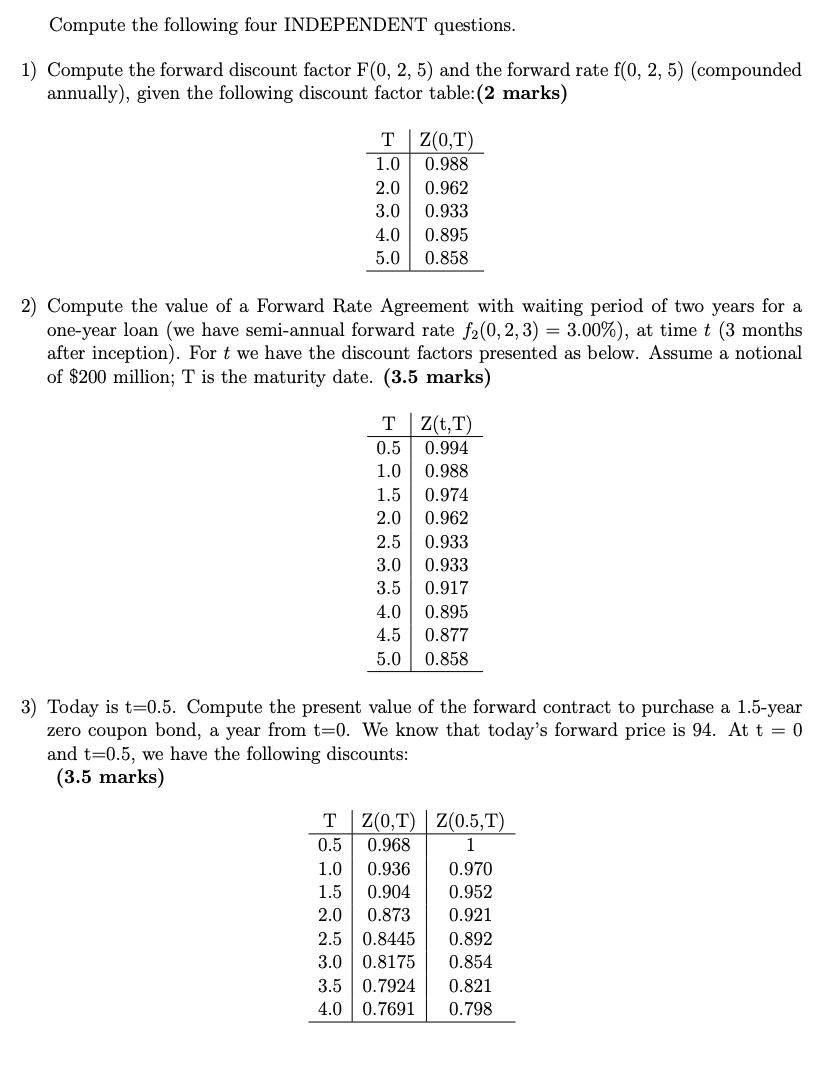

Compute the following four INDEPENDENT questions. 1) Compute the forward discount factor F(0, 2, 5) and the forward rate f(0, 2,5) (compounded annually), given the following discount factor table:(2 marks) T 1.0 2.0 3.0 4.0 5.0 Z(0,T) 0.988 0.962 0.933 0.895 0.858 2) Compute the value of a Forward Rate Agreement with waiting period of two years for a one-year loan (we have semi-annual forward rate f2(0,2,3) = 3.00%), at time t (3 months after inception). For t we have the discount factors presented as below. Assume a notional of $200 million; T is the maturity date. (3.5 marks) T Z(t,T) 0.5 0.994 1.0 0.988 1.5 0.974 2.0 0.962 2.5 0.933 0.933 3.5 0.917 4.0 0.895 4.5 0.877 5.0 0.858 3.0 3) Today is t=0.5. Compute the present value of the forward contract to purchase a 1.5-year zero coupon bond, a year from t=0. We know that today's forward price is 94. At t = 0 and t=0.5, we have the following discounts: (3.5 marks) T Z(0,T) Z(0.5,T) 0.5 0.968 1 1.0 0.936 0.970 1.5 0.904 0.952 2.0 0.873 0.921 2.5 0.8445 0.892 3.0 | 0.8175 0.854 3.5 0.7924 0.821 4.0 0.7691 0.798 Compute the following four INDEPENDENT questions. 1) Compute the forward discount factor F(0, 2, 5) and the forward rate f(0, 2,5) (compounded annually), given the following discount factor table:(2 marks) T 1.0 2.0 3.0 4.0 5.0 Z(0,T) 0.988 0.962 0.933 0.895 0.858 2) Compute the value of a Forward Rate Agreement with waiting period of two years for a one-year loan (we have semi-annual forward rate f2(0,2,3) = 3.00%), at time t (3 months after inception). For t we have the discount factors presented as below. Assume a notional of $200 million; T is the maturity date. (3.5 marks) T Z(t,T) 0.5 0.994 1.0 0.988 1.5 0.974 2.0 0.962 2.5 0.933 0.933 3.5 0.917 4.0 0.895 4.5 0.877 5.0 0.858 3.0 3) Today is t=0.5. Compute the present value of the forward contract to purchase a 1.5-year zero coupon bond, a year from t=0. We know that today's forward price is 94. At t = 0 and t=0.5, we have the following discounts: (3.5 marks) T Z(0,T) Z(0.5,T) 0.5 0.968 1 1.0 0.936 0.970 1.5 0.904 0.952 2.0 0.873 0.921 2.5 0.8445 0.892 3.0 | 0.8175 0.854 3.5 0.7924 0.821 4.0 0.7691 0.798