Answered step by step

Verified Expert Solution

Question

1 Approved Answer

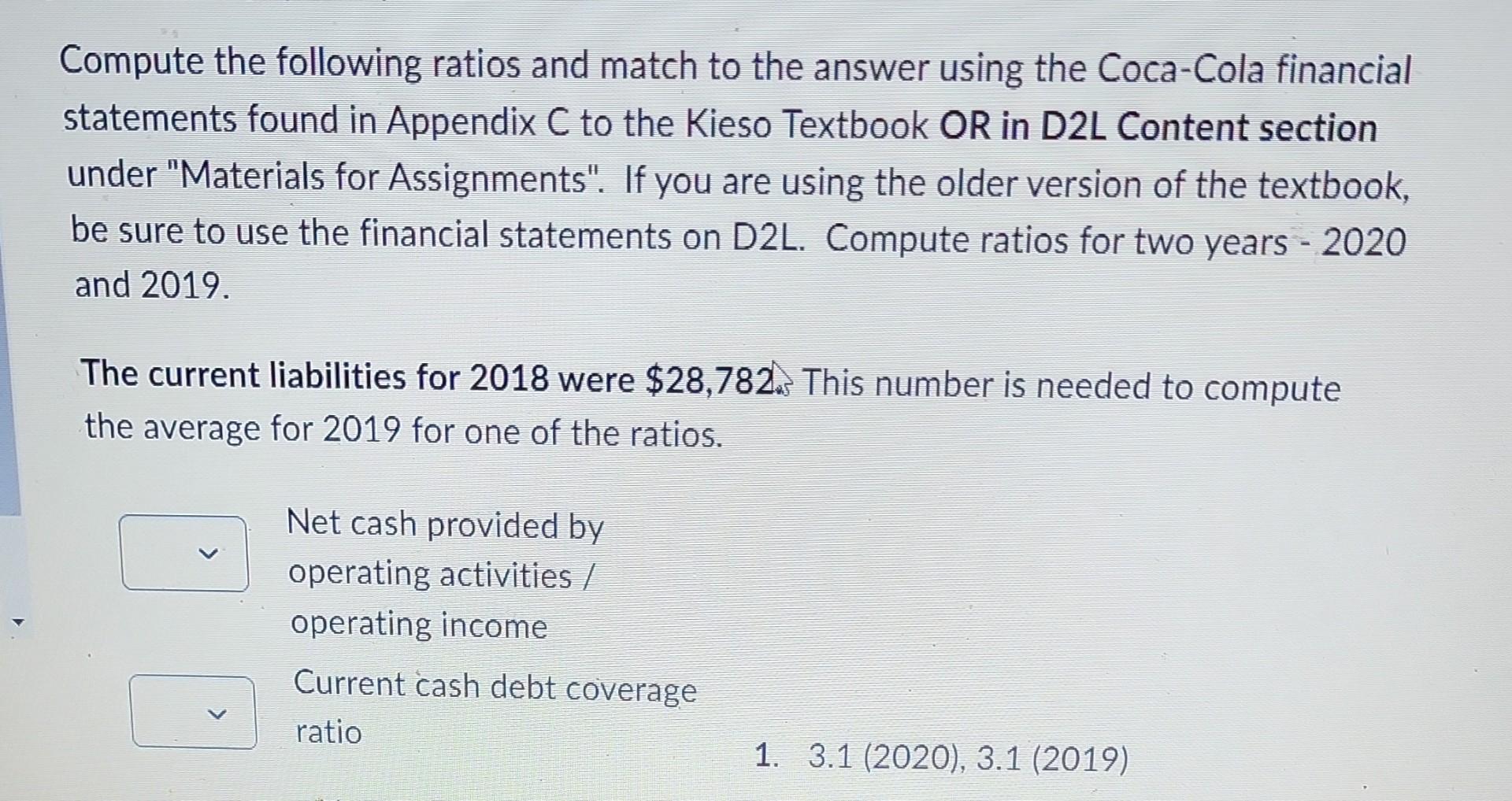

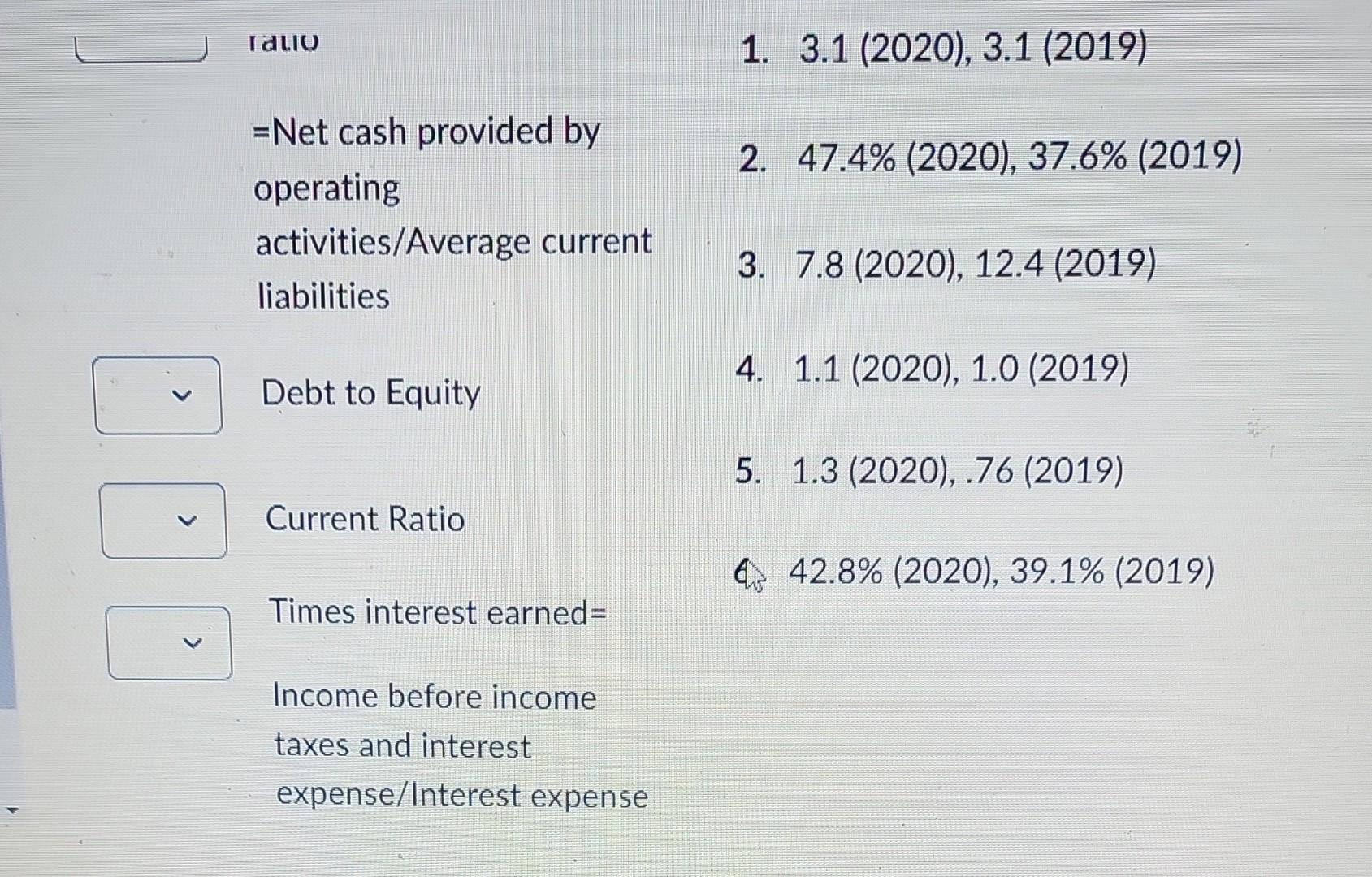

Compute the following ratios and match to the answer using the Coca-Cola financial statements found in Appendix C to the Kieso Textbook OR in D2L

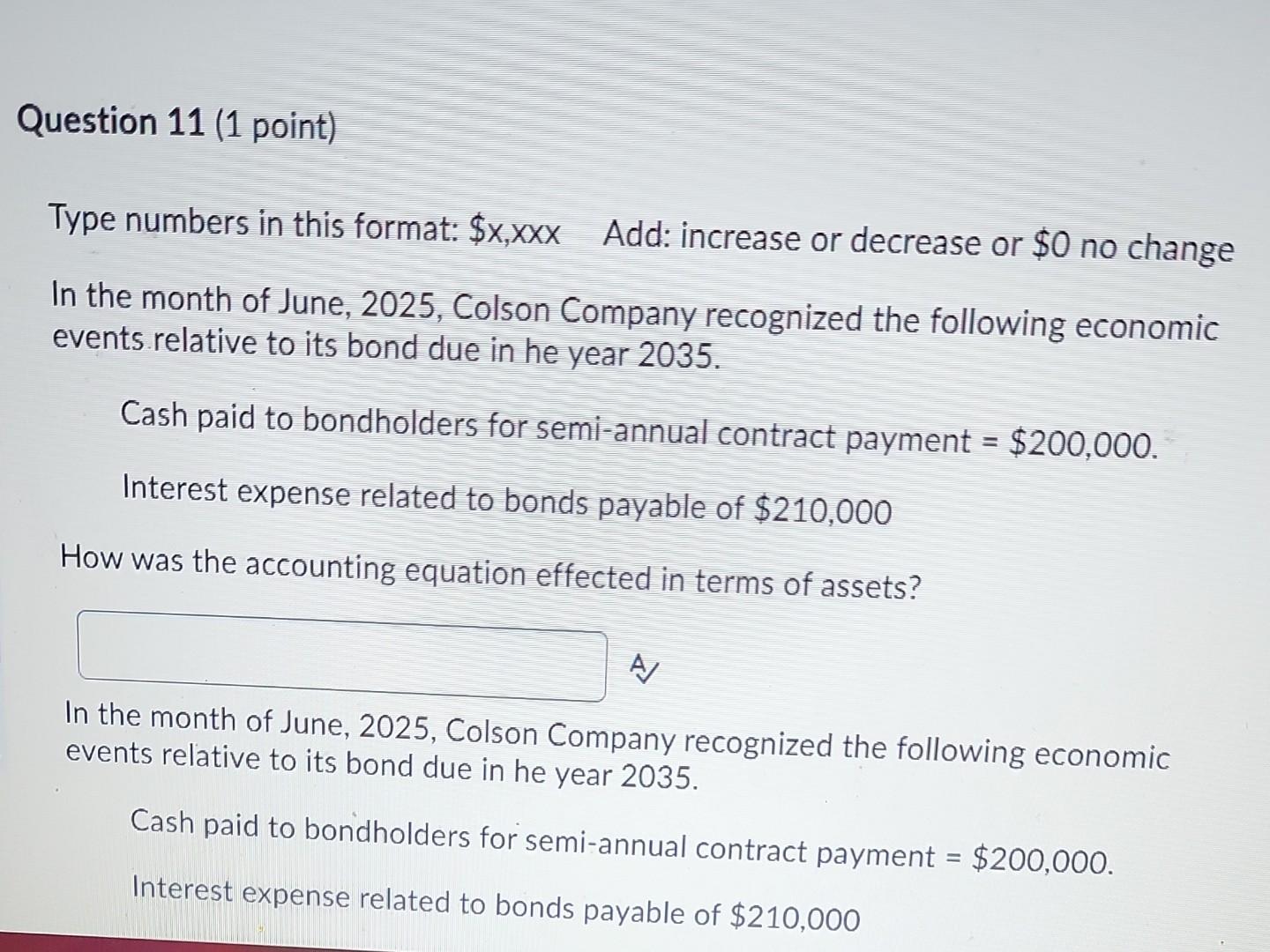

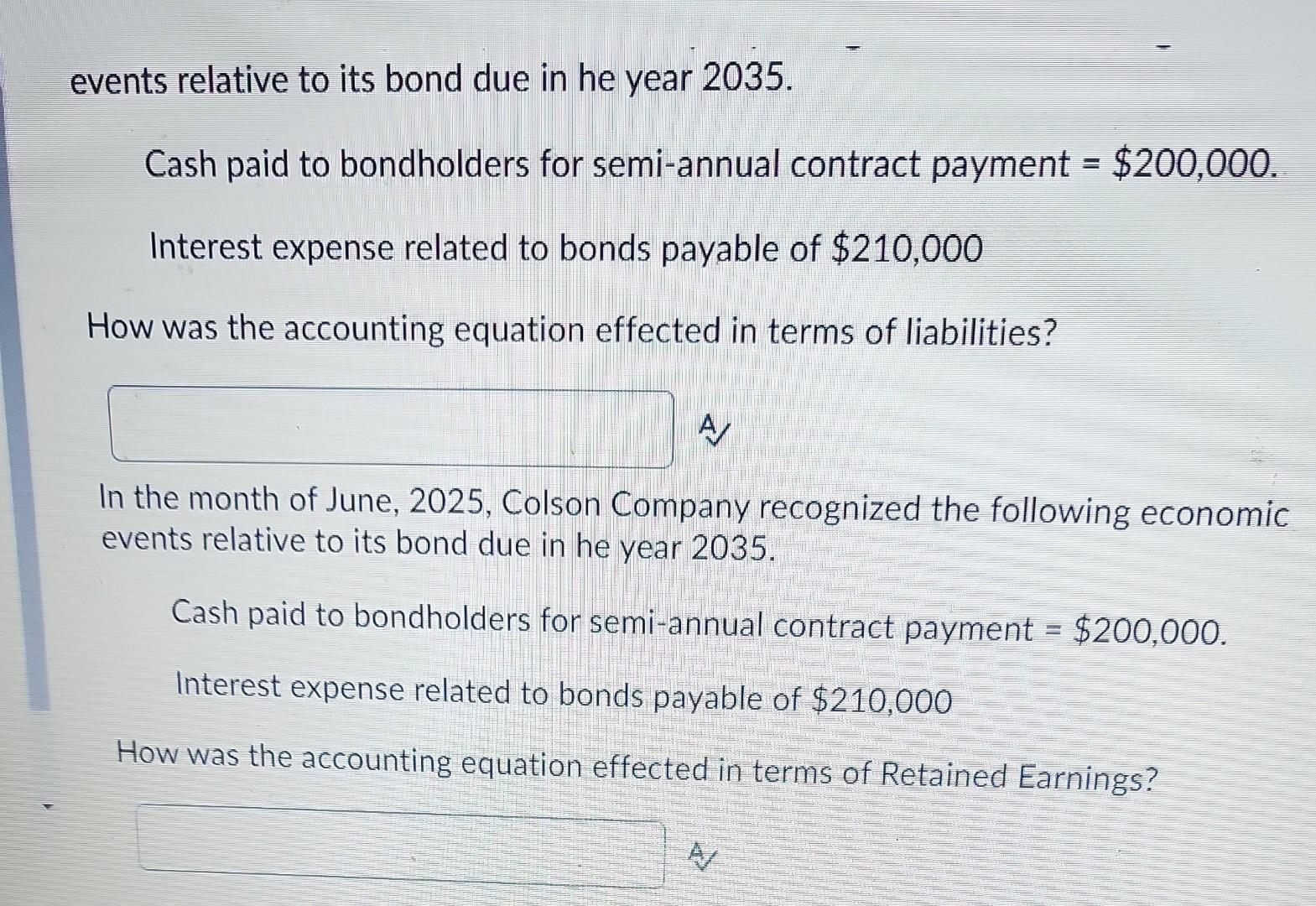

Compute the following ratios and match to the answer using the Coca-Cola financial statements found in Appendix C to the Kieso Textbook OR in D2L Content section under "Materials for Assignments". If you are using the older version of the textbook, be sure to use the financial statements on D2L. Compute ratios for two years - 2020 and 2019. The current liabilities for 2018 were $28,782. This number is needed to compute the average for 2019 for one of the ratios. Net cash provided by operating activities / operating income Current cash debt coverage ratio 1. 3.1 (2020), 3.1 (2019) Idulu 1. 3.1(2020),3.1 (2019) =Net cash provided by 2. 47.4%(2020),37.6%(2019) operating activities/Average current liabilities 3. 7.8(2020),12.4 (2019) Debt to Equity 4. 1.1 (2020), 1.0 (2019) 5. 1.3 (2020), .76 (2019) Current Ratio Times interest earned= . 42.8%(2020),39.1% (2019) Income before income taxes and interest expense/Interest expense Question 11 (1 point) Type numbers in this format: $x,xxX Add: increase or decrease or $0 no change In the month of June, 2025 , Colson Company recognized the following economic events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 How was the accounting equation effected in terms of assets? In the month of June, 2025 , Colson Company recognized the following economic events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 How was the accounting equation effected in terms of liabilities? A In the month of June, 2025, Colson Company recognized the following economic events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 How was the accounting equation effected in terms of Retained Earnings? Compute the following ratios and match to the answer using the Coca-Cola financial statements found in Appendix C to the Kieso Textbook OR in D2L Content section under "Materials for Assignments". If you are using the older version of the textbook, be sure to use the financial statements on D2L. Compute ratios for two years - 2020 and 2019. The current liabilities for 2018 were $28,782. This number is needed to compute the average for 2019 for one of the ratios. Net cash provided by operating activities / operating income Current cash debt coverage ratio 1. 3.1 (2020), 3.1 (2019) Idulu 1. 3.1(2020),3.1 (2019) =Net cash provided by 2. 47.4%(2020),37.6%(2019) operating activities/Average current liabilities 3. 7.8(2020),12.4 (2019) Debt to Equity 4. 1.1 (2020), 1.0 (2019) 5. 1.3 (2020), .76 (2019) Current Ratio Times interest earned= . 42.8%(2020),39.1% (2019) Income before income taxes and interest expense/Interest expense Question 11 (1 point) Type numbers in this format: $x,xxX Add: increase or decrease or $0 no change In the month of June, 2025 , Colson Company recognized the following economic events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 How was the accounting equation effected in terms of assets? In the month of June, 2025 , Colson Company recognized the following economic events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 How was the accounting equation effected in terms of liabilities? A In the month of June, 2025, Colson Company recognized the following economic events relative to its bond due in he year 2035. Cash paid to bondholders for semi-annual contract payment =$200,000. Interest expense related to bonds payable of $210,000 How was the accounting equation effected in terms of Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started