Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to-total assets answer

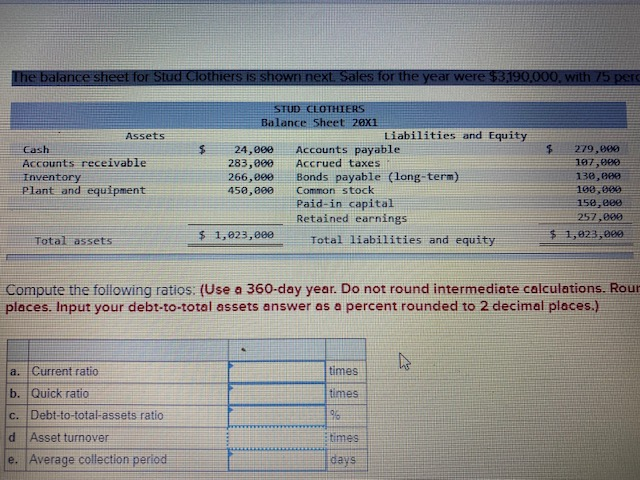

Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to-total assets answer as a percent rounded to 2 decimal places.)

The balance sheet for Stud Clothiers is shown next. Sales for the year were $3,190,000, with 75 perc STUD CLOTHIERS Balance Sheet 20X1 Liabilities and Equity %24 Assets Accounts payable Cash 279,000 24,000 Accounts receivable Inventory Plant and equipment 283,000 266,000 450,000 Accrued taxes 107,000 130,000 Bonds payable (long-term) Common stock Paid-in capital Retained earnings 100,000 150,000 257,000 $ 1,023,000 $ 1,023,0e0 Total liabilities and equity Total assets Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Rour places. Input your debt-to-total assets answer as a percent rounded to 2 decimal places.) Current ratio times a. b. Quick ratio times c. Debt-to-total-assets ratio 96 d Ass times turnover e. Average collection perlod daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started