Answered step by step

Verified Expert Solution

Question

1 Approved Answer

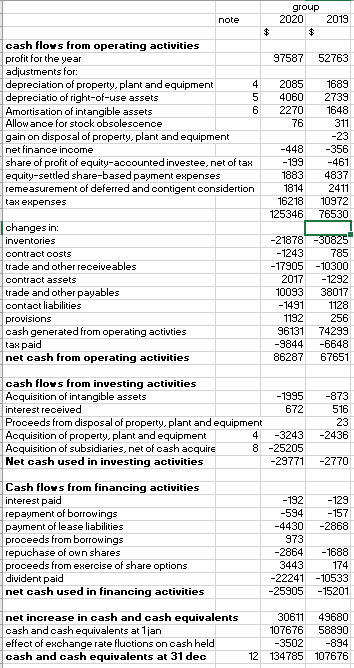

Compute the Free Cash Flow to Finance and Free Cash Flow to Equity. Compute the projected growth rate for this company using a suitable method

Compute the Free Cash Flow to Finance and Free Cash Flow to Equity.

Compute the projected growth rate for this company using a suitable method

group note 2020 2019 $ $ cash flows from operating activities profit for the year 97587 52763 adjustments for: depreciation of property, plant and equipment 4 2085 1689 depreciatio of right-of-use assets 5 4060 2739 Amortisation of intangible assets 6 2270 1648 Allowance for stock obsolescence 76 311 gain on disposal of property, plant and equipment -23 net finance income -448 -356 share of profit of equity-accounted investee, net of tax -199 -461 equity-settled share-based payment expenses 1883 4837 remeasurement of deferred and contigent considertion 1814 2411 tax expenses 16218 10972 125346 76530 changes in: inventories -21878 -30825 contract costs -1243 785 trade and other receiveables -17905 -10300 contract assets 2017 -1292 trade and other payables 10093 38017 contact liabilities -1491 1128 provisions 1192 256 cash generated from operating activties 96131 74299 tax paid -9844 -6648 net cash from operating activities 86287 67651 cash flows from investing activities Acquisition of intangible assets -1995 -873 interest received 672 516 Proceeds from disposal of property, plant and equipment 23 Acquisition of property, plant and equipment 4 -3243 -2436 Acquisition of subsidiaries, net of cash acquire 8 -25205 Net cash used in investing activities -29771 -2770 Cash flows from financing activities interest paid -192 -129 repayment of borrowings -594 -157 payment of lease liabilities -4430 -2868 proceeds from borrowings 973 repuchase of own shares -2864 - 1688 proceeds from exercise of share options 3443 174 divident paid -22241 -10533 net cash used in financing activities -25905 -15201 net increase in cash and cash equivalents 30611 49680 cash and cash equivalents at 1jan 107676 58890 effect of exchange rate fluctions on cash held -3502 -894 cash and cash equivalents at 31 dec 12 134785 107676 group note 2020 2019 $ $ cash flows from operating activities profit for the year 97587 52763 adjustments for: depreciation of property, plant and equipment 4 2085 1689 depreciatio of right-of-use assets 5 4060 2739 Amortisation of intangible assets 6 2270 1648 Allowance for stock obsolescence 76 311 gain on disposal of property, plant and equipment -23 net finance income -448 -356 share of profit of equity-accounted investee, net of tax -199 -461 equity-settled share-based payment expenses 1883 4837 remeasurement of deferred and contigent considertion 1814 2411 tax expenses 16218 10972 125346 76530 changes in: inventories -21878 -30825 contract costs -1243 785 trade and other receiveables -17905 -10300 contract assets 2017 -1292 trade and other payables 10093 38017 contact liabilities -1491 1128 provisions 1192 256 cash generated from operating activties 96131 74299 tax paid -9844 -6648 net cash from operating activities 86287 67651 cash flows from investing activities Acquisition of intangible assets -1995 -873 interest received 672 516 Proceeds from disposal of property, plant and equipment 23 Acquisition of property, plant and equipment 4 -3243 -2436 Acquisition of subsidiaries, net of cash acquire 8 -25205 Net cash used in investing activities -29771 -2770 Cash flows from financing activities interest paid -192 -129 repayment of borrowings -594 -157 payment of lease liabilities -4430 -2868 proceeds from borrowings 973 repuchase of own shares -2864 - 1688 proceeds from exercise of share options 3443 174 divident paid -22241 -10533 net cash used in financing activities -25905 -15201 net increase in cash and cash equivalents 30611 49680 cash and cash equivalents at 1jan 107676 58890 effect of exchange rate fluctions on cash held -3502 -894 cash and cash equivalents at 31 dec 12 134785 107676Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started