Answered step by step

Verified Expert Solution

Question

1 Approved Answer

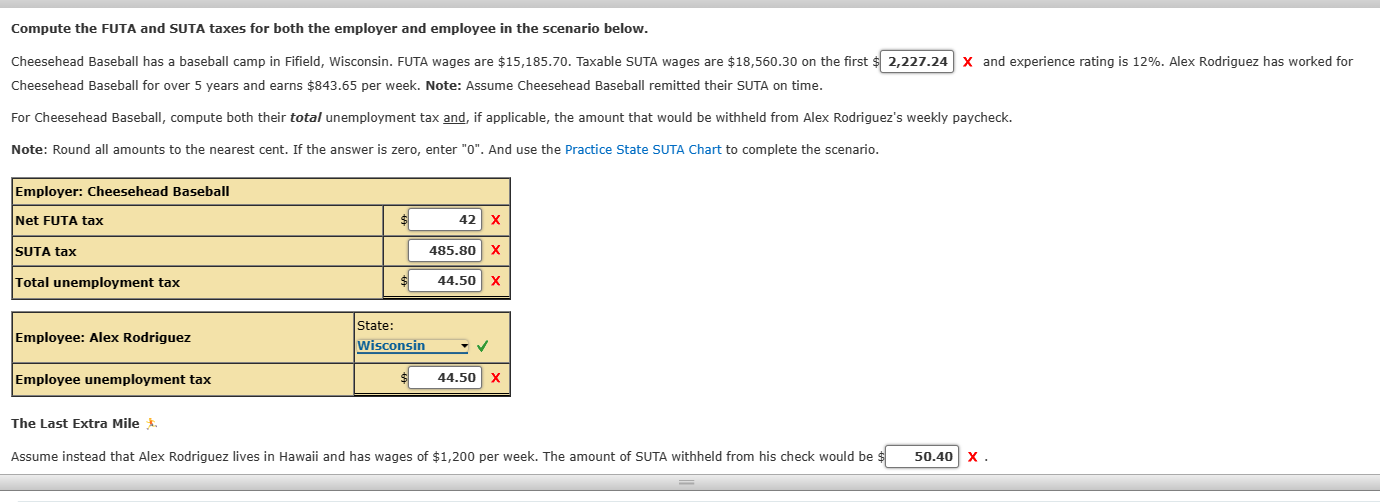

Compute the FUTA and SUTA taxes for both the employer and employee in the scenario below. Cheesehead Baseball for over 5 years and earns $843.65

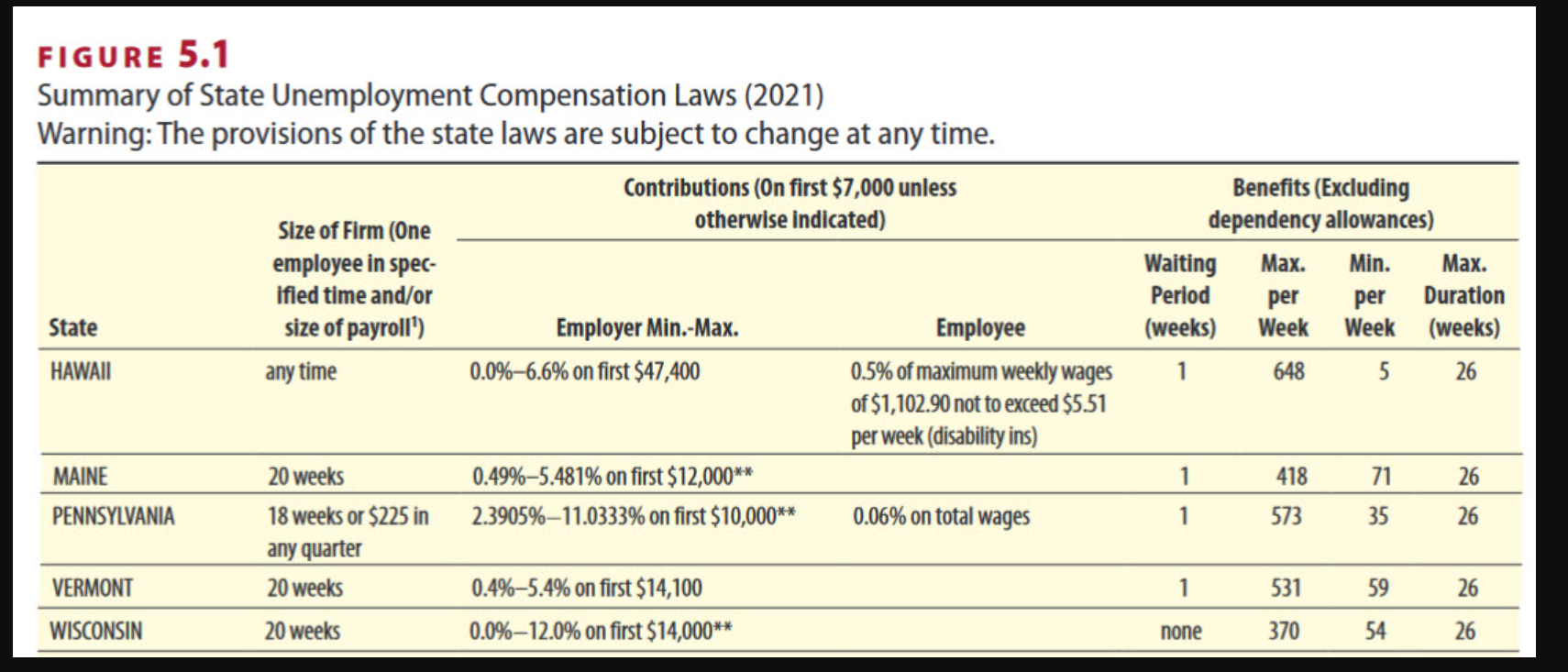

Compute the FUTA and SUTA taxes for both the employer and employee in the scenario below. Cheesehead Baseball for over 5 years and earns $843.65 per week. Note: Assume Cheesehead Baseball remitted their SUTA on time. For Cheesehead Baseball, compute both their total unemployment tax and, if applicable, the amount that would be withheld from Alex Rodriguez's weekly paycheck. Note: Round all amounts to the nearest cent. If the answer is zero, enter "0". And use the Practice State SUTA Chart to complete the scenario. The Last Extra Mile 1 Assume instead that Alex Rodriguez lives in Hawaii and has wages of $1,200 per week. The amount of SUTA withheld from his check would be FIGURE 5.1 Summary of State Unemployment Compensation Laws (2021) Warning: The provisions of the state laws are subject to change at any time

Compute the FUTA and SUTA taxes for both the employer and employee in the scenario below. Cheesehead Baseball for over 5 years and earns $843.65 per week. Note: Assume Cheesehead Baseball remitted their SUTA on time. For Cheesehead Baseball, compute both their total unemployment tax and, if applicable, the amount that would be withheld from Alex Rodriguez's weekly paycheck. Note: Round all amounts to the nearest cent. If the answer is zero, enter "0". And use the Practice State SUTA Chart to complete the scenario. The Last Extra Mile 1 Assume instead that Alex Rodriguez lives in Hawaii and has wages of $1,200 per week. The amount of SUTA withheld from his check would be FIGURE 5.1 Summary of State Unemployment Compensation Laws (2021) Warning: The provisions of the state laws are subject to change at any time Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started