Answered step by step

Verified Expert Solution

Question

1 Approved Answer

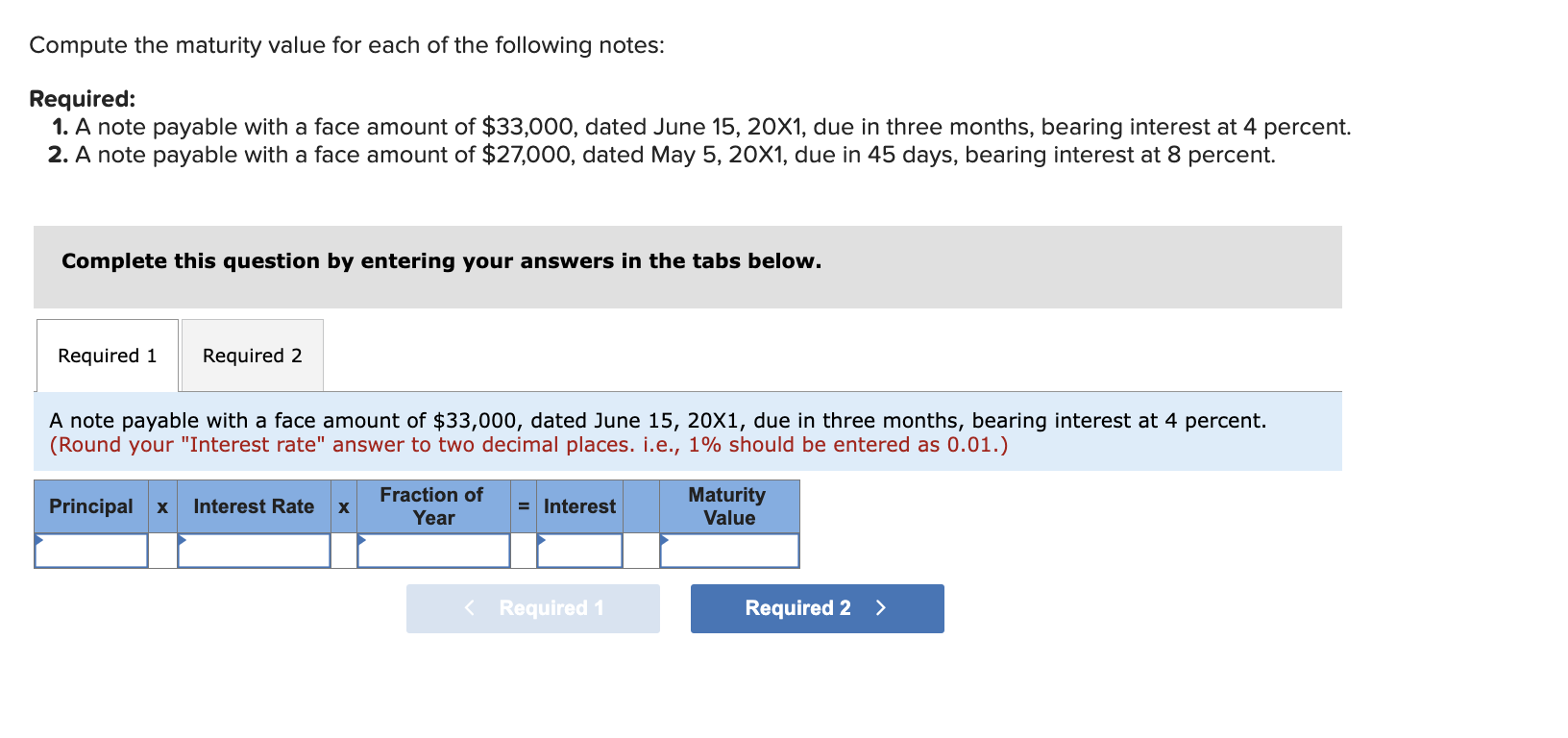

Compute the maturity value for each of the following notes: Required: 1. A note payable with a face amount of $33,000, dated June 15,201, due

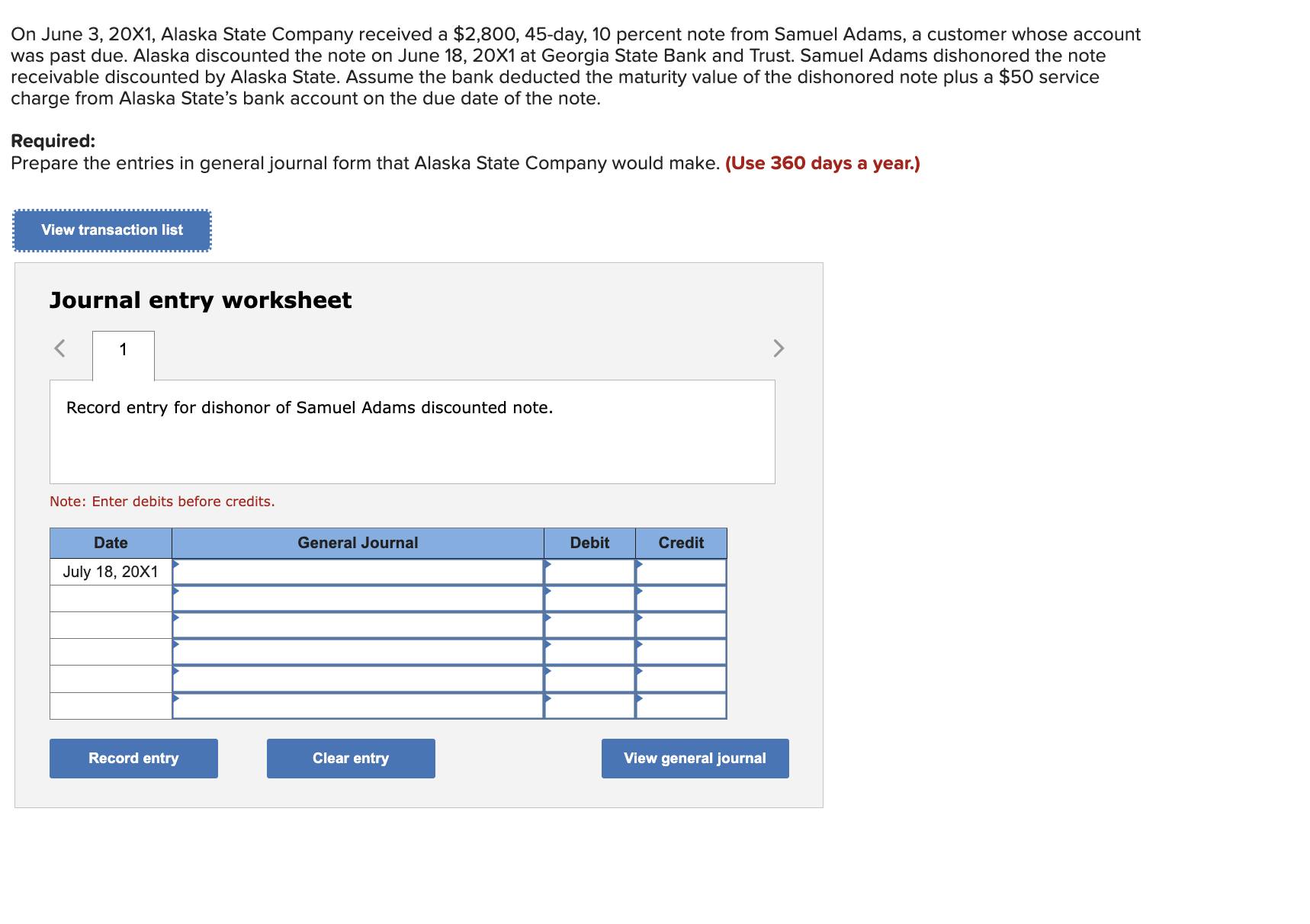

Compute the maturity value for each of the following notes: Required: 1. A note payable with a face amount of $33,000, dated June 15,201, due in three months, bearing interest at 4 percent 2. A note payable with a face amount of $27,000, dated May 5,201, due in 45 days, bearing interest at 8 percent. Complete this question by entering your answers in the tabs below. A note payable with a face amount of $33,000, dated June 15,201, due in three months, bearing interest at 4 percent. (Round your "Interest rate" answer to two decimal places. i.e., 1% should be entered as 0.01. ) On June 3, 20X1, Alaska State Company received a $2,800,45-day, 10 percent note from Samuel Adams, a customer whose account vas past due. Alaska discounted the note on June 18, 20X1 at Georgia State Bank and Trust. Samuel Adams dishonored the note eceivable discounted by Alaska State. Assume the bank deducted the maturity value of the dishonored note plus a $50 service harge from Alaska State's bank account on the due date of the note. Required: Prepare the entries in general journal form that Alaska State Company would make. (Use 360 days a year.) Journal entry worksheet Record entry for dishonor of Samuel Adams discounted note. Note: Enter debits before credits

Compute the maturity value for each of the following notes: Required: 1. A note payable with a face amount of $33,000, dated June 15,201, due in three months, bearing interest at 4 percent 2. A note payable with a face amount of $27,000, dated May 5,201, due in 45 days, bearing interest at 8 percent. Complete this question by entering your answers in the tabs below. A note payable with a face amount of $33,000, dated June 15,201, due in three months, bearing interest at 4 percent. (Round your "Interest rate" answer to two decimal places. i.e., 1% should be entered as 0.01. ) On June 3, 20X1, Alaska State Company received a $2,800,45-day, 10 percent note from Samuel Adams, a customer whose account vas past due. Alaska discounted the note on June 18, 20X1 at Georgia State Bank and Trust. Samuel Adams dishonored the note eceivable discounted by Alaska State. Assume the bank deducted the maturity value of the dishonored note plus a $50 service harge from Alaska State's bank account on the due date of the note. Required: Prepare the entries in general journal form that Alaska State Company would make. (Use 360 days a year.) Journal entry worksheet Record entry for dishonor of Samuel Adams discounted note. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started