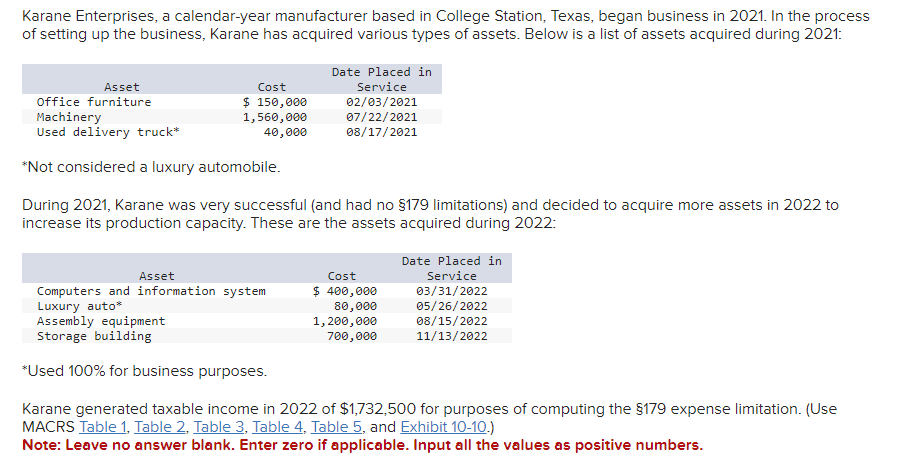

-Compute the maximum 2021 depreciation deductions, including 179 expense (ignoring bonus depreciation)

- Compute the maximum 2022 depreciation deductions, including 179 expense (ignoring bonus depreciation).

- Compute the maximum 2022 depreciation deductions, including 179 expense, but now assume that Karane would like to take bonus depreciation.

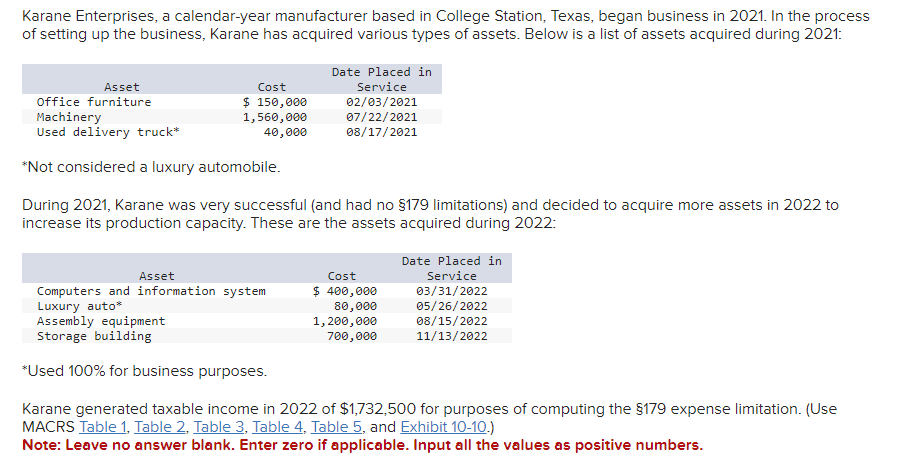

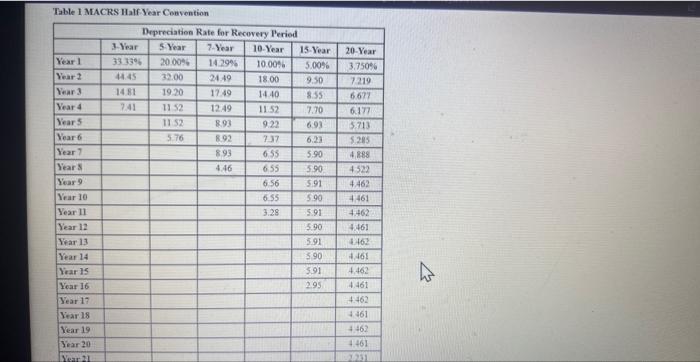

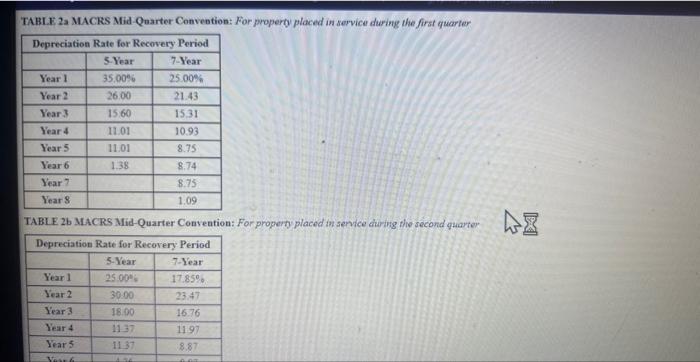

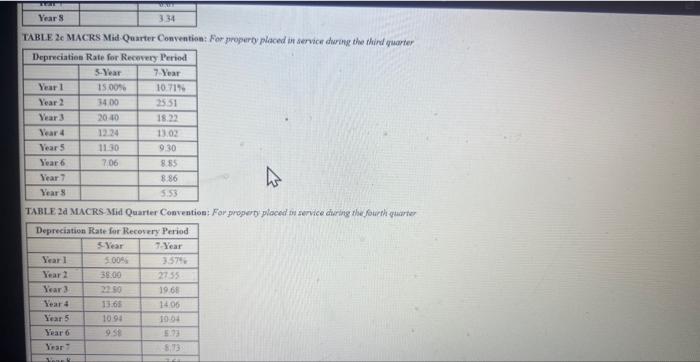

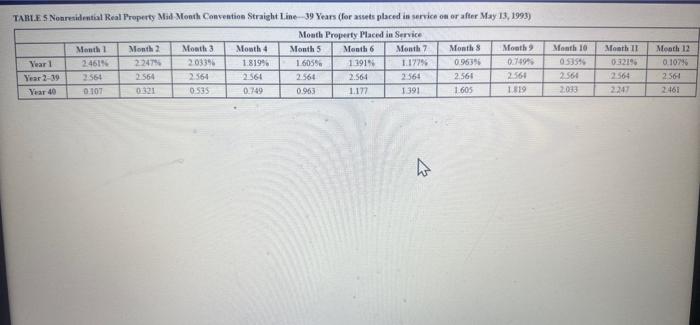

Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 : *Used 100% for business purposes. Karane generated taxable income in 2022 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Table 1 MLCRS Half Year Convention TABI.E 2a MACRS Mid Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid Quarter Convention: For propery placed in service during the thind quarter TABLE 2d MACRS-Mfid Quarter Convention: For properp- ploced in senvice dwring the fouich guarter TARt. 5 Nonresidential Real Property Mid Month Convention Straight line-39 Years (for assets placed in service on or afier May 13, 1993) Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021 : *Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 : *Used 100% for business purposes. Karane generated taxable income in 2022 of $1,732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Table 1 MLCRS Half Year Convention TABI.E 2a MACRS Mid Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid Quarter Convention: For propery placed in service during the thind quarter TABLE 2d MACRS-Mfid Quarter Convention: For properp- ploced in senvice dwring the fouich guarter TARt. 5 Nonresidential Real Property Mid Month Convention Straight line-39 Years (for assets placed in service on or afier May 13, 1993)