Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compute the net present value (NPV) of the project to manufacture and sell the new product. Round off your answer to the nearest dollar and

Compute the net present value (NPV) of the project to manufacture and sell the new product. Round off your answer to the nearest dollar and show all relevant workings.

Comment on whether Messina should proceed with the project.

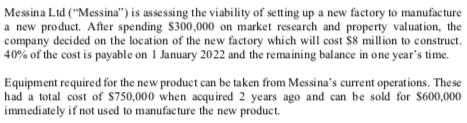

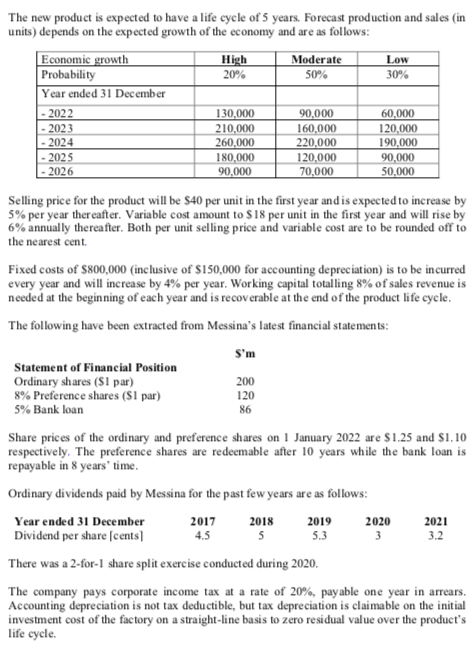

Messina Ltd ("Messina") is assessing the viability of setting up a new factory to manufacture a new product. After spending $300,000 on market research and property valuation, the company decided on the location of the new factory which will cost $8 million to construct. 40% of the cost is payable on 1 January 2022 and the remaining balance in one year's time. Equipment required for the new product can be taken from Messina's current operations. These had a total cost of $750,000 when acquired 2 years ago and can be sold for $600,000 immediately if not used to manufacture the new product. The new product is expected to have a life cycle of 5 years. Forecast production and sales (in units) depends on the expected growth of the economy and are as follows: Selling price for the product will be $40 per unit in the first year and is expected to increase by 5% per year thereafter. Variable cost amount to $18 per unit in the first year and will rise by 6% annually thereafter. Both per unit selling price and variable cost are to be rounded off to the nearest cent. Fixed costs of $800,000 (inclusive of $150,000 for accounting depreciation) is to be incurred every year and will increase by 4% per year. Working capital total ling 8% of sales revenue is needed at the beginning of each year and is recoverable at the end of the product life cycle. The following have been extracted from Messina's latest financial statements: Share prices of the ordinary and preference shares on 1 January 2022 are $1.25 and $1.10 respectively. The preference shares are redeemable after 10 years while the bank loan is repayable in 8 years' time. Ordinary dividends paid by Messina for the past few years are as follows: There was a 2-for-1 share split exercise conducted during 2020. The company pays corporate income tax at a rate of 20%, payable one year in arrears. Accounting depreciation is not tax deductible, but tax depreciation is claimable on the initial investment cost of the factory on a straight-line basis to zero residual value over the product's life cycleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started