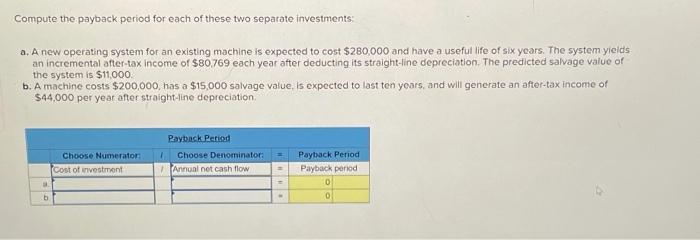

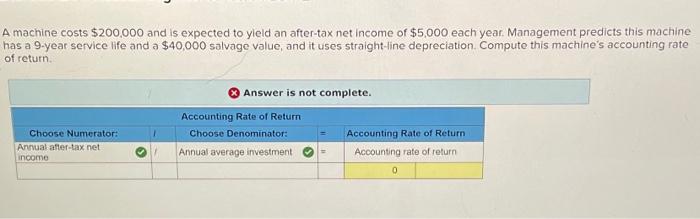

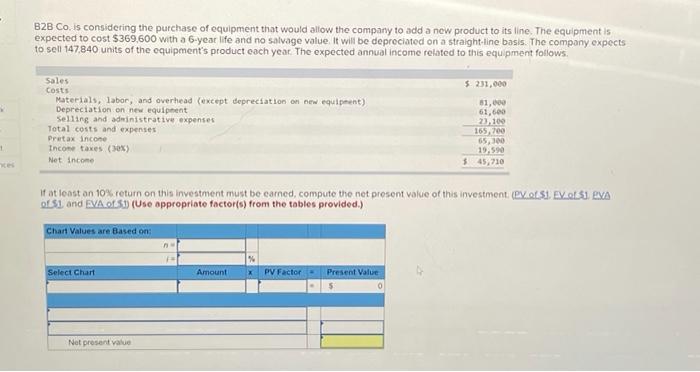

Compute the payback period for each of these two separate investments a. A new operating system for an existing machine is expected to cost $280,000 and have a useful life of six years. The system yields an incremental after-tax income of $80,769 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $11,000 b. A machine costs $200,000, has a $15,000 salvage value, is expected to last ten years, and will generate an after-tax income of $44.000 per year after straight-line depreciation 1 Choose Numerator Cost of investment Payback Period Choose Denominator 'Annual net cash flow Payback Period Payback period 0 0 b A machine costs $200,000 and is expected to yield an after-tax net income of $5,000 each year. Management predicts this machine has a 9-year service life and a $40,000 salvage value, and it uses straight-line depreciation Compute this machine's accounting rate of return Answer is not complete. Accounting Rate of Return Choose Denominator: Accounting Rate of Return Annual average investment Accounting rate of return Choose Numerator: Annual after-tax net income 0 B2B Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is expected to cost $369,600 with a 6-year life and no salvage value. It will be depreciated on a straight line basis. The company expects to sell 147,840 units of the equipment's product each year. The expected annual income related to this equipment follows Sales $ 231,000 Costs Materials, labor, and overhead (except depreciation on new equipment) Depreciation on new equipment Selling and administrative expenses Total costs and expenses Pretax incon Income taxes (50%) Net Income $1,000 61,600 23.100 165/700 65,100 19.50 45,710 + HE If at least an 10% return on this investment must be earned, compute the net present value of this investment (VESI, EVOS1 EYA 0151 and EVA 051) (Use appropriate factors) from the tables provided) Chart Values are Based on Select Chart Amount PV Factor - Present Value Net present value