Answered step by step

Verified Expert Solution

Question

1 Approved Answer

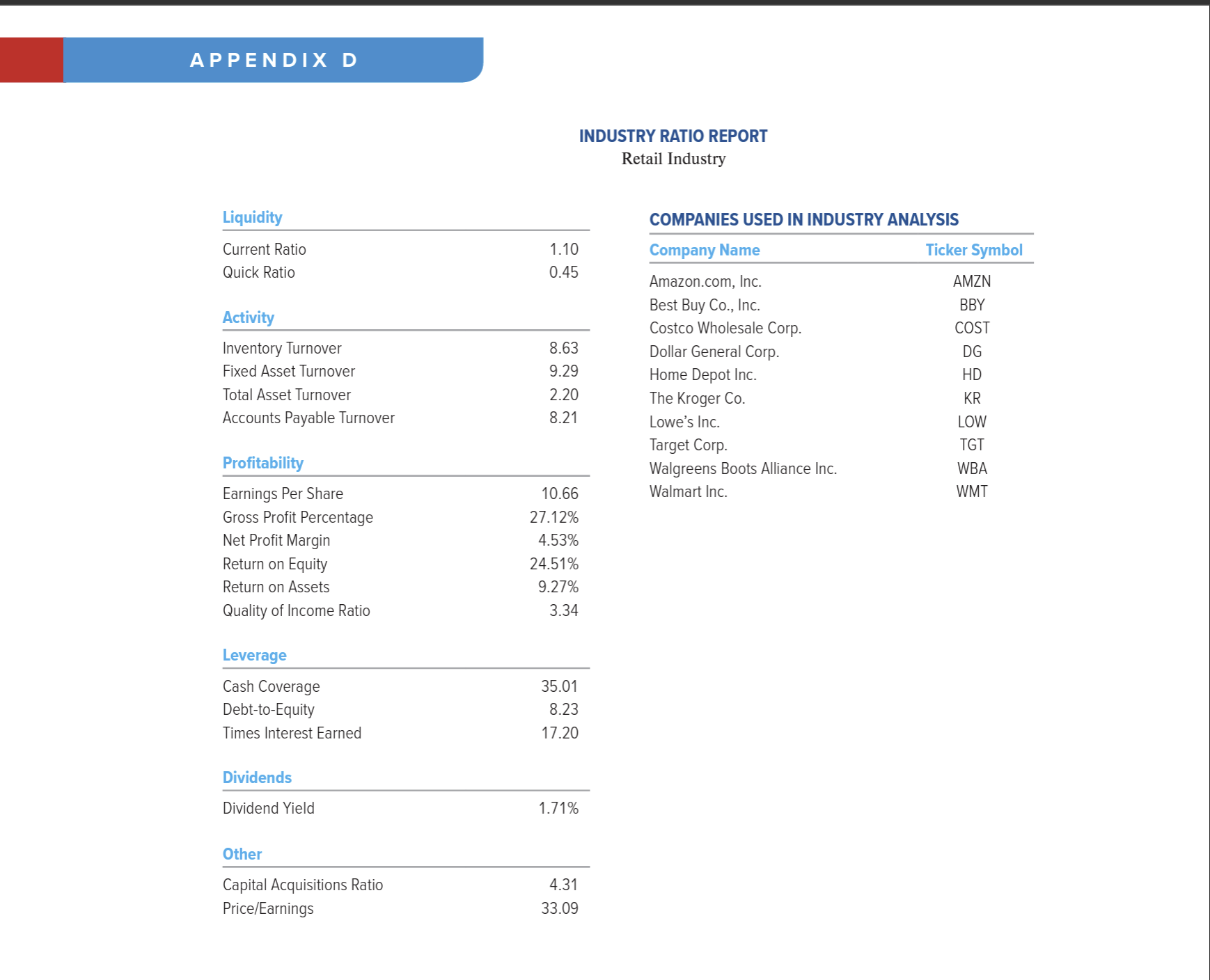

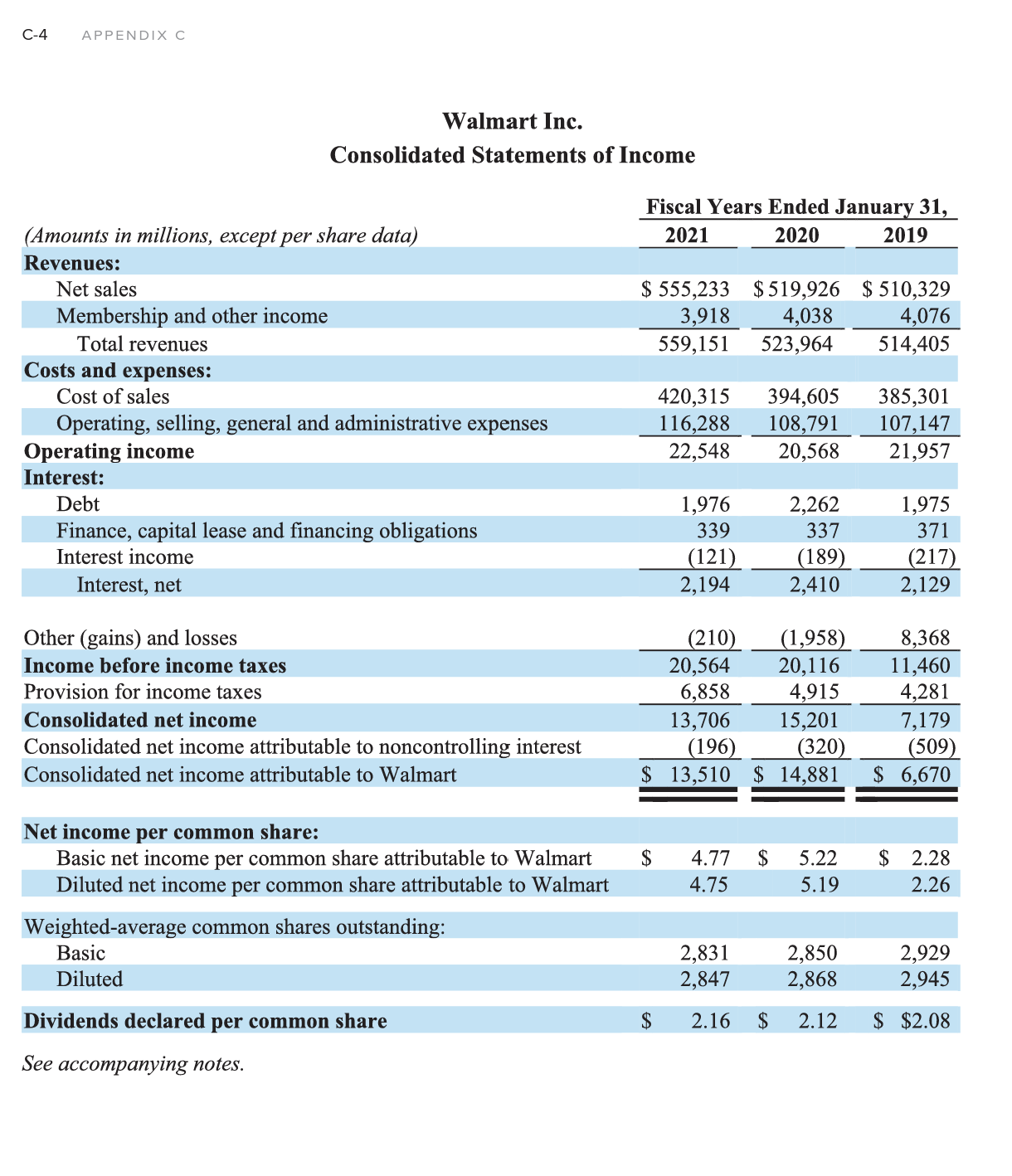

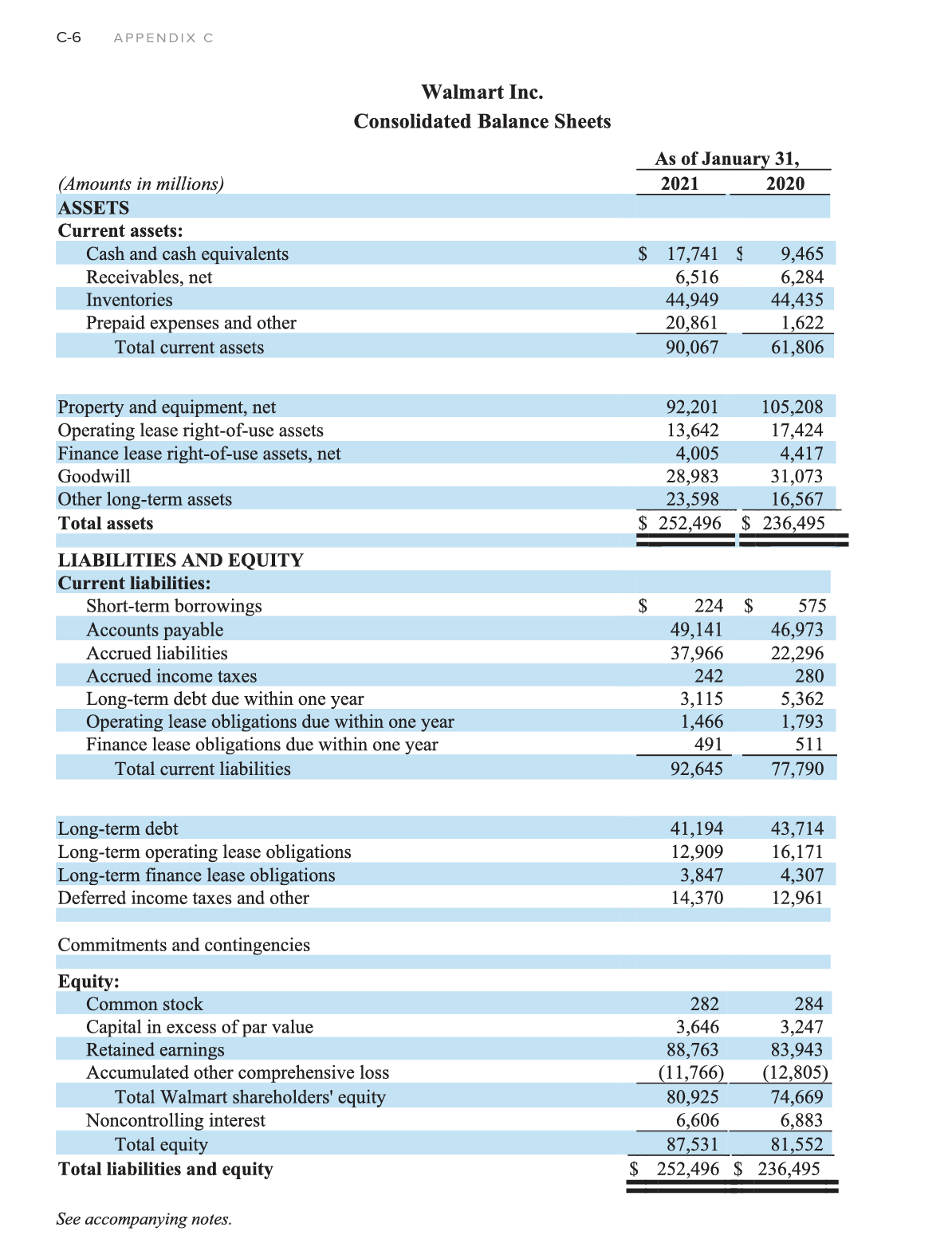

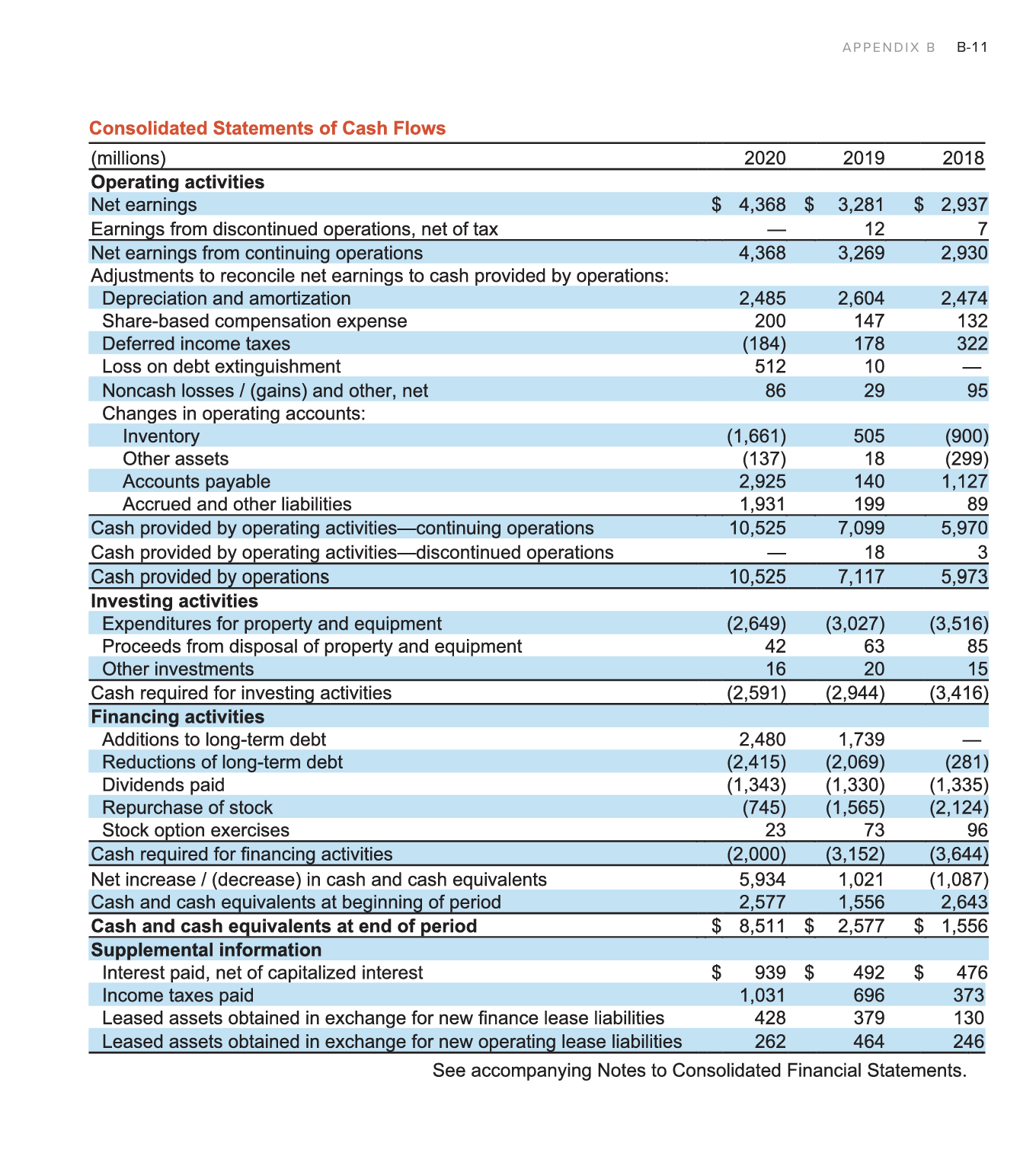

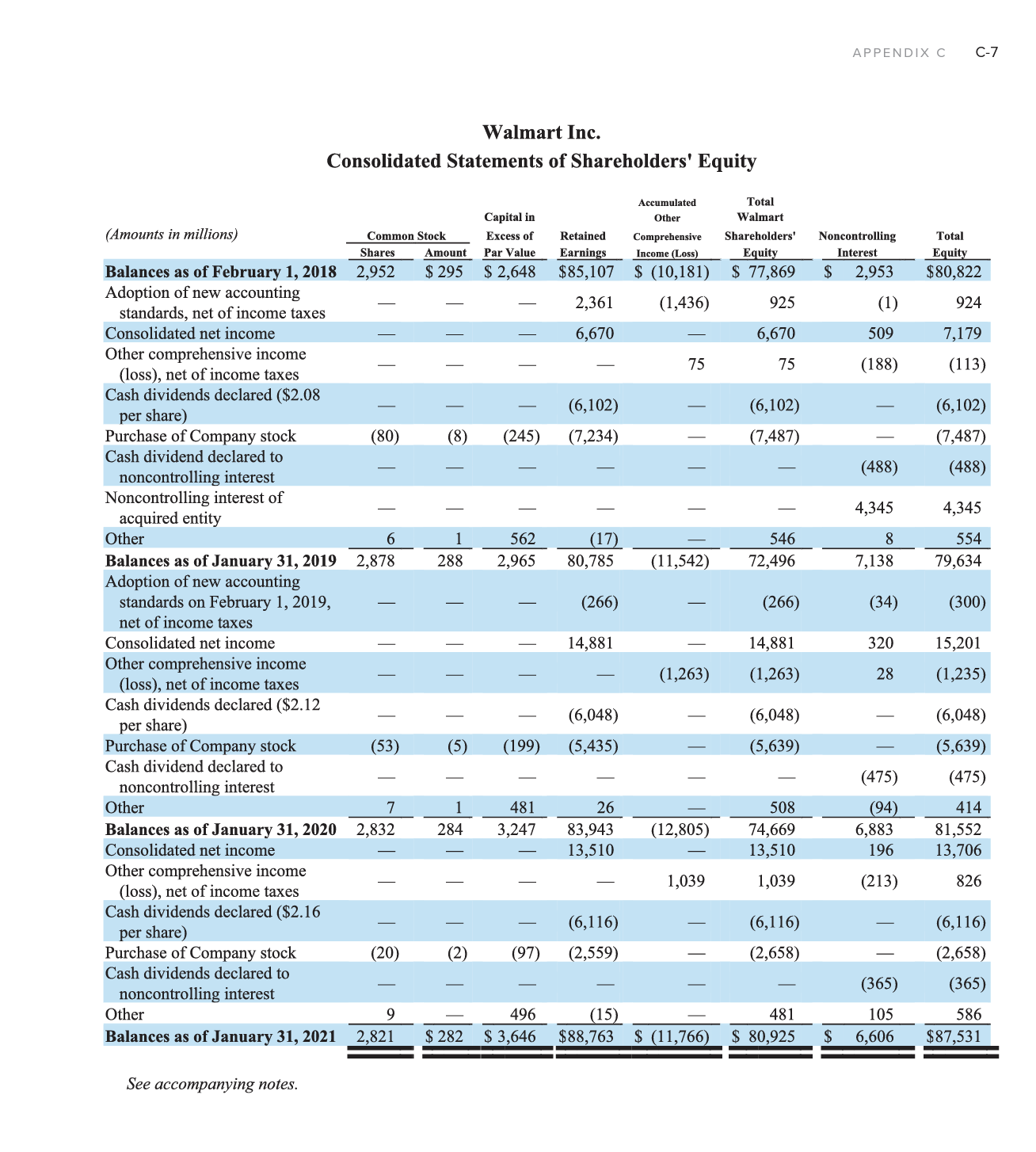

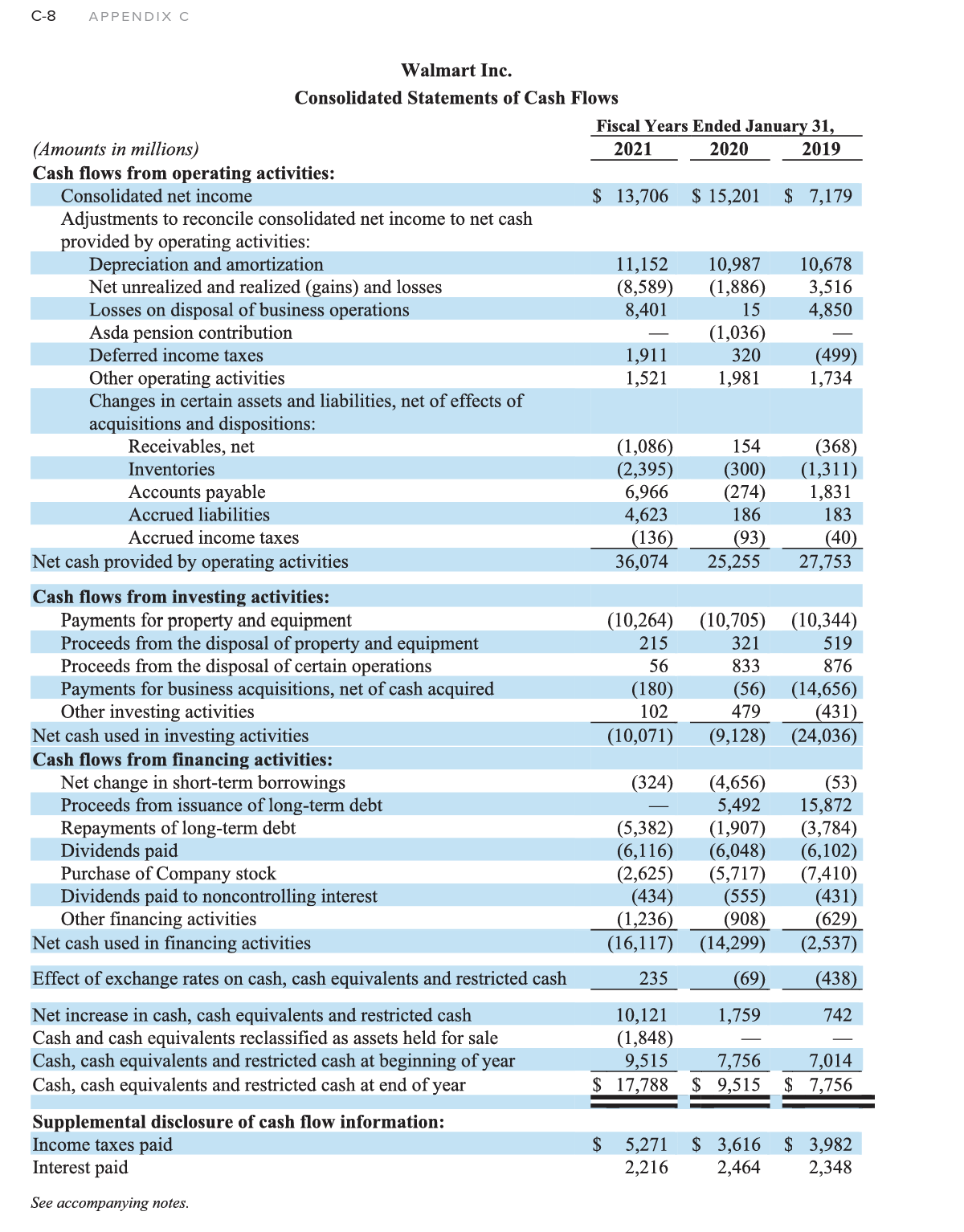

Compute the quality of income ratio for both companies for the most recent reporting year. Compute the capital acquisitions ratio for both companies for the

Compute the quality of income ratio for both companies for the most recent reporting year.

Compute the capital acquisitions ratio for both companies for the most recent reporting year.

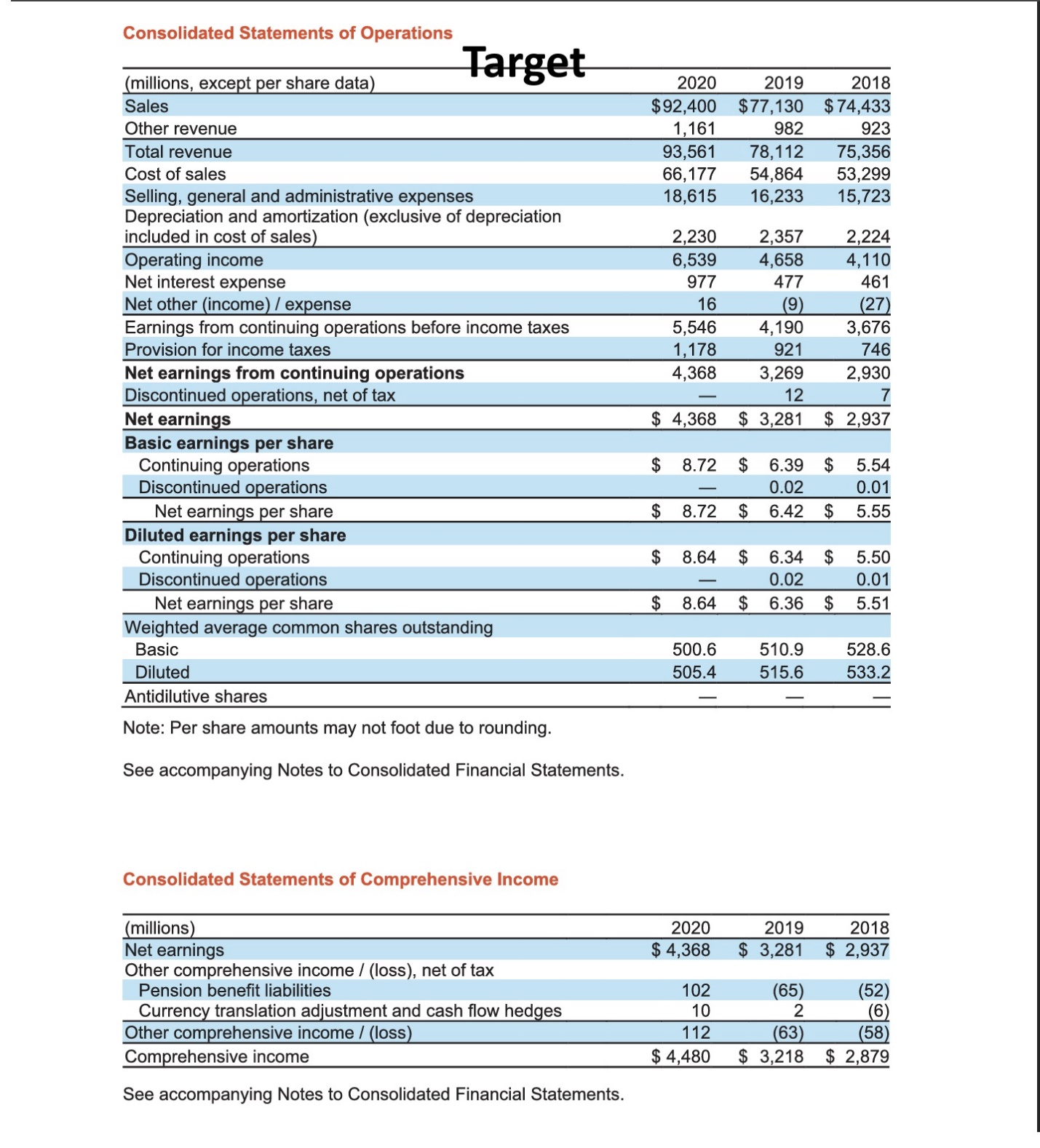

Consolidated Statements of Operations (millions, except per share data) Sales Other revenue Target 2020 2019 $92,400 $77,130 2018 $74,433 1,161 982 923 Total revenue Cost of sales 93,561 78,112 75,356 66,177 54,864 53,299 Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation 18,615 16,233 15,723 included in cost of sales) Operating income Net interest expense Net other (income) / expense Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share 2,230 2,357 2,224 6,539 4,658 4,110 977 477 461 16 (9) (27) Earnings from continuing operations before income taxes 5,546 4,190 3,676 1,178 921 746 4,368 3,269 2,930 12 $ 4,368 $ 3,281 $ 2,937 Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earnings per share $ 8.72 $ 6.39 $ 5.54 0.02 0.01 $ 8.72 $ 6.42 $ 5.55 $ 8.64 $ 6.34 $ 5.50 0.02 0.01 $ 8.64 $ 6.36 $ 5.51 Weighted average common shares outstanding Basic 500.6 510.9 528.6 Diluted 505.4 515.6 533.2 Antidilutive shares Note: Per share amounts may not foot due to rounding. See accompanying Notes to Consolidated Financial Statements. Consolidated Statements of Comprehensive Income (millions) Net earnings Other comprehensive income / (loss), net of tax Pension benefit liabilities Currency translation adjustment and cash flow hedges Other comprehensive income/(loss) Comprehensive income See accompanying Notes to Consolidated Financial Statements. 2020 $ 4,368 2019 $ 3,281 2018 $ 2,937 102 (65) (52) 10 112 2 (63) (6 (58) $ 4,480 $ 3,218 $ 2,879

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started