COMPUTE THE TAXABLE INCOME AND TAX DUE FOR THE BUSINESS USING 8% INCOME TAX RATE

USE THE TAX TABLE OF 2018 PHILIPPINES

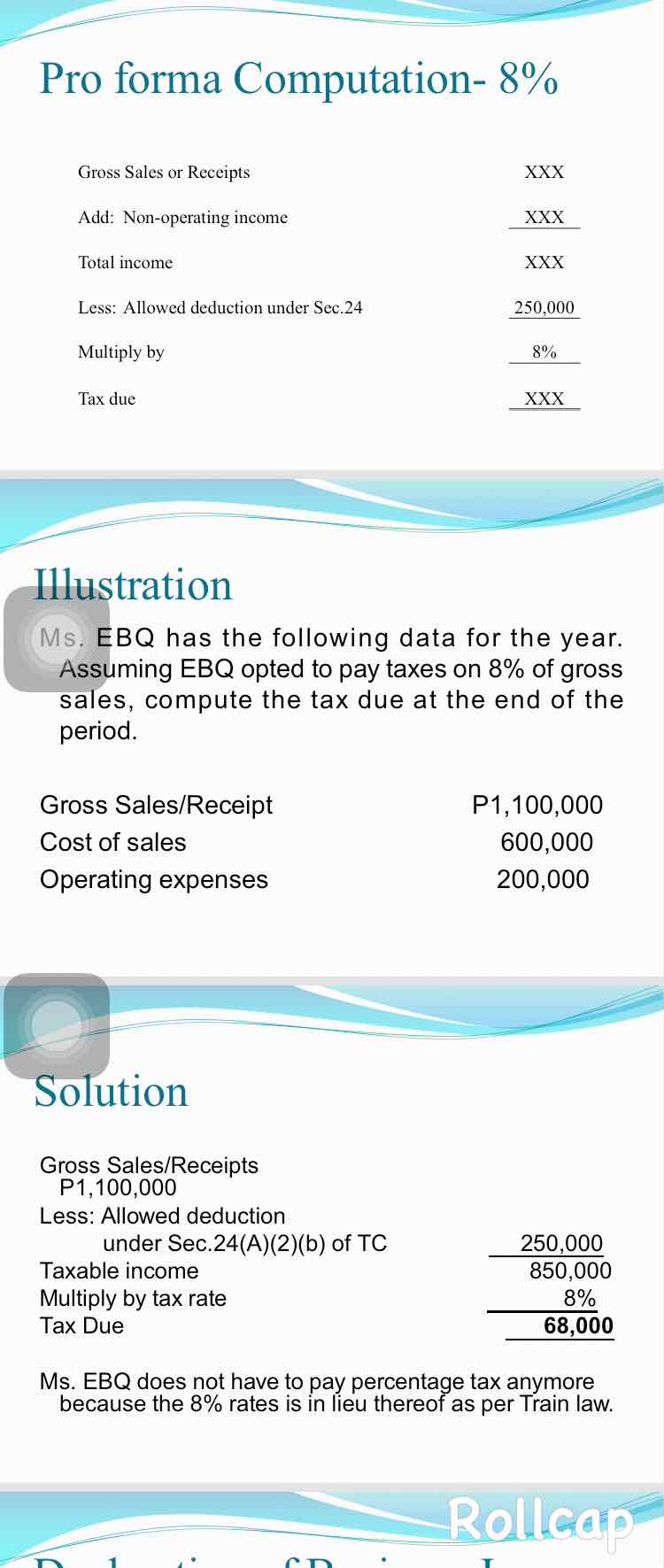

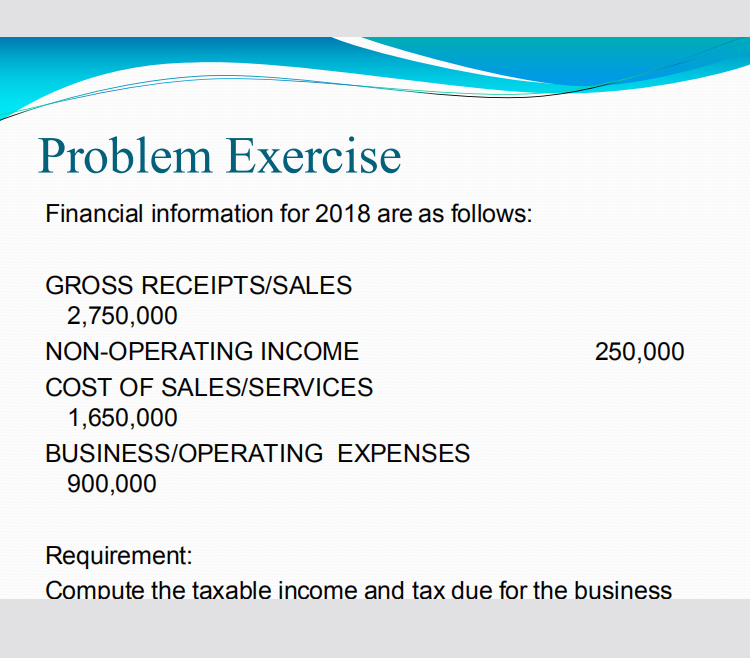

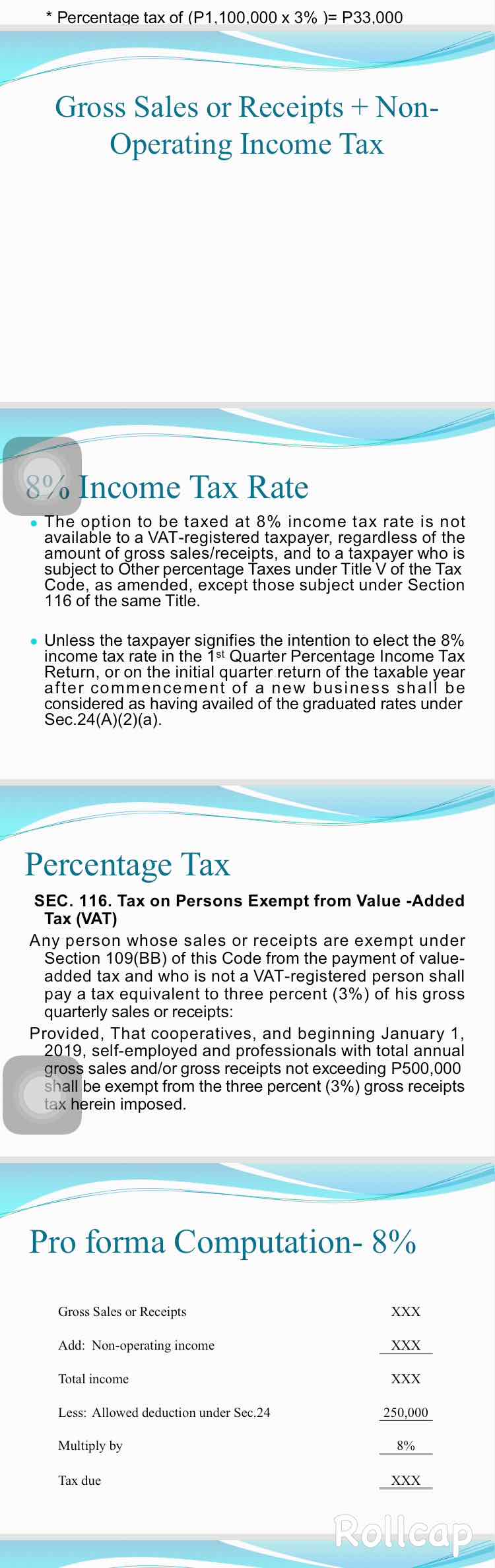

Pro forma Computation- 8% Gross Sales or Receipts XXX Add: Non-operating income XXX Total income XXX Less: Allowed deduction under Sec.24 250,000 Multiply by 8% Tax due XXX Illustration Ms. EBQ has the following data for the year. Assuming EBQ opted to pay taxes on 8% of gross sales, compute the tax due at the end of the period. Gross Sales/Receipt P1, 100,000 Cost of sales 600,000 Operating expenses 200,000 Solution Gross Sales/Receipts P1, 100,000 Less: Allowed deduction under Sec.24(A)(2)(b) of TC 250,000 Taxable income 850,000 Multiply by tax rate 8% Tax Due 68,000 Ms. EBQ does not have to pay percentage tax anymore because the 8% rates is in lieu thereof as per Train law. RollcapProblem Exercise Financial information for 2018 are as follows: GROSS RECEIPTS/SALES 2,750,000 NON-OPERATING INCOME 250,000 COST OF SALES/SERVICES 1,650,000 BUSINESS/OPERATING EXPENSES 900,000 Requirement: Compute the taxable income and tax due for the business* Percentage tax of (P1, 100,000 x 3% )= P33,000 Gross Sales or Receipts + Non- Operating Income Tax 8% Income Tax Rate . The option to be taxed at 8% income tax rate is not available to a VAT-registered taxpayer, regardless of the amount of gross sales/receipts, and to a taxpayer who is subject to Other percentage Taxes under Title V of the Tax Code, as amended, except those subject under Section 116 of the same Title. . Unless the taxpayer signifies the intention to elect the 8% Income tax rate in the 1 st Quarter Percentage Income Tax Return, or on the initial quarter return of the taxable year after commencement of a new business shall be considered as having availed of the graduated rates under Sec.24(A)(2)(a). Percentage Tax SEC. 116. Tax on Persons Exempt from Value -Added Tax (VAT) Any person whose sales or receipts are exempt under Section 109(BB) of this Code from the payment of value- added tax and who is not a VAT-registered person shall pay a tax equivalent to three percent (3%) of his gross quarterly sales or receipts: Provided, That cooperatives, and beginning January 1, 2019, self-employed and professionals with total annual gross sales and/or gross receipts not exceeding P500,000 shall be exempt from the three percent (3%) gross receipts tax herein imposed. Pro forma Computation- 8% Gross Sales or Receipts XXX Add: Non-operating income XXX Total income XXX Less: Allowed deduction under Sec.24 250,000 Multiply by 8% Tax due XXX Rollcap