Answered step by step

Verified Expert Solution

Question

1 Approved Answer

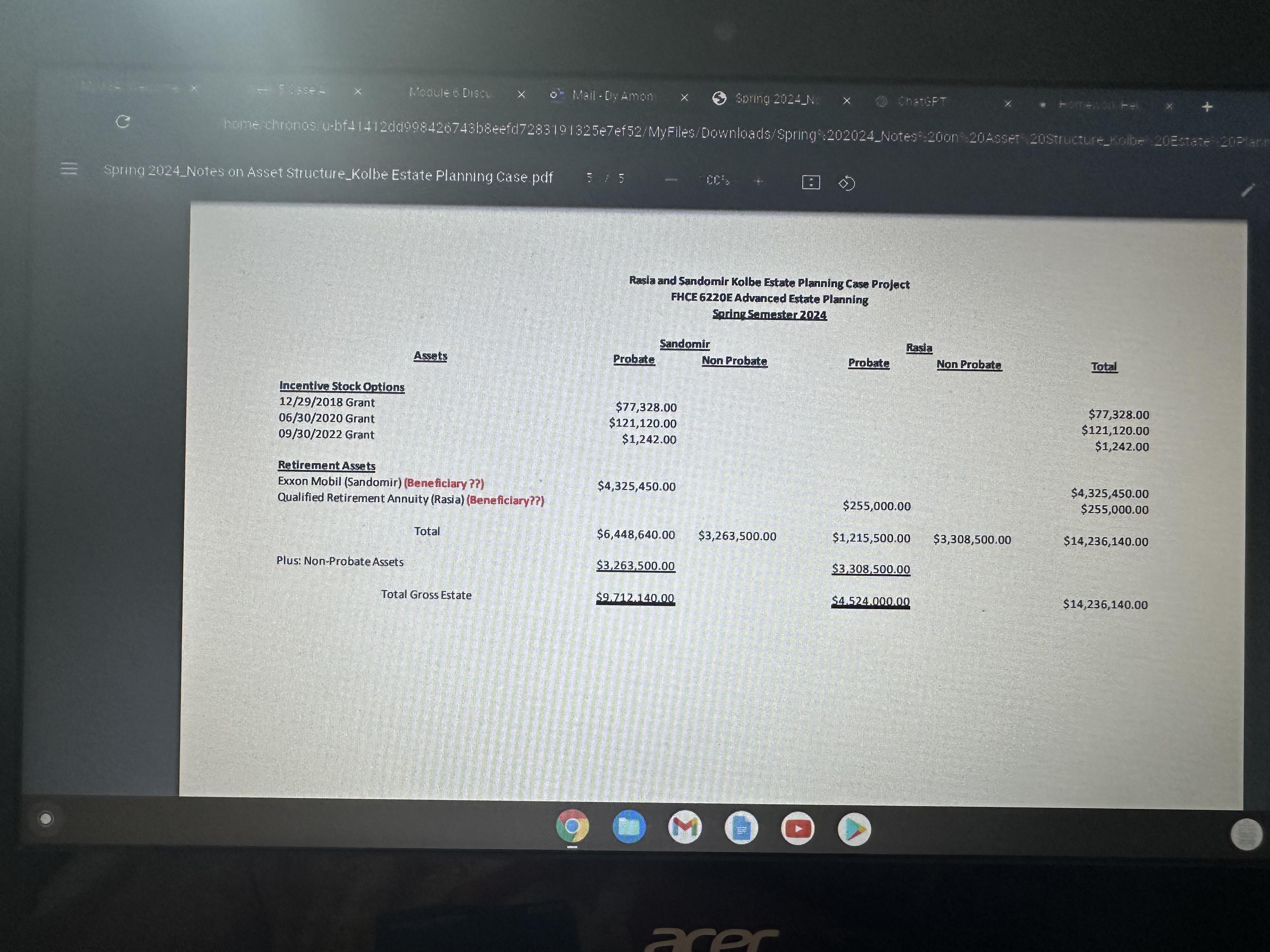

Compute the Tentative Taxable Estate for each of Rasia and Sandomir, assuming each is the first to die and assuming there will be $150,000 payable

Compute the Tentative Taxable Estate for each of Rasia and Sandomir, assuming each is the first to die and assuming there will be $150,000 payable in state death taxes for each estate.

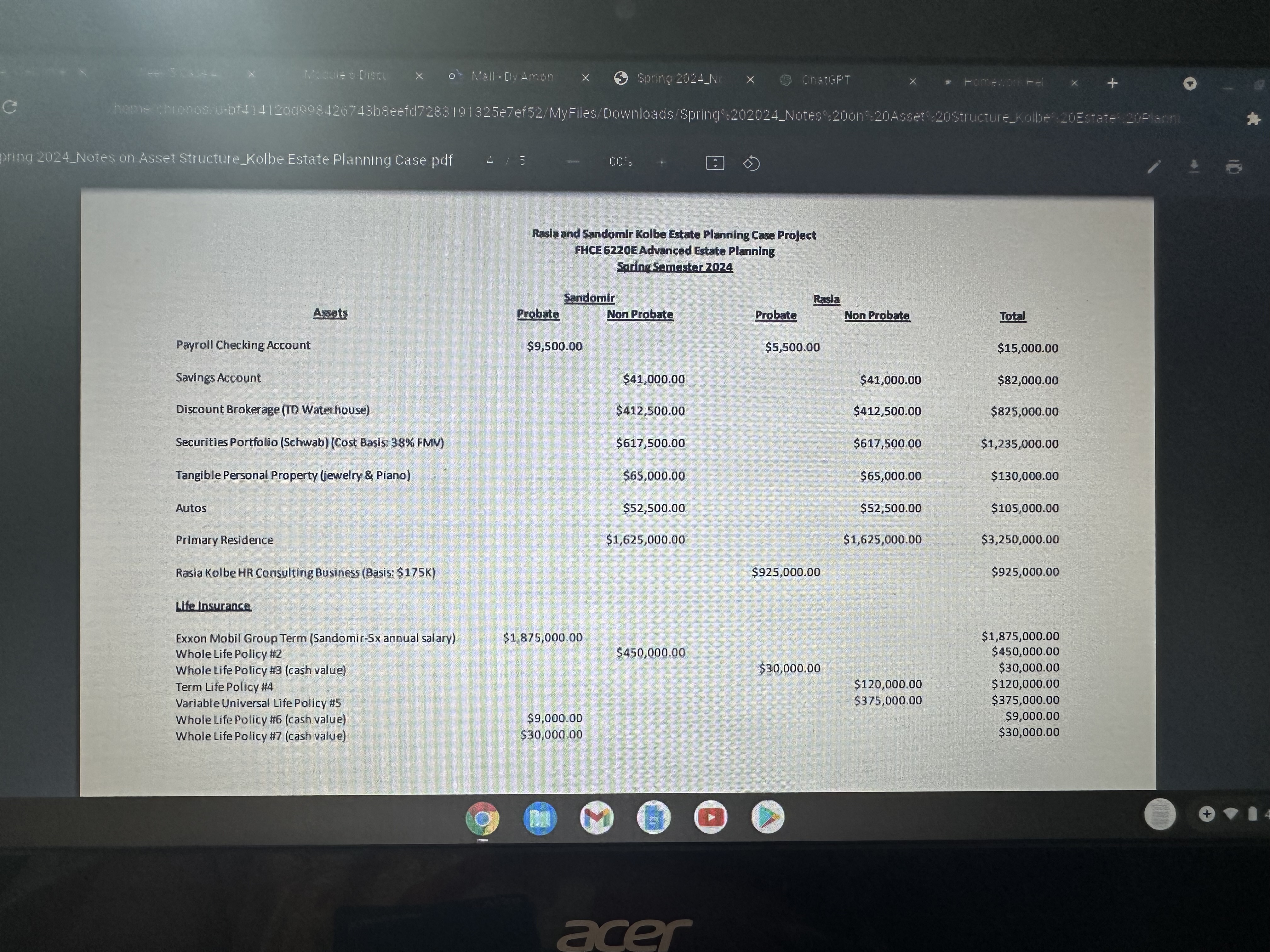

o Mall Dy Amon X Spring 2024_N ChatGPT Homework Pel e home chronos u-bf41412dd998426743b8eefd7283191325e7ef52/MyFiles/Downloads/Spring%202024_Notes%20on%20Asset%20Structure_Kolbe 20Estate 20Planni pring 2024_Notes on Asset Structure_Kolbe Estate Planning Case.pdf 4 / 5 CC Rasia and Sandomir Kolbe Estate Planning Case Project FHCE 6220E Advanced Estate Planning Spring Semester 2024 Payroll Checking Account Sandomir Assets Probate Non Probate $9,500.00 Savings Account Discount Brokerage (TD Waterhouse) Securities Portfolio (Schwab) (Cost Basis: 38% FMV) Tangible Personal Property (jewelry & Piano) Autos Primary Residence Rasia Kolbe HR Consulting Business (Basis: $175K) Rasia Probate Non Probate Total $5,500.00 $41,000.00 $412,500.00 $15,000.00 $41,000.00 $82,000.00 $412,500.00 $825,000.00 $617,500.00 $617,500.00 $1,235,000.00 $65,000.00 $65,000.00 $130,000.00 $52,500.00 $52,500.00 $105,000.00 $1,625,000.00 $1,625,000.00 $3,250,000.00 $925,000.00 $925,000.00 Life Insurance Exxon Mobil Group Term (Sandomir-5x annual salary) Whole Life Policy #2 $1,875,000.00 $1,875,000.00 $450,000.00 $450,000.00 Whole Life Policy #3 (cash value) $30,000.00 $30,000.00 Term Life Policy #4 Variable Universal Life Policy #5 $120,000.00 $375,000.00 $120,000.00 $375,000.00 Whole Life Policy #6 (cash value) Whole Life Policy #7 (cash value) $9,000.00 $30,000.00 M acer $9,000.00 $30,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started