Answered step by step

Verified Expert Solution

Question

1 Approved Answer

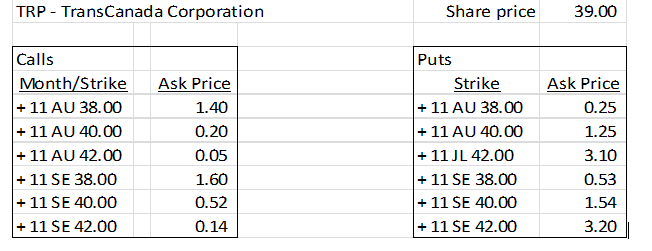

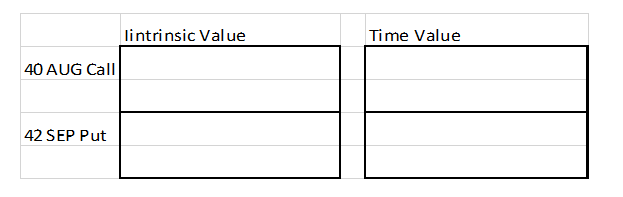

Compute the time value and intrinsic value for the following options. Show your work! (4 marks) Using the above information, you take the long position

- Compute the time value and intrinsic value for the following options. Show your work!

(4 marks)

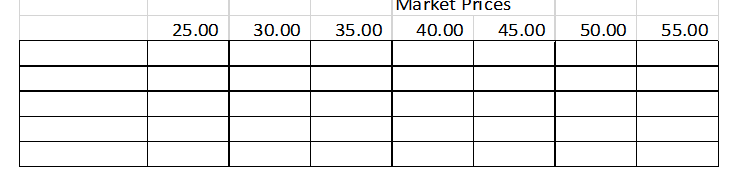

- Using the above information, you take the long position in a call option with an exercise price of $40.00 and that expires in August. Prepare a profit/loss (net payoff) schedule for your investments for market prices of $25, $30, $35, $40, $45, $50 and $55 (2 marks)

c. Graph your payoff from the call option

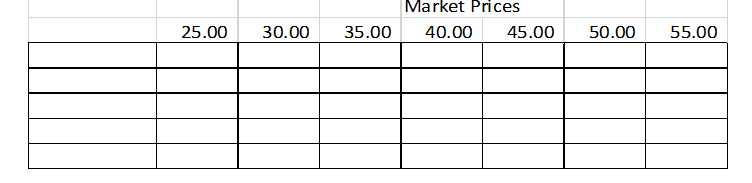

d. Using the above information, you take the short position in a call option with an exercise price of $40.00 and that expires in August. Prepare a profit/loss (net payoff) schedule for your investments for market prices of $25, $30, $35, $40, $45, $50 and $55

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started