Compute two cash flow ratios. (Round ratios to 2 decimal places, e.g. 0.62.)

| Current cash debt coverage ratio | | | :1 |

| Cash debt coverage ratio | | | :1 |

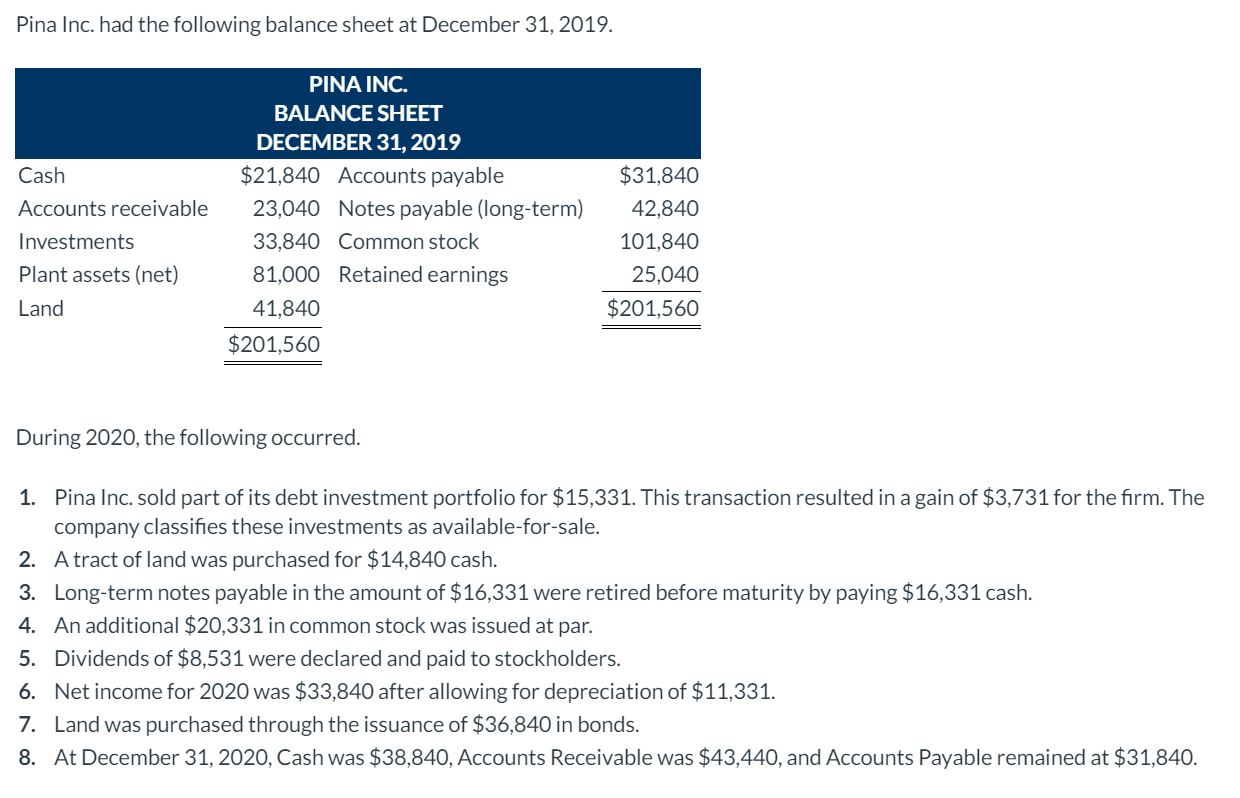

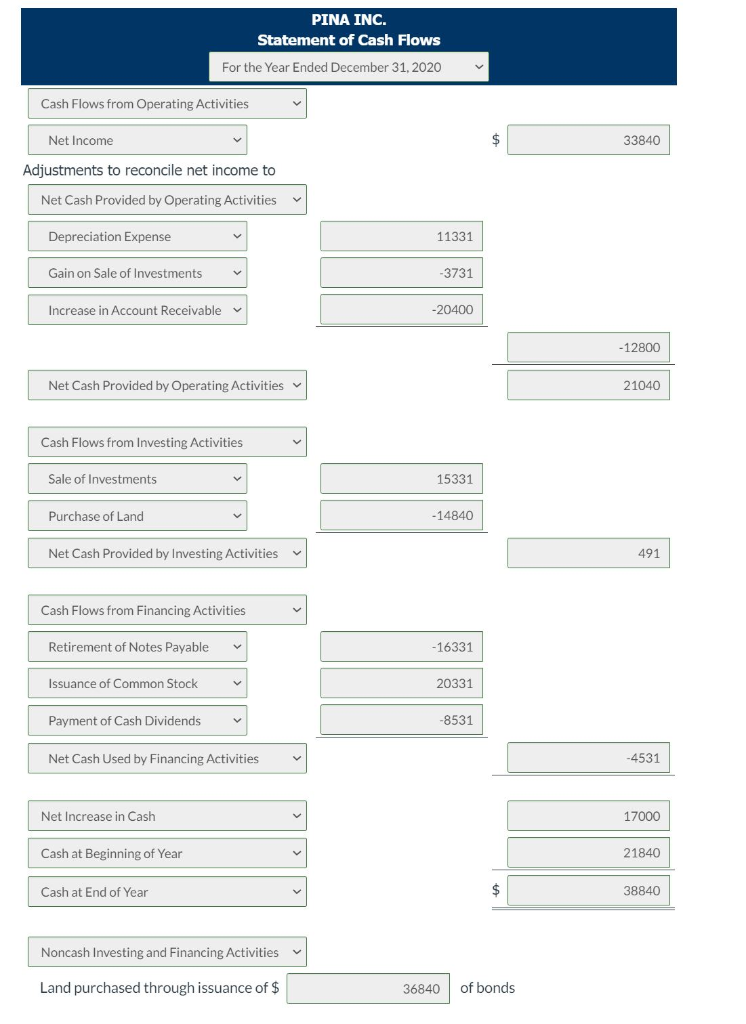

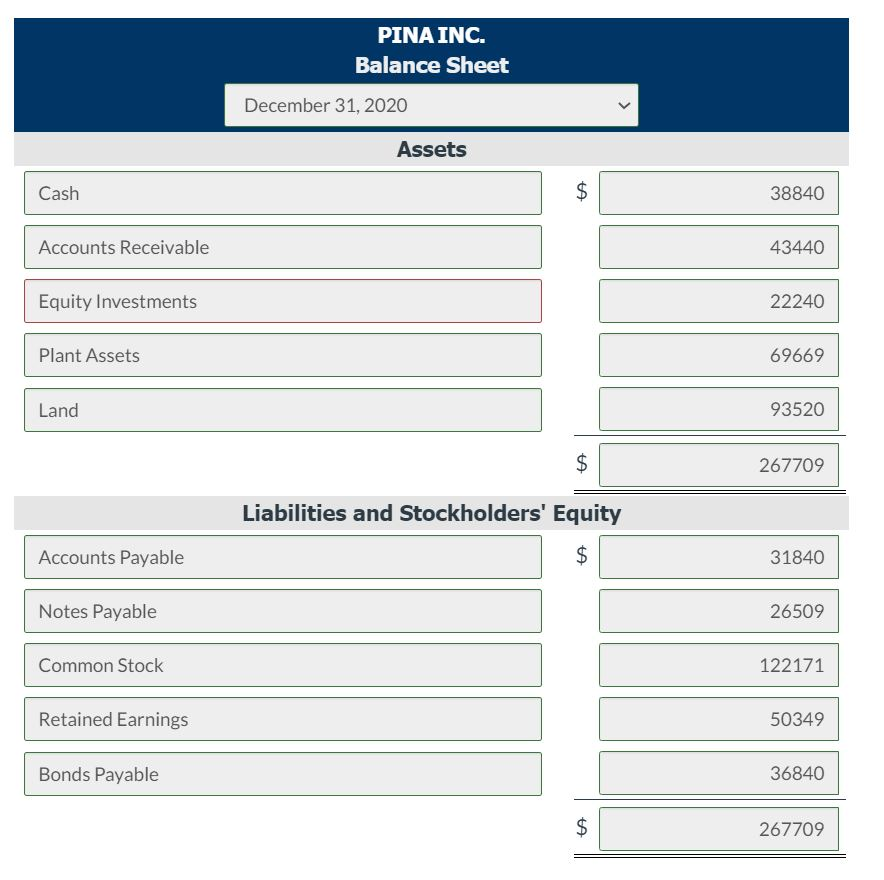

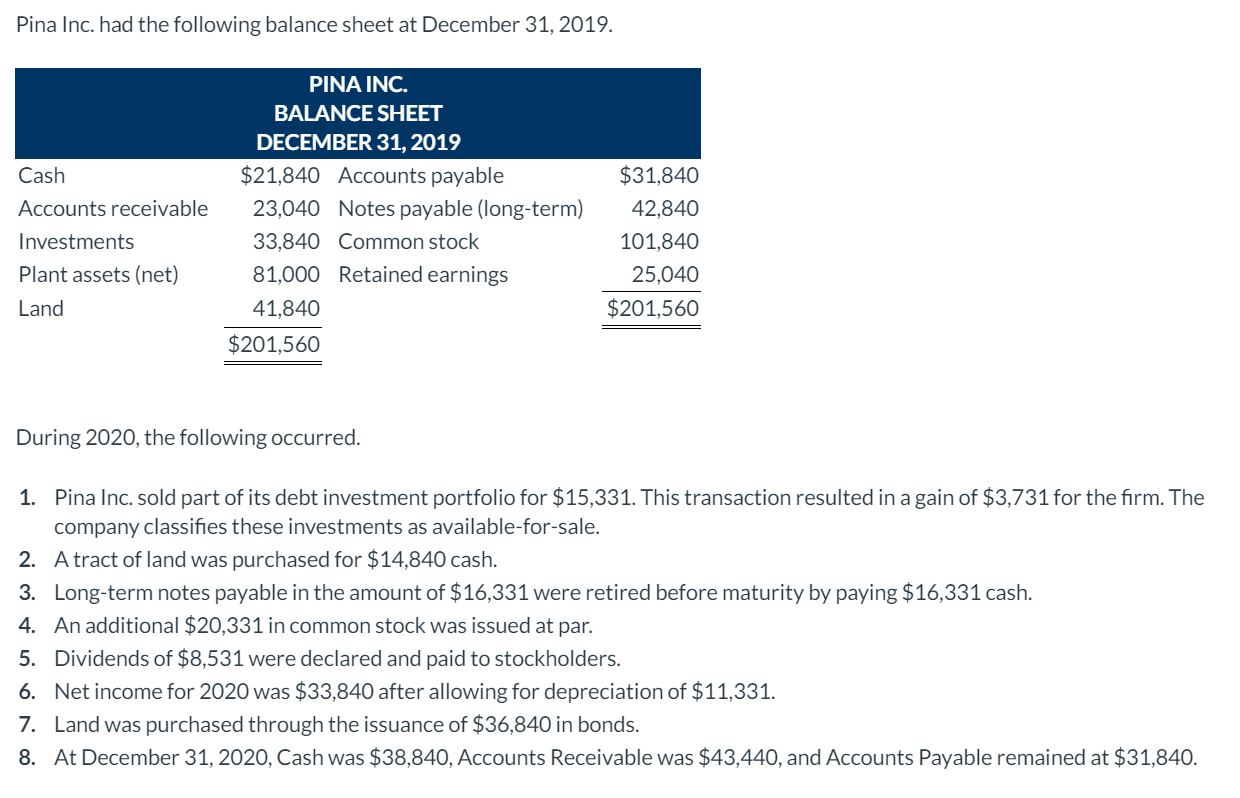

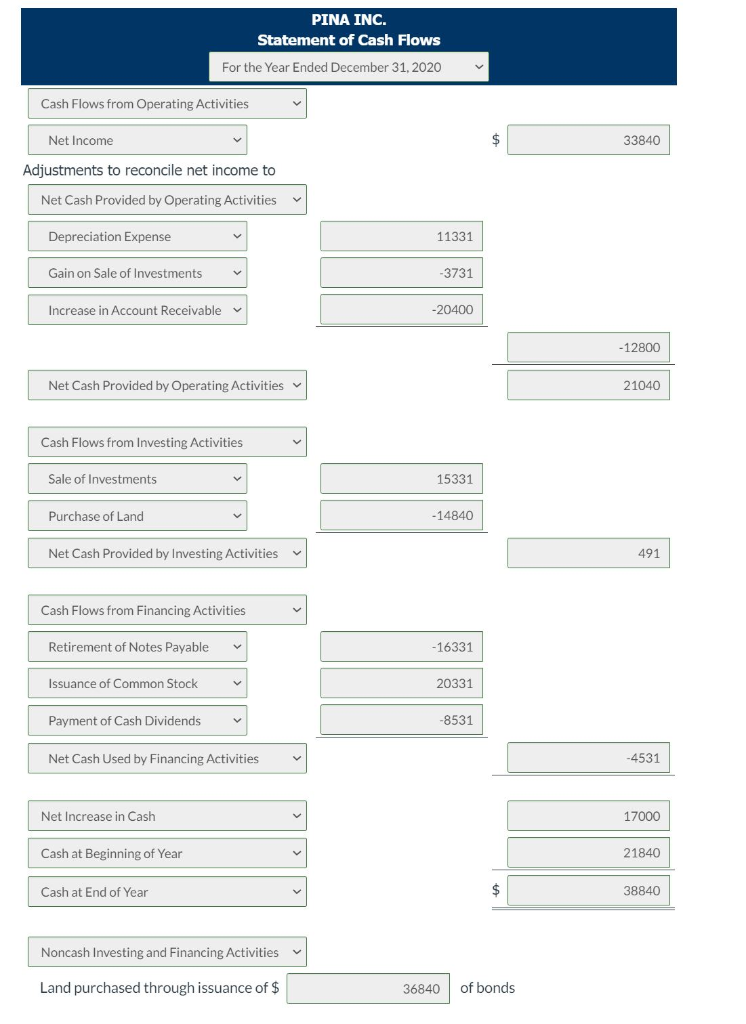

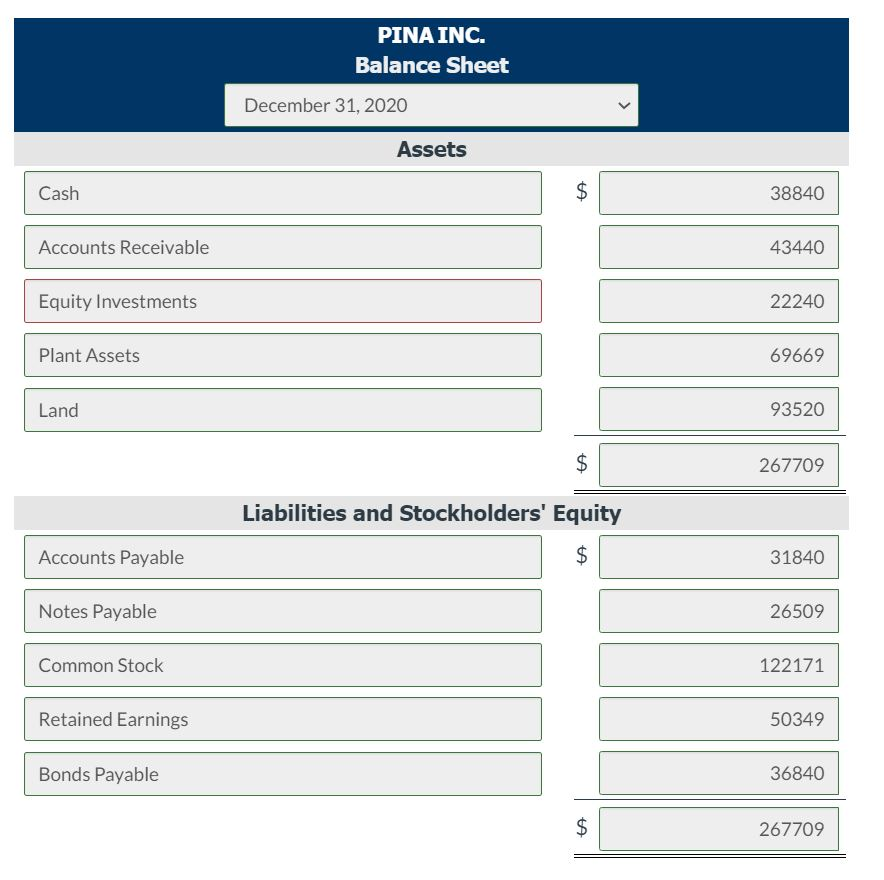

Pina Inc. had the following balance sheet at December 31, 2019. Cash Accounts receivable Investments Plant assets (net) Land PINA INC. BALANCE SHEET DECEMBER 31, 2019 $21,840 Accounts payable 23,040 Notes payable (long-term) 33,840 Common stock 81,000 Retained earnings 41,840 $201,560 $31,840 42,840 101,840 25,040 $201,560 During 2020, the following occurred. 1. Pina Inc. sold part of its debt investment portfolio for $15,331. This transaction resulted in a gain of $3,731 for the firm. The company classifies these investments as available-for-sale. 2. Atract of land was purchased for $14,840 cash. 3. Long-term notes payable in the amount of $16,331 were retired before maturity by paying $16,331 cash. 4. An additional $20,331 in common stock was issued at par. 5. Dividends of $8,531 were declared and paid to stockholders. 6. Net income for 2020 was $33,840 after allowing for depreciation of $11,331. 7. Land was purchased through the issuance of $36,840 in bonds. 8. At December 31, 2020, Cash was $38,840, Accounts Receivable was $43,440, and Accounts Payable remained at $31,840. PINA INC. Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operating Activities Net Income $ 33840 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense 11331 Gain on Sale of Investments -3731 Increase in Account Receivable -20400 -12800 Net Cash Provided by Operating Activities 21040 Cash Flows from Investing Activities Sale of Investments 15331 Purchase of Land -14840 Net Cash Provided by Investing Activities 491 Cash Flows from Financing Activities Retirement of Notes Payable -16331 Issuance of Common Stock v 20331 Payment of Cash Dividends -8531 Net Cash Used by Financing Activities -4531 Net Increase in Cash 17000 Cash at Beginning of Year 21840 Cash at End of Year $ 38840 Noncash Investing and Financing Activities Land purchased through issuance of $ 36840 of bonds PINA INC. Balance Sheet December 31, 2020 Assets Cash $ 38840 Accounts Receivable 43440 Equity Investments 22240 Plant Assets 69669 Land 93520 $ 267709 Liabilities and Stockholders' Equity Accounts Payable $ 31840 Notes Payable 26509 Common Stock 122171 Retained Earnings 50349 Bonds Payable 36840 $ 267709 Compute two cash flow ratios. (Round ratios to 2 decimal places, e.g. 0.62.) Current cash debt coverage ratio :1 Cash debt coverage ratio :1