Answered step by step

Verified Expert Solution

Question

1 Approved Answer

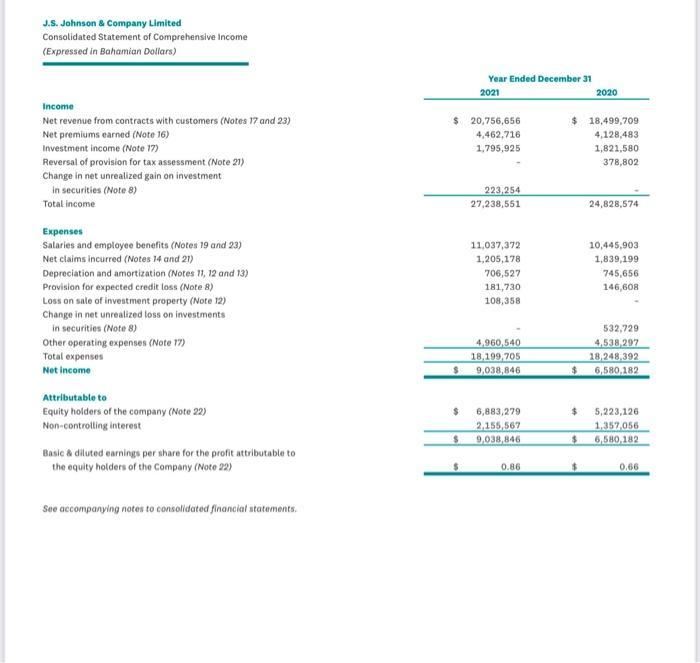

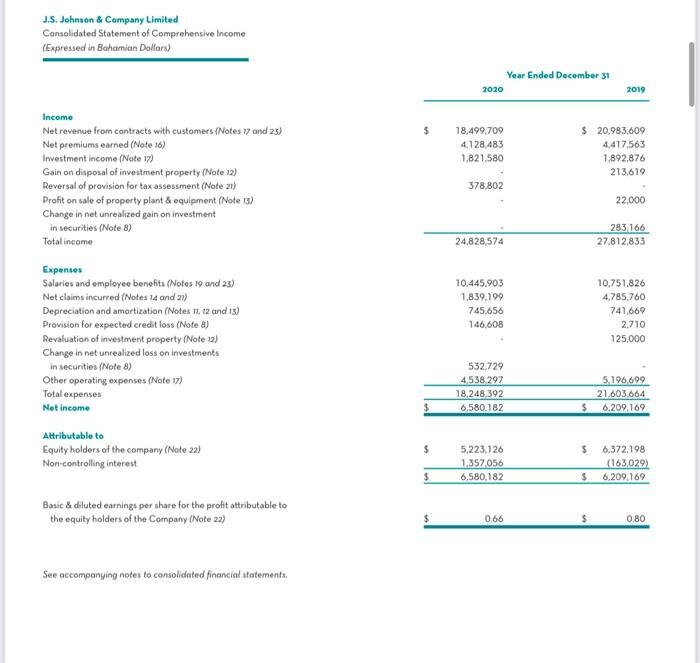

Compute vertical common-size analysis using 2021, 2020, and 2019's income statement (use year-end REVENUE balances for the base, including two (2) prior years in your

Compute vertical common-size analysis using 2021, 2020, and 2019's income statement (use year-end REVENUE balances for the base, including two (2) prior years in your comparative analysis). Comment on the results.

J.S. Johnson & Company Limited Consolidated Statement of Comprehensive Income (Expressed in Bahamian Dollars) Income Net revenue from contracts with customers (Notes 17 and 23) Net premiums earned (Note 16) Investment income (Note 17) Reversal of provision for tax assessment (Note 21) Change in net unrealized gain on investment in securities (Note 8) Total income Expenses Salaries and employee benefits (Notes 19 and 23) Net claims incurred (Notes 14 and 21) Depreciation and amortization (Notes 11, 12 and 13) Provision for expected credit loss (Note 8) Loss on sale of investment property (Note 12) Change in net unrealized loss on investments in securities (Note 8) Other operating expenses (Note 17) Total expenses Net income Attributable to Equity holders of the company (Note 22) Non-controlling interest Basic & diluted earnings per share for the profit attributable to the equity holders of the Company (Note 22) See accompanying notes to consolidated financial statements. $ 20,756,656 4,462,716 1,795,925 $ $ $ Year Ended December 31 2021 $ 223,254 27,238,551 11,037,372 1,205,178 706,527 181,730 108,358 4,960,540 18,199,705 9,038,846 6,883,279 2.155,567 9,038,846 0.86 $ 18,499,709 4,128,483 1,821,580 378,802 $ $ $ 2020 $ 24,828,574 10,445,903 1,839,199 745,656 146,608 532,729 4.538,297 18,248,392 6,580,182 5,223,126 1.357,056 6,580,182 0.66

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Common size Income Statement It is a form of analysis and interpretation of the financial statement Common size statement is also named as vert...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started